Amid accusations that Florida’s property insurance companies, including state-backed Citizens Insurance, are deliberately paying only half their claims and “in a state of collapse,” comes new insight and fresh data that debunk the charges. The man behind the allegations is Martin Weiss of Weiss Ratings, who’s now the subject of an investigation by state insurance regulators.

Former Florida Deputy Insurance Commissioner Lisa Miller shares the new push-back from Citizens’ President & CEO on these accusations and sits down with the head of a large private insurance company who shares new data showing why these charges are inaccurate and unfair in what is a tightly-regulated marketplace.

Locke Burt, CEO and Chairman, Security First Insurance Company. Courtesy, Security First

Show Notes

The news stories emerged mere weeks after two devastating hurricanes – Helene and Milton – struck Florida, creating $5.3 billion in estimated insured losses in Florida as of late November 2024. Host Miller dives deep into the controversies and complexities surrounding the state-created Citizens Property Insurance Corporation and the broader Florida property insurance market on its claims handling and claims payment rates.

“The innuendo that’s going around in the media space is that there is a suspicion that Citizens is trying to cheat its customers, and now forces are trying to extend that innuendo to Florida’s private property insurance market companies,” said Miller. “In my opinion, that’s just plain dishonest and unfair.” Citizens is the largest property insurance carrier in Florida, with just under 1-million policyholders as of late November 2024.

The program features soundbites from Martin Weiss, founder of Weiss Ratings, Citizens Property Insurance President & CEO Tim Cerio, and a studio interview with Locke Burt, CEO and Chairman of Security First Insurance Company. Burt served in the Florida Senate for 12 years, where he helped write the laws that created Citizens and the Florida Hurricane Catastrophe Fund.

Dr. Martin Weiss, Founder, Weiss Ratings. Courtesy, WPTV-TV

Weiss, in various November media reports, said that he’d reviewed Citizens Property Insurance 2023 annual financial statement and concluded that Citizens didn’t pay 50.4% of its 2023 claims. He said that was worse than any private insurance company’s no-pay rate. Weiss declined an invitation to appear on the podcast.

Burt and Cerio defended Citizens and the broader Florida insurance market against Weiss’ accusations, noting there are legitimate reasons claims are closed without payment. It’s not always about denial. The reasons include:

- Claims that fall below the policyholder’s deductible.

- Duplicate claims.

- Claims related to flood damage, which are not covered by standard homeowners’ policies.

Weiss, in his criticism of Citizens, was quoted in the media as saying “One factor that we believe is probably playing a role is a deliberate strategy to reduce their liabilities for whatever reason.”

Tim Cerio, President & CEO, Citizens Property Insurance Corporation at the December 4, 2024 Board of Governors meeting. Courtesy, The Florida Channel

Cerio shot back at the December 4, 2024 Citizens Board of Governors meeting. “It’s critical to just point out that, we are the state created, not for profit, insurer of last resort. We have no financial incentive to not play claims. Zero,” he said.

Burt pointed out that Citizens has made $500 million so far in 2023, has a significant surplus of $5.6 billion, and that its employees are motivated to pay legitimate claims promptly. He pointed out questionable methodology used by Weiss in reviewing Citizens 2023 claims. “It’s very selective,” said Burt. “He limits his analysis to claims that were reported in 2023 and closed in 2023. In the insurance business, we call that accident year statistics, and it’s a very small percentage of the claims that are handled by an insurance company every year.”

