Florida tops in private flood coverage

A new report shows Florida property owners stand to lose the most from projected sea level rise; insured flood losses have doubled in the past decade yet insurance still covers just a fraction of the losses; the last ditch effort to renew the National Flood Insurance Program (NFIP) before it expires at month’s end, while Florida leads the nation in private flood coverage; and NOAA shares its data with the insurance industry. It’s all in this week’s Flood Digest.

A new report shows Florida property owners stand to lose the most from projected sea level rise; insured flood losses have doubled in the past decade yet insurance still covers just a fraction of the losses; the last ditch effort to renew the National Flood Insurance Program (NFIP) before it expires at month’s end, while Florida leads the nation in private flood coverage; and NOAA shares its data with the insurance industry. It’s all in this week’s Flood Digest.

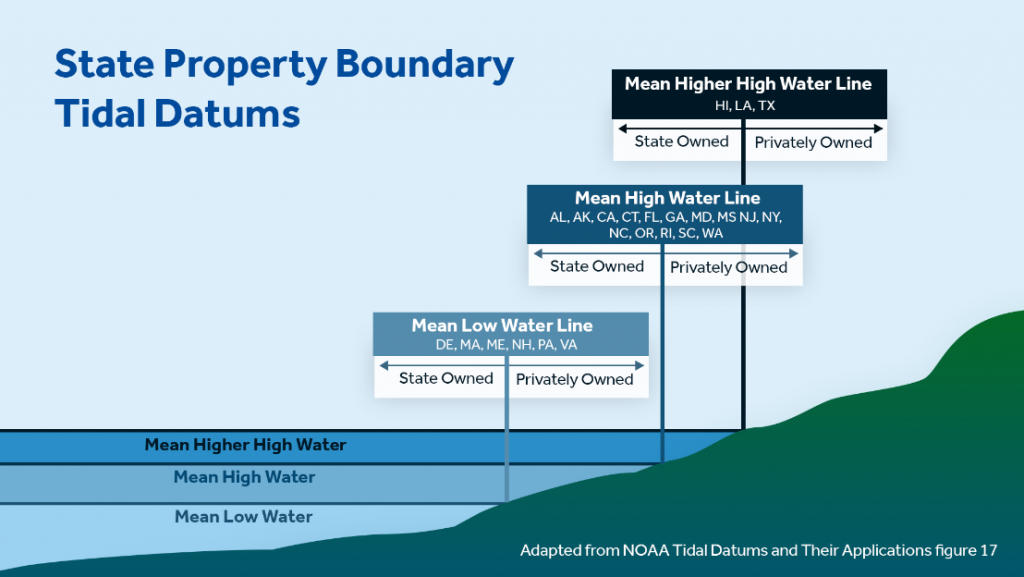

Losing Property: Researchers with Climate Central, a nonprofit news organization that analyzes and reports on climate science, have determined that private property owners across the U.S. will lose an area the size of New Jersey by the year 2050 due to sea level rise. Their report, Sinking Tax Base, says as many as 4.4 million acres are projected to fall below the high tide line nationwide and revert to public property, as shown in the graphic below. Four states – Florida, Louisiana, North Carolina, and Texas – account for 87% of the total area lost. Findings by county are detailed in more than 250 reports.

From Climate Central

Monroe and Miami-Dade counties will be most affected in Florida. Monroe has 46,324 land parcels (52% of its total parcels) that are projected to be in the annual flood risk zone by 2050. Their current taxable land value is $3.47 billion. Miami-Dade has 14,135 land parcels (2.4% of its total) worth $3.81 billion for tax purposes that will be in the annual flood risk zone by then.

Flooding & Insurance: The Swiss Re Institute’s latest report shows insured flood losses doubled to $80 billion globally during 2011-2020 compared to the previous decade. In 2021 alone, losses amounted to $20 billion, yet just 18% of those losses were covered by insurance. The report says that new data and modeling enable risk-based pricing of flood risk and is opening up a new market for private insurance companies. They saw an annual 20.5% growth rate in direct flood premiums written since 2016, compared to a 1.8% growth in NFIP premiums. Private premiums last year totaled about $2 billion compared to $4.7 billion in NFIP premiums. The report said there is a “huge potential” for the private market if it invests more in modeling and risk awareness-raising initiatives to help close the protection gap, as nearly 40% of the U.S. population lives in coastal counties and 10% in floodplains.

