We begin this newsletter edition with some over-arching observations about the Florida legislative session, now just past the halfway point. There is increasing contention among lawmakers, even of the same party, on some major issues, including insurance. “What is being revealed basically says they lied to us,” Rep. Dianne Hart (D-Tampa) told her colleagues during last Thursday’s (April 3, 2025) House Insurance & Banking Subcommittee hearing, referring to the Florida Office of Insurance Regulation (OIR). Her comment followed testimony from OIR’s consultant who wrote the draft MGA report that’s been the subject of the subcommittee’s special hearings. The subcommittee then approved a revamped HB 881 adding language that would require insurance companies to provide more details on their MGA and affiliate relationships and allow regulators much greater powers – even to determine the amount of payments and dividends. There was no admonishment of Rep. Hart for her comment and Insurance Commissioner Michael Yaworsky was forced to defend himself and OIR in the press afterward. The subcommittee passed another bill in a growing list that would allow more insurance lawsuits – HB 1181 – that replaces Florida’s no-fault automobile insurance laws and replaces it with a fault-based system. “This feels good for the trial attorneys, and maybe we should call this the ‘Insurance and Trial Attorneys Subcommittee’,” said Rep. Mike Caruso (R-Delray Beach).

Senate President Ben Albritton on opening day of the Legislature. Courtesy, The Florida Channel

Despite the House action, all of the Senate policy committees are no longer meeting in this session, unless Senate President Ben Albritton decides to hold one. Meaning, for example, that HB 881 will most likely not be heard in the Senate and die. Its Senate companion, SB 1428, was temporarily postponed from having its first hearing last week. Up and down our Bill Watch list, none of the House’s pro-litigation bills have had their Senate companions heard in a single committee.

If you look at the three top political leaders of state government – Albritton, House Speaker Daniel Perez, and Governor Ron DeSantis – all three have distinctive personalities and policy priorities. Albritton, a farmer, is a very measured leader using calm rationale and a voice of reason, as reflected in the budget memorandum he put out on March 31. While acknowledging both Perez (pushing a permanent sales tax cut) and DeSantis (desiring a permanent property tax cut instead) have good ideas, Albritton in the memo’s third paragraph writes “Cutting taxes now does little good if they have to be raised two years from now to address budget shortfalls.”

House Speaker Daniel Perez on opening day of the Legislature. Courtesy, The Florida Channel

Speaker Perez, an attorney, is bright and has very pointed ideas about where he wants House members to go on policy and he doesn’t hesitate to put his footprint on proposed legislation. As recently as last week, the two Proposed Committee Substitute bills for HB 881 above and for HB 1429 on insurance regulation had identical language increasing scrutiny of affiliate relationships. Perez has also authorized the Insurance & Banking Subcommittee to interview and hire a forensic accounting firm to “investigate and determine what shortcomings exist in the current way Florida regulators monitor insurer and affiliate relationships in the payments or transfers of money made between them,” said Subcommittee Chair Brad Yeager (R-New Port Richey). As an attorney, Perez has specific ideas on what tort and first party litigation should look like.

Governor Ron DeSantis news conference following his State of the State address on March 4, 2025. Courtesy, The Florida Channel

Governor DeSantis doesn’t agree with the House Speaker. “Our markets were being driven into the ground because of excessive litigation,” he said after his March State of the State Address. During last week’s Florida Chamber Town Hall meeting, the Governor strongly opposed HB 1551 that would essentially undo the 2023 session’s elimination of one-way attorney fees. He pointed out that even the bill analysis states it would increase insurance premiums. He also called-out the conflict of interest by legislators who are lawyers in pushing HB 1551 and other pro-litigation bills. He took aim specifically at HB 1551 sponsor and trial lawyer Rep. Hillary Cassel (R-Dania Beach), making a strong point about how the bill directly benefits the trial lawyer profession. He closed his remarks saying “that is wrong…(and is happening) at the expense of our economy.”

