Nine months after hurricanes Helene and Milton struck Florida, new insurance claims data is revealing the growing amount of damage not covered by insurance. Of the more than half a million combined claims filed so far, 56% of Helene residential claims were closed without payment and about 43% of Milton residential claims. A closer look shows the majority were uninsured or underinsured.

Former Florida Deputy Insurance Commissioner Lisa Miller sat down with the heads of an insurance agency and a claims adjusting firm to find out why this is happening, how to determine proper coverage this hurricane season, and improvements in claims processes and technology.

Lee Wiglesworth, President, Wiglesworth-Rindom Insurance Agency

Fraser Hudson, CEO, Lozano Insurance Adjusters

Show Notes

When hurricanes Helene and Milton swept through Florida, they left more than just physical devastation in their wake − they exposed critical gaps in homeowners’ understanding of natural risk and insurance coverage, especially regarding flood protection. In this podcast, host Lisa Miller talked with two industry veterans − Lee Wiglesworth, President of Wiglesworth-Rindom Insurance Agency in Stuart, Florida, and Fraser Hudson, CEO of Lozano Insurance Adjusters of St. Petersburg − to dissect the data, debunk common myths, and offer actionable advice for insurance agents and Florida policyholders facing the daunting world of insurance claims. From claims to coverage, they discussed what every Florida property owner must know after hurricanes Helene and Milton. The podcast also provides a deep dive into Florida’s insurance landscape.

Reasons for Uninsured/Underinsured Properties

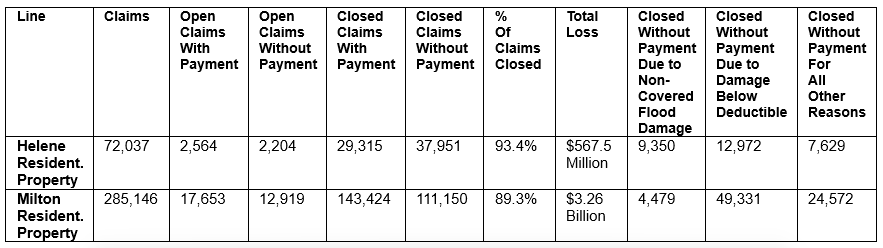

Hurricane Helene and Milton Florida insurance claims now total $7.3 billion with more than 90% of claims closed, according to the Florida of Insurance Regulation (OIR), in its June 10, 2025 claims update, the first since November 2024, just weeks after the storms’ landfalls. More than a half a million claims (519,689) have been filed across all insurance lines. On homeowners claims, the data shows that 56% of Helene residential claims have been closed without payment and about 43% of Milton residential claims. The majority of those unpaid claims were flood damage not covered under a homeowners policy or the damage was below the policy deductible, per the table below.

“And when you figure in a lack of coverage for all other reasons, and those are all listed, there’s about 17 reason categories on the OIR website for closed claims without payment, those percentages jump to 79% for Helene and 71% for Milton,” noted host Miller. She warned listeners of others, such as trial attorneys and Weiss Ratings, who will use this data as they did last fall to insinuate that insurance companies are purposely denying claims arbitrarily (see Florida Insurance Roundup episode #54 – The Truth Behind the 50% Claims Denial).

So why so many claims without payment? “We have too many residents without flood insurance, and if you just have hurricane coverage on your homeowner’s policy, without flood insurance, you’re not fully covered for a hurricane,” said Wiglesworth, who has more than 20 years of experience as an agent. “I also know that homeowners don’t fully understand their coverages, their policy, or how their deductible works, and that we as agents need to do a better job of educating and explaining and working past some of those misconceptions.”

Wiglesworth pointed to statistics from the National Flood Insurance Program (NFIP) that shows only 13% of Florida properties have flood insurance. “So that’s 87% of homeowners, again, not fully covered for a hurricane,” he said. “We pay exorbitant amounts of money for wind coverage, for wind damage that could destroy our roofs, damage our roofs, damage our homes, and we have nothing for some of the most-costly damages that we’ve seen in recent hurricanes, for rising water, storm surge, and over saturation.” The hurricanes flooded both coastal and inland residents, including those living along streams and rivers.