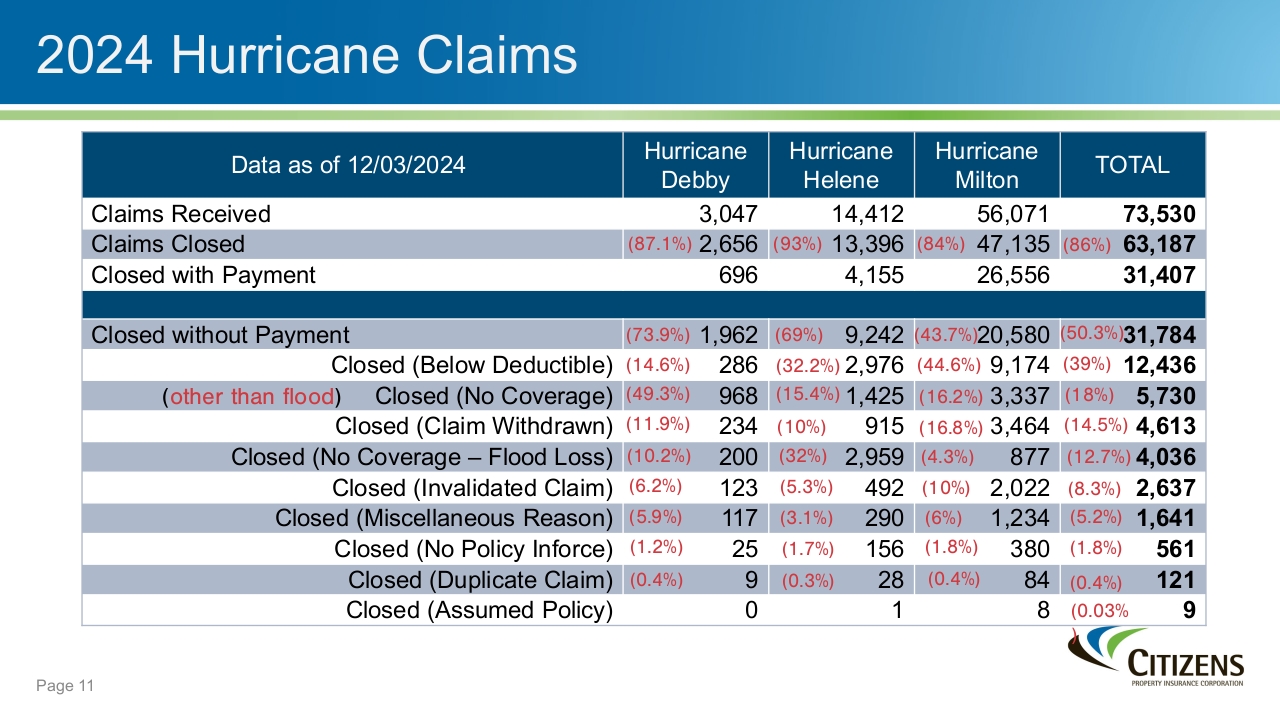

The podcast also delves into Citizens closed claims during the 2024 hurricanes: Debby, Helene, and Milton. Some news media have reported a 77% denial rate of claims from the storms. “That’s absolutely false,” said Cerio. He pointed out that taken altogether, 50% of those hurricanes’ claims have been closed without payment. But 18% had damage that wasn’t covered under the policy and another almost 13% had flood damage which is not covered under a homeowners policy. So those total 31% – a big difference, Cerio noted. Burt refined the numbers even further. “Only 5,730 claims were closed because the loss was not covered by the Citizens’ policies. That’s only 9.1%. That’s a far cry from the 77% reported in the press,” said Burt.

Source: Citizens Property Insurance Corporation (with percentages added by Lisa Miller & Associates)

Weiss has also made accusations against the broader property insurance market in Florida. That includes the more than 130 companies writing almost 7.6 million policies statewide. He was quoted in the news media as saying that that homeowners are at a “high risk” of not being paid for their claims related to hurricanes Helene and Milton and that the state insurance market “is already in a state of collapse.” Weiss said that “some of the bigger providers in the state have denial rates closer to 50%,” that companies were “stiffing their customers” and “abusing their power to deny damage claims as a deliberate tactic to conserve cash and avoid bankruptcy.”

Those accusations have caught the attention of the Florida Office of Insurance Regulation (OIR). The OIR issued subpoenas to Weiss and Weiss Ratings to produce the documentation to back up his claims.

“My perspective is that the OIR sent Weiss a subpoena because Weiss is not looking at the same numbers that the OIR is looking at,” said Burt. “The NAIC got a certified financial statement from every Florida company on November 15, 2024. If Dr Weiss would have simply looked at those statements, he would have seen that a number of Florida companies are making money. And if he would have done that, what he would see is State Farm of Florida made $72 million, Castle Key made $29 million, Florida Pen made $45 million, HCI made $42 million, Heritage made $10 (million). Does that sound like an industry that’s on the verge of collapse? I think not,” said Burt. He noted that those profits will be needed to pay for Hurricane Milton claims.

Host Miller pointed out that, according to the Miami Herald, “In 2006, Weiss’ company paid $2.1 million to the Securities and Exchange Commission to settle claims he misled subscribers about the performance of some investments.” Miller said there are six companies recognized and regulated by the U.S. Securities and Exchange Commission that rate Florida property insurance companies and that Weiss Ratings is not one of them.

Miller and Burt also discussed that the recent criticism on claims handling failed to remind Florida policyholders of the enhanced safeguards that went with the tort reform passed by the Florida Legislature in 2022 and 2023. That includes passage of House Bill 7052, the Insurer Accountability Act, which increased the regulation of property insurance companies.

