An AmeriCorps Disaster Response Team removes damaged flooring from a flooded home on Pine Island, Florida after Hurricane Ian, November 29, 2022. Courtesy, AmeriCorps

FEMA this past Monday (April 8, 2024) issued a 30-day pause on its decision in late March to eliminate the 25% discount on federal flood insurance policies on up to 125,000 property owners in Southwest Florida. FEMA said five governments in Lee County, ground zero for Hurricane Ian’s September 2022 landfall, failed to follow federal rules on permissible rebuilding after the storm. The pause came after elected officials from both the state and federal governments appealed to FEMA officials to at least reconsider – if not overturn – their decision.

FEMA eliminated the discount provided under the National Flood Insurance Program’s (NFIP) Community Rating System (CRS), which rewards local communities that mitigate flood risk with various policy discounts for their residents. That includes proper enforcement of the so-called “50% Rule” which requires homes in flood zones that suffer damage of at least 50% of their market value (not including the land) be brought up to current building codes – often involving more costly rebuild and elevation, rather than simple repair.

The Issue

FEMA Region 4 Administrator Robert Samaan

FEMA claimed local officials had loosened the rules after Ian and that there was a large amount of unpermitted work, a lack of documentation, and a failure to properly monitor rebuilding in FEMA-designated Special Flood Hazard Areas. FEMA Region 4 Administrator Robert Samaan detailed to the Miami Herald how the agency tried to get the needed information. “Nobody wanted to get to this point, but unfortunately this is where we’re at with this,” Samaan said. The decision applies to Cape Coral, Fort Myers Beach, Bonita Springs, Estero and unincorporated Lee County.

Cape Coral Mayor John Gunter

“FEMA is the villain here,” said Cape Coral mayor John Gunter at an April 3 meeting, putting the loss of the discount to his residents at $8 million. The average flood premium will rise by about $300 a year, starting Oct. 1. He and other local officials outlined in a statement the back and forth communication between them and FEMA over the past 18 months since Ian’s landfall. “For the federal government to have made this decision without any prior discussions seems punitive,” said Lee Board of County Commission Chairman Mike Greenwell.

Sanibel Island and the City of Fort Myers were not found in violation and will remain in the CRS program. Fort Myers Mayor Kevin Anderson, when asked by local television station Fox 4 what his city did right, answered “It’s a never-ending process,” working with FEMA. “You have to understand the requirements and do your best to meet them…It’s a continual assessment on our part, not only to make sure we stay within the guidelines, but hopefully we’re improving our rating to, possibly, get a greater discount at some point.”

Both Florida U.S. Senators Rick Scott and Marco Rubio, joined by Congressmen Byron Donalds and Greg Steube, sent a letter on April 3 to FEMA Administrator Deanne Criswell urging her to reverse the agency’s decision “and meet with local leaders to remedy any issues and keep NFIP discounts in place. (This) is yet another unforeseen challenge for Lee County residents, who continue their fight to recover from Hurricane Ian,” the letter read. The letter no doubt led to FEMA issuing this pause “to give each of the five communities an additional 30 days to gather requested documentation to help retain their standing in the Community Rating System,” according to a FEMA spokesperson.

The Crossroad

One of many coastal homes in Lee County buckled by Hurricane Ian’s winds and storm surge, December 21, 2022. Courtesy, AmeriCorps

This story illustrates where the “rubber meets the road”: A home is at least 50% damaged; the taxpayer-supported FEMA wants to avoid repeatedly spending money on the same structure whenever there’s a flood; FEMA requires the home be torn-down if needed in order to meet current, more resilient building codes; and the local official has to enforce federal demands. But the homeowner either doesn’t have the money or the insurance coverage to pay for that or doesn’t want to wait for a rebuild when a “simple repair” can get them back in their home. The question is, how do local building officials respond to homeowners who are in this situation? Their goal, after all, is to get residents back in their homes as quickly and safely as possible. The Sarasota Herald reported two months post-Ian that local government officials in Southwest Florida had been meeting with FEMA officials to relax the rules, with no success.

As a former regulator, I know that FEMA had done as much as it could before it made its March decision. I feel for the local leaders because the front line stops with them, and too, for the residents that are saying please don’t make me rebuild my home, let me repair it, even if it’s damaged more than 50% and I need to elevate it. That’s the crossroad.

