Special session on Ian & the property insurance market

Cleanup continues at the Pink Shell Beach Resort & Marina in Ft. Myers Beach, heavily damaged in Hurricane Ian. Courtesy, Business Observer

The economic losses continue to mount as well in Southwest Florida, with total hospitality layoffs now topping 1,000 and growing. Providing more economic relief there is one of the reasons Governor DeSantis called a special session of the legislature for next month. The other reason is to “stabilize” Florida’s property insurance market and “introduce more competition and policies that will lower prices for consumers.”

Insurance industry discussions have been underway over the past two weeks on just how the legislature should build on the property insurance reforms it passed in the May special session. We are continuing to monitor policy development centering on four key areas:

Excessive Litigation – There are renewed calls to eliminate the one-way attorney fees statute altogether, contingency fee multipliers, Assignment of Benefits (AOB) contracts between homeowners and contractors, and reform Bad Faith law under the civil remedy statute. (You can read more on past efforts here.) Florida has 7% of the nation’s homeowners insurance claims yet 76% of the nation’s homeowners insurance lawsuits, per state regulators. “Florida’s highly litigious environment will make it difficult for insurers to settle claims for Hurricane Ian,” Moody’s said.

Roof Coverage – The ongoing debate is how carriers can insure roofs without the coverage being used as a warranty by unscrupulous contractors seeking work or homeowners who fail to perform proper maintenance. The May reforms created a non-catastrophe roof deductible with opt-out and greater scrutiny of 15 year-old roofs. Current discussions are focusing on a mandatory actual cash value (as 40 other states do) or fixed-life payout rather than replacement value, and further tightening roofing solicitation.

Cat Fund Operation – Proposals for the Florida Hurricane Catastrophe Fund include suspending the rapid cash buildup factor (the “hurricane tax”) and lowering the retention point so insurance companies can access this much less expensive source of reinsurance and save homeowners an average $150 a year on their premiums. Because of the anticipated hard 2023 reinsurance renewal season, the Cat Fund needs to function as a shock absorber to adapt to what the private market is experiencing. The statute creating the Cat Fund after Hurricane Andrew, said its expressed purpose was to “maintain a viable and orderly market for property insurance…(and) provide a stable and ongoing source of reimbursement to insurers.”

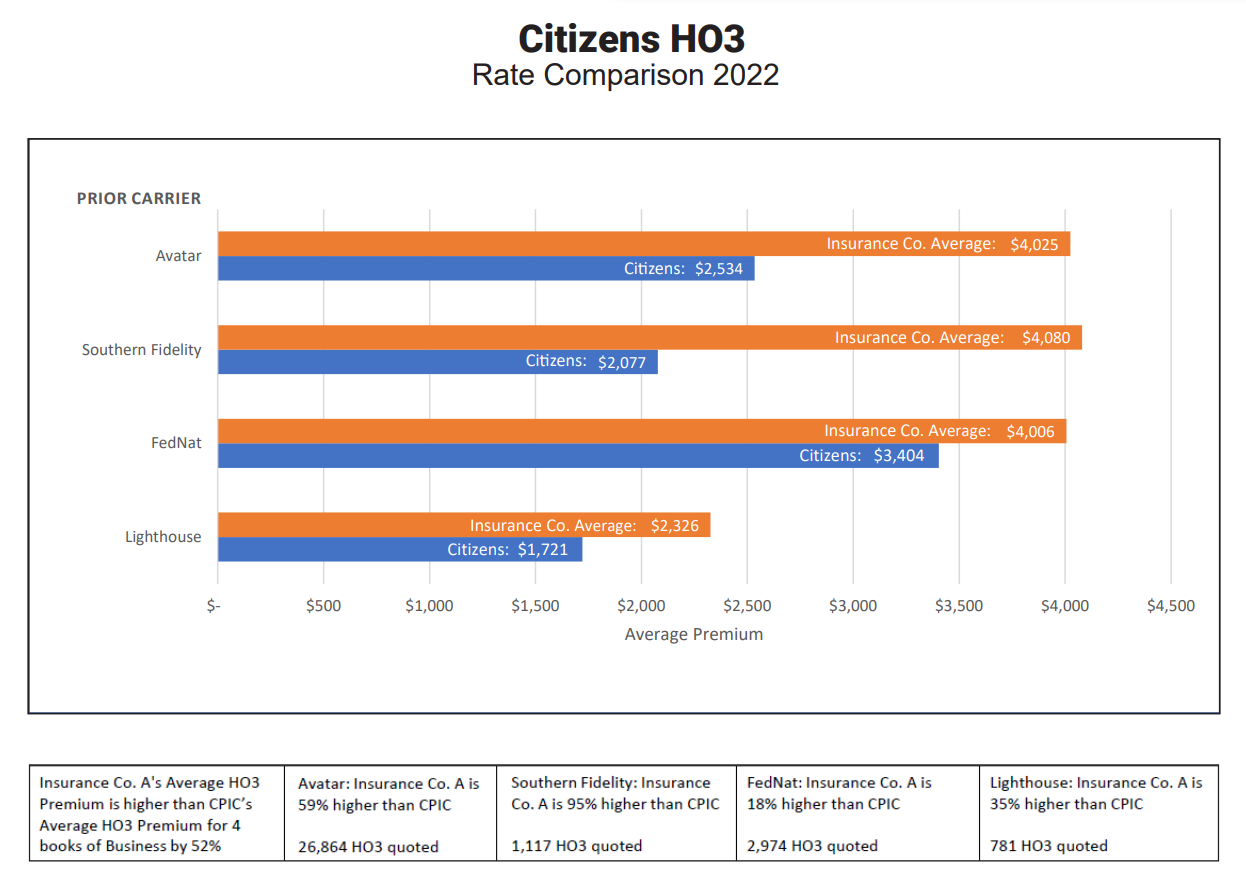

Citizens Depopulation – The discussion is on how best to return Citizens Property Insurance Corporation to being what the 2002 Legislature created, as the “insurer of last resort.” Those analyzing current numbers say that one of every two policies written by the private market end up at Citizens at renewal because they can’t compete on price with Citizens’ legislatively-capped rates (see the chart below). With 1.1 million policies and still growing, it has become the largest insurance company in Florida, with 26% more policies than #2 Universal Property & Casualty, which had 873,000 policies on September 30. Combining Cat Fund reform with proposals to increase takeouts from Citizens to the private market, such as including surplus lines carriers, would keep the rate gap from growing, reducing incentives for policyholders to switch and reducing every Floridians’ risk of paying state-mandated assessments should Citizens need help paying claims in future storms.

CFO Patronis previously outlined the reforms he’d like to see the legislature pass, including banning AOB contracts altogether, which drive a lot of the hustle. No specific date nor length of the December special session has been announced.

Six Florida property insurance companies have become insolvent this year, among the 11 since November of 2019. There’s growing consensus that property insurance rates will rise along with reinsurance rates given the continuing deterioration of the Florida market, made worse by Hurricane Ian claims.

LMA Newsletter of 11-7-22