“The press and the public don’t really have any comprehension of the scrutiny that the private industry faces every single day on its claim handling,” said Burt, whose Security First Insurance has about 135,000 policies in force currently.

Florida Insurance Commissioner Michael Yaworsky. Courtesy, OIR

Those very reforms and the progress they made in helping the Florida insurance market get back on its feet, with easing insurance rates, are in jeopardy, according to Cerio. “I know there are groups out there that are going to be very interested in rolling them (the 2022 & 2023 legislative reforms) back, if we can, and that’s why I think it’s important we correct the record,” said Cerio. “Who I do criticize is the cottage industry of lawyers teamed up with contractors, teamed up with public adjusters, who engage in fraudulent behavior and inflate claims. Those are the folks that may galvanize to try and roll back these reforms, and it’s just going to be a fight, and we’ve got to not be afraid to join the issue in a transparent and communicative fashion.”

Miller and Burt also discussed the upcoming March 2025 legislative session and Florida Insurance Commissioner Michael Yaworsky’s recent comment urging the legislature take no further reform efforts.

“No one, including insurance companies, wants to see policyholders with rightful claims have their benefits denied,” said Miller, who also urged listeners who don’t have flood insurance, to consider purchasing it. “Our recent Florida hurricanes, Helene and Milton, caused some pretty bad damage. I was in those areas. I saw the flood lines in Pinellas County, Treasure Island, Manatee, Siesta Key − so much flooding that is not covered under a homeowners property insurance policy.”

Links and Resources Mentioned in this Episode

State-run Citizens insurance had worst rate of paying Floridians’ claims (Tampa Bay Times, November 19, 2024)

Citizens Insurance rate of paying claims questioned (WPTV-TV, November 19, 2024)

He said Florida’s insurance market is ‘on the brink’ of collapse. Then came the subpoena (Miami Herald, November 22, 2024)

Florida Citizens’ insurance claim closures need closer look (Miami Herald Editorial, November 22, 2024)

Subpoenas Issued to Martin Weiss and Weiss Ratings (Florida Office of Insurance Regulation via the Tampa Bay Times)

Citizens insurance: Why half of 2023 homeowner property damage claims closed without payment (Palm Beach Post, November 25, 2024)

Florida Office of Insurance Regulation subpoenas Palm Beach Gardens firm over Citizens Insurance allegations (WPTV-TV, November 25, 2024)

Annual Statement of Citizens Property Insurance Corporation 2023 (Citizens Property Insurance Corp.)

Report on the Citizens Property Insurance Corporation’s December 4, 2024 Board of Governors meeting (Lisa Miller & Associates)

Florida’s Insurance Commissioner Provides Update on Continued Property Insurance Market Stabilization (Florida Office of Insurance Regulation, October 10, 2024)

Citizens Property Insurance Corporation

Catastrophe Claims Data and Reporting (Florida Office of Insurance Regulation)

Lawsuits against insurers declined again this year. Will this year’s hurricanes reverse the trend? (South Florida Sun Sentinel, November 12, 2024)

Florida’s insurance commissioner urging legislators not to enact any more reforms next spring (South Florida Sun Sentinel, December 4, 2024)

Property Insurance Stability Report (Florida Office of Insurance Regulation, July 2024)

Florida Property Insurance Market Stats, Data and Facts (Florida Office of Insurance Regulation)

Florida Department of Consumer Services Consumer Helpline (online) or 1-877-693-5236 (phone)

Flood Insurance Writers in Florida (Florida Office of Insurance Regulation)

Subscribe to the LMA Newsletter and The Florida Insurance Roundup podcast (free)

Image credit: danielfela/Shutterstock

** The Listener Call-In Line for your recorded questions and comments to air in future episodes is 850-388-8002 or you may send email to [email protected] **

The Florida Insurance Roundup from Lisa Miller & Associates, brings you the latest developments in Property & Casualty, Healthcare, Workers’ Compensation, and Surplus Lines insurance from around the Sunshine State. Based in the state capital of Tallahassee, Lisa Miller & Associates provides its clients with focused, intelligent, and cost conscious solutions to their business development, government consulting, and public relations needs. On the web at www.LisaMillerAssociates.com or call 850-222-1041. Your questions, comments, and suggestions are welcome! Date of Recording 12/6/2024. Email via [email protected] Composer: www.TeleDirections.com © Copyright 2017-2024 Lisa Miller & Associates, All Rights Reserved