Plus, survey shows willingness to commit fraud

A massive five-year long Florida insurance fraud investigation has come to a close with sentencing of the public adjuster who served as ringleader, and a new survey shows nearly a third of younger Americans say they would submit a fraudulent property insurance claim. It’s all in this week’s Fraud News.

Barbara Gonzalez mugshot. Courtesy, Miami-Dade County

Operation Rubicon: It was back in 2018 that we reported on what prosecutors had dubbed “Operation Rubicon” named for The Rubicon Group, a public adjusting company in Miami. Investigators had arrested the ringleader Barbara Maria Gonzalez (aka Barbara Maria Diaz de Villegas), Rubicon’s owner, and charged her with grand theft and organized fraud. She was accused of heading a multi-layer fraud racket that filed more than $1 million in bogus insurance claims stretching to Tampa, through accomplices that included water mitigation and restoration companies, insurance agencies and agents, appraisers, and willing homeowners.

More than 100 claims were filed against Citizens Property Insurance and it was the Senior Director of its Special Investigations Unit, Joseph Theobald and his team who first became suspicious and alerted investigators with the Florida Department of Financial Services (DFS). Theobald reports that Gonzalez recently agreed to a plea agreement as the primary defendant in the prosecution.

“Under the terms of that plea agreement, Gonzalez essentially will receive a prison sentence that spans 10 years,” he told the June meeting of the Citizens Claims Committee. “That includes an adjudication of guilt as a felony and being barred from participating or being licensed in any work involving insurance. She is sentenced to three years at a Florida State Prison followed by two years house arrest, which is then followed up by five years of supervised probation. She’s ordered to pay restitution in the amount of $910,000, which is backed by a civil lien order, which is jointly and severally liable with the co-defendants. The prosecutor has provided a check to Citizens for $20,000 towards that restitution. Lastly, she is required to submit to an interview with the Coalition Against Insurance Fraud data committee, which was conducted in early May.”

Theobald said that overall there’s been 43 arrests of insureds and others associated with this crime ring. To date, Citizens has collected over $298,000 in restitution payments, including $100,000 restitution from two key individuals that helped organize and stage these claims. We join the Citizens Board of Governors and the Florida taxpayers who back Citizens in complimenting Theobald and his team on a “job well done” and the men and women with the DFS Division of Investigative and Forensic Services for their hard work in helping bring charges that led to the successful prosecution of these bad actors who are responsible for the ever rising costs of homeowners insurance.

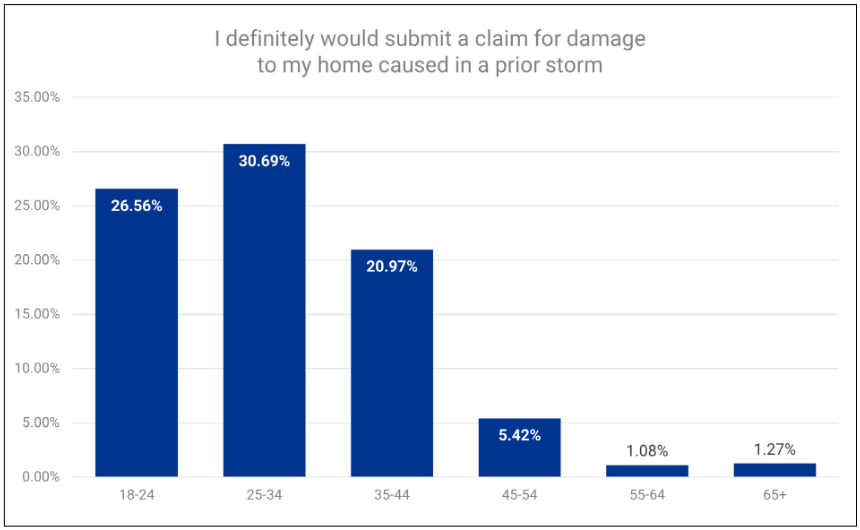

Who Commits Insurance Fraud and Why: The Coalition Against Insurance Fraud and Verisk have teamed to produce this snappy-named research report, which includes a survey of Americans attitudes toward fraud. It’s frankly shocking. Among the results: younger people have a higher tolerance for automobile fraud and its impacts, with more than 30% of those ages 25-34 saying they “definitely would” submit a fraudulent claim. Another 36% of survey respondents consider it okay to inflate an auto damage claim. On the homeowners insurance side, a range of 21% to 31% of respondents under 44 years old say they would definitely submit a claim for damage caused in a prior storm. “Those seeking to commit insurance fraud crimes are the enemies of all honest policyholders and insurance carriers alike,” concludes the report.

From: The Coalition Against Insurance Fraud and Verisk, June 2023

LMA Newsletter of 6-26-23