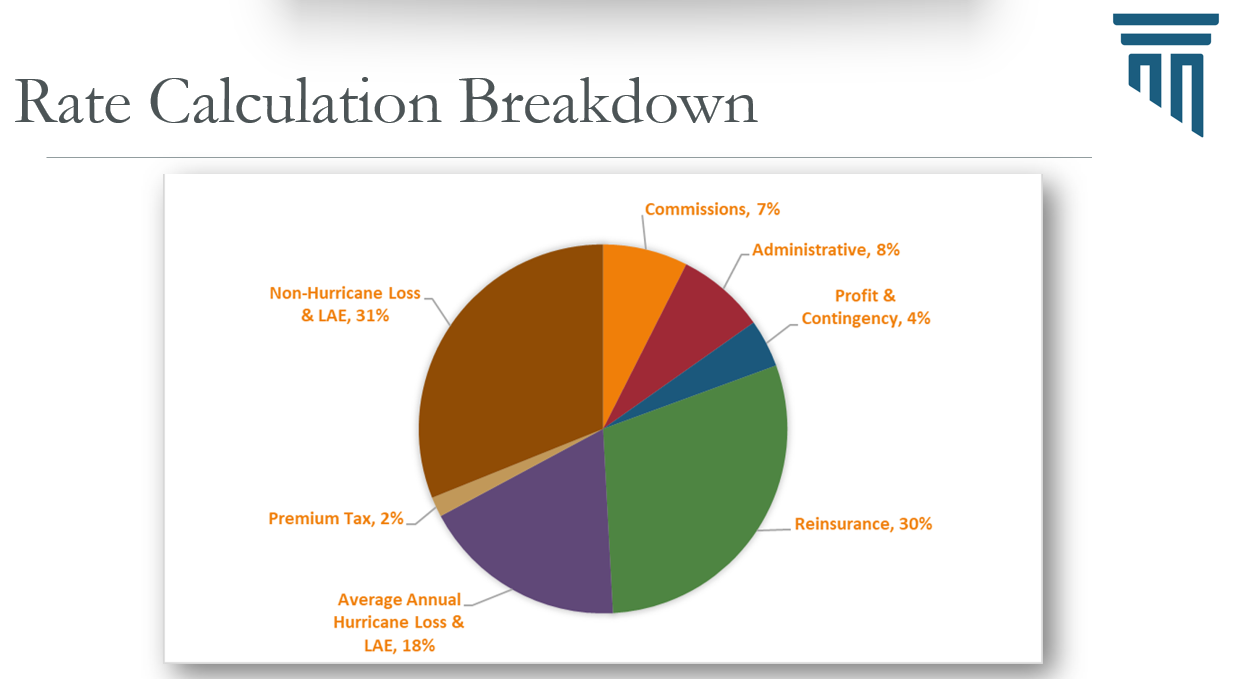

The House seems to be skeptical of the intensive regulation that OIR does, buoyed by enhanced power given to it in the 2022 & 2023 legislative reforms, which followed the OIR consultant’s draft MGA report. Commissioner Yaworski can ask an insurance company anything, anytime, anywhere, and has unfettered access to all of their financial reports and for anyone to insinuate otherwise is wrong. The inconvenient truth for the trial bar is that the 2022-2023 reforms are working in bringing down homeowners and automobile insurance rates, as evidenced by this just released presentation by Commissioner Yaworsky, titled “Florida’s Tort Reform.” All indicators are heading in the right direction as new rates make their way into policies statewide. The chart below is very informative on rate components and “where the money is going.” Former House Speaker Paul Renner, like Yaworsky, is urging lawmakers to stay the course on the reforms. Renner, an attorney and Navy war veteran, presided over the reforms that “ended sham litigation practices that made billboard lawyers rich at our expense,” as he tweeted last week. He urged lawmakers to vote “no” on HB 947 which repeals parts of the accuracy in damages law, warning “Billboard lawyers want those savings back in their pockets.”

Source: Florida Office of Insurance Regulation

For those readers using LinkedIn, you may have noticed my back-and-forth posts on these issues with trial bar lawyers and their allies. One big overlooked issue: continued lack of transparency over attorney fees that are figured into the total cost of the insurance claim, as required under the 2022 reforms. Florida Statute 624.424 (11)(p)(q) requires companies to note the amount paid for the claimant’s attorney and that attorney’s expenses for each closed claim. But the plaintiff lawyers won’t provide the information, even though Florida Bar Rule 4-1.5(f)(5) requires a lawyer to prepare a closing statement upon the conclusion of a contingent fee case, itemizing costs, expenses, and fees, signed by the lawyer and client. An insurance regulator can see all parts of MGA and affiliate operations they seek. But as far as trial lawyer earnings that created the perverse incentive to sue insurance companies that made those reforms necessary? No one is watching. How about some data on that?

We are watching the growing differences this session among Albritton, Perez, and DeSantis and it’s going to be the survival of the fittest as to who prevails in these policy differences. We won’t know until the legislature’s scheduled May 2 adjournment. Ultimately, it’s the Governor with the power of the veto, and the Senate President who has shown no interest in going along with the House in overriding the Governor’s past vetoes, who should prevail. Also, the Governor is still the chief executive of our state and as such, we anticipate him not wavering in his resolve to oppose any legislation that increases rates, stifles competition, or limits investors’ appetite in providing needed capital for new and existing Florida property insurance companies.

Next up, our Bill Watch, with what’s happening with individual bills, followed by a look at other property insurance news, more on that ongoing secret mortgage blacklist of condominiums, plus some shining examples of professional development!