Wiglesworth said a federal NFIP policy costs as little as $500 a year and explained the benefits and differences between the NFIP and private market flood insurance policies. Host Miller noted that Florida now has more than 30 private companies writing flood coverage – policies that can exceed the $250,000 coverage limit of NFIP and are usually more comprehensive, including paying temporary living expenses.

Hudson said his years of overseeing claim adjusting include “homeowners that didn’t understand that flood wasn’t covered by their homeowners policies. Many of them mistakenly believe that the flood, the storm surge, the catastrophic rain, was all caused by a hurricane, and they’re covered by a hurricane, so therefore they should be covered under their homeowners policy. But the reality is…the resulting damages are excluded under most of your homeowners insurance policies,” said Hudson. He said whether you live in a FEMA flood zone or not, “if it rains where you live, particularly in Florida, where we have flat topography and the water doesn’t drain, you need to have flood insurance.”

Hudson said the biggest reaction he sees from homeowners is regret – when they realize there’s a big price to pay for not having flood insurance. “Two inches of water is going to damage your floors. It can damage your walls, damage your cabinets, damage your furniture, and you could very easily end up $100,000 in debt, having to pay for all that out of pocket, when you could have paid $500 a year to be covered,” he said.

How the 2022-2023 Legislative Reforms Have Helped Claims Management

The new OIR claims data also shows that in the seven months from November 2024 to June 2025, insurance companies have reduced the number of Helene’s open claims without payment from 13,681 to 2,204; and reduced Milton’s similarly open claims from 108,105 to 12,919.

“Only having 10% of the claims open less than a year from an event is significant,” said Hudson. “Carriers are being held more accountable for their performance now, and it’s obvious that they responded. They over-staffed for Milton to be able to do it, plus they had a new statute that reduced the amount of time that they had to address claims from 90 days down to 60 days, as long as there were no factors outside of their control.”

Hudson also pointed out the other parts of the 2022 and 2023 insurance consumer reforms passed by the Florida Legislature that are having a positive impact on claims handling, including the end of one-way attorney fees for plaintiff lawyers and outlawing Assignment of Benefit (AOB) contracts for all property insurance claims. “If you go and look at OIR data for (Hurricane) Ian that was published in March of this year, there are still 20% of the Ian claims in Broward County open, and 25% of the Ian claims in Miami-Dade that are still open. And Ian was almost three years ago and really did not have much of an impact in Miami-Dade or Broward. You compare that with the 10% that are open for Milton and Helene today, only 10 months post storm, it really indicates to me that the removal of the one-way attorney fees has disincentivized those frivolous lawsuits that tend to keep claims open,” said Hudson.

Improved Efficiencies in Claims Handling

Host Miller asked whether the lower claims counts could lead to a shortage of adjusters, who may be leaving the profession for jobs in other fields. “Some adjusters are retiring out of the business and some may be looking for jobs elsewhere,” agreed Hudson, who serves as a strategic partner to Citizens Property Insurance Corporation. The key now will be to apply recently developed technologies “to make adjusters more efficient and make them more accurate,” he said. These include:

- AI Chatbots that take voice calls, speak the calling policyholder’s language, and can take the First Notice of Loss, passing along notes to human claim adjusters. “Now when the person calls in their claim, they don’t have to wait for an hour on hold or wait for a callback from someone because it’s a computer answering. You can have 1,000 of those chat bots going at the same time, filing claims and getting the claims out to the field, which is usually ready to respond faster than your desk adjusters are, because they’re already deploying in advance of the storm,” Hudson said.

- AI letter-writing, that can take a policy form, a declaration page, a copy of the field adjuster’s report, and a copy of the estimate, and then draft the response letter to the policyholder. “This is one of the things that slows down your desk adjusters on processing claims, is they are manually writing their coverage letters, their request for information letters,” he said.

Hudson said the purpose is to put the adjuster more into a review position, helping them be more efficient, while keeping the human touch on processing the claim. “These are some things I think that carriers need to embrace to be more efficient to meet the new timelines for the Florida claims handling statutes, as well as getting money to the policyholders faster,” he added.

Determining Proper Insurance Coverage

Host Miller said one of the big questions that news media and homeowners always ask her is, ‘How much coverage is enough?’ The simple answer is enough coverage to replace the home if it was totally destroyed. But how do agents determine that?