The Bigger Picture

I know the leaders at FEMA. They’re not kidding and they’re doing the right thing, as this is an issue across the country. The New York Times reported in 2020 that nearly 250,000 federal flood insurance policies are for structures that were built after these flood elevation rules took effect and are in violation of them. The article references FEMA data that those policyholders together filed 29,639 flood insurance claims between 2009 and 2018, leading to payouts of more than $1 billion. At the time, more than 2,000 counties across America had buildings on the list with the greatest number including Florida’s Pinellas and Monroe Counties. According to the article, “Local governments are responsible for enforcing the requirements, but almost none have been penalized for failing to do so.”

I understand the goal of local officials is to get residents back in their homes. I think FEMA’s action serves as a wake-up call for our communities that the 50% rule is not intended to be punitive. It is intended to save people’s lives. Floodwaters are not forgiving, especially here in Florida where Ian claimed 156 lives, many from drowning. Our catastrophe risk is higher than anywhere else in the world, except for Tokyo, Japan’s earthquake risk.

Ian Devastation & Lessons

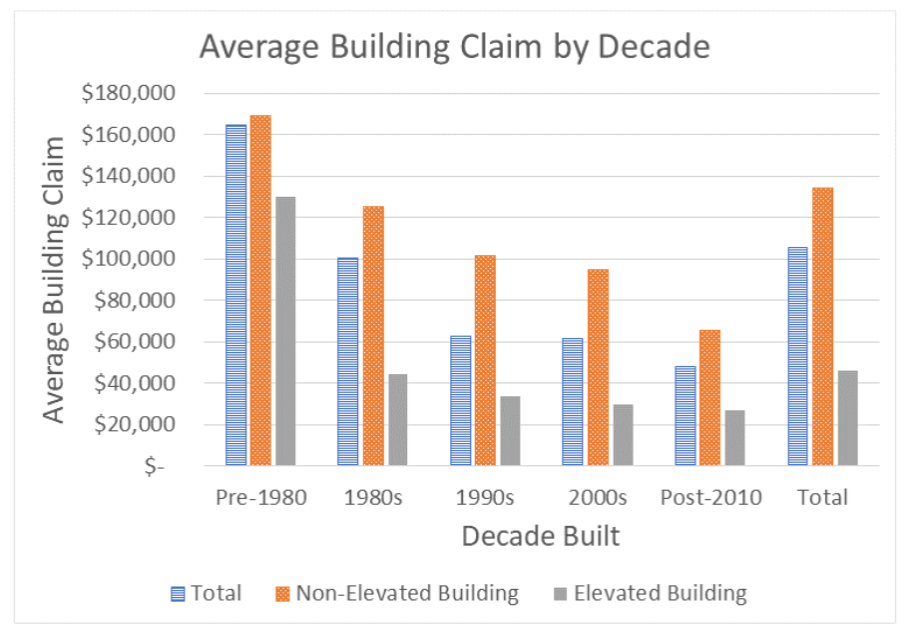

The flood damage from Hurricane Ian was staggering, ranking as the fourth most expensive flood disaster by FEMA’s National Flood Insurance Program (NFIP) payouts, right behind Hurricanes Katrina, Harvey, and Sandy. FEMA’s recent Hurricane Ian NFIP Claims Analysis on single-family houses in Southwest Florida provides a direct comparison of storm and flood damage between older and newer construction homes and their elevation, showing that newer, elevated homes fared best. As of September 2023, NFIP has paid out $4.3 billion on more than 48,000 claims. About 37,000 of those were in Florida with 22,000 of those in Lee County. That payout came from premiums paid by the NFIP’s 4.68 million policyholders – including those who live inland with smaller risks – together with additional subsides from U.S. taxpayers. So this is also a story of fairness.

Hurricane Ian average building claim from flooding in elevated versus non-elevated buildings by decade. Source: FEMA

So what’s next? If I was Lee County, I would make a list of those homes that FEMA has a problem with and I would show that they could withstand the next storm, if they can. That’s the whole point: When the next flood comes, these homes are going to make it, and FEMA won’t have to pay another claim. I’ll certainly be following this story with interest to see how it is resolved and what message it may bring to other communities across Florida and the nation who are in similar circumstances.