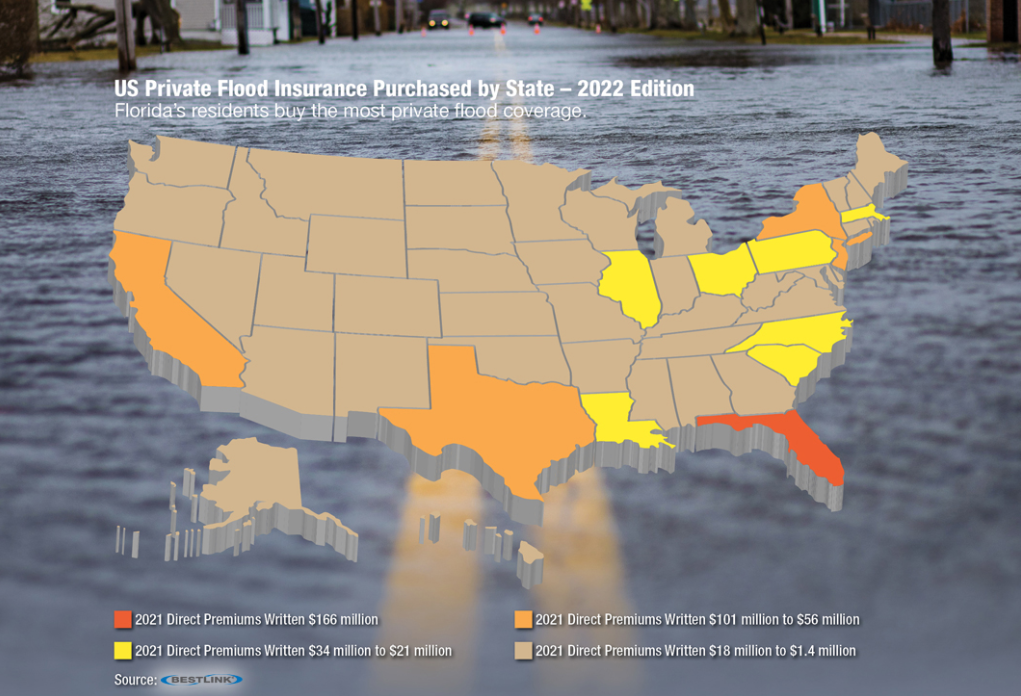

NFIP Reauthorization: AM Best is out with its list of Top 25 Writers of US Private Flood Insurance and the cool graphic below that shows Florida remains the leading state in private flood policies, with $166 million in direct premiums written in 2021. I’m honored to have served as an advisor on passage of Florida’s two key laws (SB 1094 and SB 542) and negotiated needed changes leading to successful passage of the national Private Primary Residential Flood Insurance Model Act in 2020, which is adding more states to the map each year.

From AM Best

The NFIP is still the big player, with 4.5 million policies and Floridians are its biggest client, with 1.7 million of those policies. The program’s current authorization from Congress expires on September 30 and it looks like once again, there will be just a temporary rather than long-term reauthorization. A group of Republican senators has released a proposal to extend the program by one year. Democrats already have a bill to extend the NFIP another five years. The Biden administration has submitted a list of proposals to reform the NFIP, as we’ve previously reported.

NOAA Insurance Data: NOAA will host the second of a series of dialogues with interested members of the insurance and reinsurance industry on September 29 from 2-3:30pm ET. The focus will be on extreme precipitation and flooding, with NOAA experts discussing data, tools, and trends relevant to the insurance industry. The forum will also be an opportunity for the industry to share thoughts about future needs and areas for collaboration. You can register for the webinar by visiting https://attendee.gotowebinar.com/register/1854325685618691853.

LMA Newsletter of 9-19-22