Wiglesworth said the question puts agents in a tough spot, because they’re not licensed adjusters or contractors. Although agents have replacement cost calculation tools provided by insurance companies, it really comes down to having a conversation with the customer to determine how to insure the home to 100% replacement cost. “I like our team going through those items line by line, room by room, what type of flooring, what type of countertops, what type of cabinetry is in there, and then that whole time, explaining it to that homeowner, that prospect or that insured of why we’re doing this and why it’s in their best interest to be properly insured,” said Wiglesworth.

He said many consumers view insurance as a commodity and simply want the agent to find the lowest price. But agents do a disservice, he said, by assuming that’s all they want. “Insurance is not something that you necessarily always want the cheapest of. You need to be asking what your coverage limits are, what you’re insured for,” Wiglesworth cautioned.

Even reviewing the house’s components and using a replacement cost calculator may not be enough, however. “To truly know, because we are not contractors, you need to have somebody else go out there. There are companies that will do full appraisals, especially when you’re dealing with some higher value properties of one million or three million dollars,” Wiglesworth advises. “Don’t put that exposure on yourself as an agency of underinsuring that home, because that is the worst time you want to be explaining to a client that they don’t have coverage, or they don’t have enough coverage, is when they’re standing in a loss situation.” Hudson agreed. “If you have a high-value property, consider a professional appraisal to ensure you’re adequately covered,” he said.

Consumer Education & Action Critical

The podcast included practical advice for policyholders to help get ready for what’s forecast to be a slightly above average 2025 hurricane season. These include removing dead trees, trimming tree branches, clearing rain gutters, having an evacuation plan, documenting your home and furnishings with pictures, and having a copy of your homeowners and flood insurance policies’ declaration pages ready to take with you. And, of course, considering the purchase of a flood policy.

“We are showing the numbers of what is happening when claims are not paid, and we’re showing you what happens when someone is underinsured. And when I say underinsured, I mean no flood insurance or not enough coverage on your homeowner’s policy,” host Miller advised the listening audience. “Protecting your home starts with knowing your coverage and being ready for the next storm.”

Links and Resources Mentioned in this Episode

Wiglesworth-Rindom Insurance Agency

2024 Hurricanes Generate Another $2.6 billion in Florida Claims (LMA Newsletter of June 16, 2025)

Catastrophe Claims Data and Reporting website (Florida Office of Insurance Regulation)

National Flood Insurance Program (FEMA)

Flood Insurance Writers in Florida (Florida Office of Insurance Regulation)

Key Provisions of 2022 Insurance Consumer Protections & Market Reforms (SB 2-D & SB 2-A) (Lisa Miller & Associates)

2023 Insurer Accountability & Litigation Reforms (Lisa Miller & Associates)

CFPB Finds Hundreds of Thousands of Mortgages in Southeast and Central Southwest US Likely Underinsured Against Flood Risk (U.S. Consumer Financial Protection Bureau, January 13, 2025)

FEMA Maps Lead to Development in Flood-Risk Areas, NC State Study Shows (Insurance Journal, January 13, 2025)

APCIA: Record Shows ‘Minimal Complaints’ on Hurricane Milton, Helene Claims (Insurance Journal, May 20, 2025)

Subscribe to the LMA Newsletter and The Florida Insurance Roundup podcast (free)

** The Listener Call-In Line for your recorded questions and comments to air in future episodes is 850-388-8002 or you may send email to [email protected] **

The Florida Insurance Roundup from Lisa Miller & Associates, brings you the latest developments in Property & Casualty, Healthcare, Workers’ Compensation, and Surplus Lines insurance from around the Sunshine State. Based in the state capital of Tallahassee, Lisa Miller & Associates provides its clients with focused, intelligent, and cost conscious solutions to their business development, government consulting, and public relations needs. On the web at www.LisaMillerAssociates.com or call 850-222-1041. Your questions, comments, and suggestions are welcome! Date of Recording 7/2/2025. Email via [email protected] Composer: www.TeleDirections.com © Copyright 2017-2025 Lisa Miller & Associates, All Rights Reserved