| What’s the Point? |

| Often times at this juncture in the legislative session (we have two weeks left and have been in session for seven weeks), you will hear those in the Capitol hallways say, “what’s the point of being here when we just aren’t able to get legislators to LISTEN?” There’s a reason for this sentiment and it’s because in so many committee meetings where bills of immense public policy interest are heard and debated, speakers approach the podium to say why a bill is good or bad, and it appears no one is listening. For example, in a committee meeting last week, not ONE single person who addressed the committee members supported the bill being presented. Yet the bill passed unanimously.

Throughout my career I have been taught that great leaders are those who are proactive, strategic, and intuitive listeners. The best leaders possess the uncanny ability to understand what is not said, witnessed, or heard. Those of us who participate in the legislative process know that we must do better before session when things aren’t so rushed to have our message delivered. And we must not give up on talking about what is important and right when it comes to Florida’s challenging issues. So harken back to last week’s newsletter and reporter Bill Cotterell’s article on how to engage and influence so that legislators will listen and respond to the arguments and facts presented. Let’s take a look at what happened last week as bills we are watching moved in many instances. |

| Bill Watch |

| Last week’s legislative activity was spirited to say the least with debate on many of the bills we are following. For example, House and Senate Committees debated their respective medical marijuana bills and the bills are vastly different. The full House passed its version of a workers’ comp bill to adjust the law in response to a couple of Florida Supreme Court decisions. The Senate bill? It’s a very different bill although it also addresses the court’s direction and will be heard most likely this week on the full Senate floor. The House assignment of benefits bill by Rep. Jamie Grant was heard in its last committee stop with opposition and support from the usual suspects. Please continue reading for all the details in our weekly Bill Watch on the major legislation we’re following:

Assignment of Benefits (AOB) – Rep. Jamie Grant’s new and improved assignment of benefits (AOB) abuse reform bill (HB 1421) was heard in the House Commerce Committee and passed on a nearly party line vote with all Democrats opposing the bill but one. The bill has 3 main components: data collection aimed at having concrete evidence of attorney fee amounts and claim costs; parameters around attorney fees vs the current “wild, wild west”; and consumer disclosure language so the consumer is fully aware of the consequences when executing an assignment of benefits document. Rep. Grant’s commitment to finding balance in AOB abuse reform was evident in his opening remarks when he said he had a two-tier criteria for the bill – one to reduce rates and the other to ensure nothing is done to harm those with an actual loss. Insurance Commissioner David Altmaier reminded the committee members that in 2016, 73% of property insurance rate filings were approved for a rate increase. This was very alarming to him along with other data including the rise in AOB lawsuits from 2010 until now. Rep. Grant’s bill will be heard on the House floor tomorrow (April 25). In the Senate, Sen. Gary Farmer’s proposed AOB legislation (SB 1218) passed out of the Senate Banking and Insurance Committee on Monday April 3 and has not had a committee hearing since. The bill includes a requirement that the Department of Business and Professional Regulation (DBPR) license water extraction firms and sanction firms who violate provisions in the proposed legislation. Several other provisions are aimed at providing consumer protections but eliminate insurer “repair networks” of vetted contractors who have been pre-screened to repair the damage. Unfortunately, Sen. Hukill’s bill (SB 1038) which had many of the Office of Insurance Regulation (OIR) recommendations was not heard and isn’t being considered by the Senate. It is unknown if the House and Senate will come to an agreement about this issue. For a bill to pass both houses and head to the governor for signature, the language has to be the same for both. Flood Insurance – SB 420 (Brandes) extends rate deregulation from 2019 to 2025 and relaxes eligibility requirements to write flood lines. It allows commercial lines coverage (residential & nonresidential), excess flood coverage, and more surplus lines participation by removing the capital/surplus requirement in favor of a stronger financial strength rating. Note that this and Diligent Effort represent a strong push this year by the unregulated lines to gain a stronger foothold in Florida’s currently stable P&C market. HB 813 (Lee) contains elements of both the Flood and Diligent Effort bills. Both bills were heard in committee last week and are expected to continue to move through the process.. Insurance Fraud – SB 1012 & SB 1014 (Brandes) and HB 1007 & HB 1009 (Raschein) are being pushed by outgoing CFO Atwater as providing needed tools to help DFS stay ahead of criminals who seek to defraud Floridians. The measures would create a dedicated Insurance Fraud Prosecutor grant funding program, require insurers to adopt an anti-fraud plan and designate primary anti-fraud employees, and require that those plans and statistics be submitted to DFS annually. SB 1014 and HB 1009 are significant as currently when a consumer or insurance company sends information to the Department of Financial Services insurance fraud authorities, that information is a public record. This bill removes that provision from the law which addresses the concerns of those who report insurance fraud practices from being a target of retaliation from parties interested in “getting back at” the person or entity who made the effort to report the fraud or abuse. These bills are moving through the process with HB 1007 and SB 1012 passing their second committee stops unanimously last week. Insurance Premium Tax – SB 378 (Flores) repeals the insurance premium tax credit of up to 15% on the salaries that insurers pay to their Florida-based full-time employees. This is a long-standing priority of the Senate President who has stated the credit was a good jobs incentive when enacted 30 years ago but is unnecessary now. The $297 million in resulting savings was originally going to go to pay for a 2% reduction in the Communications Services Tax but instead would now go to reducing the Business Rent Tax on building leases by 1% (from 6% to 5%). While there was no action on the bill this week, another bill SB 484 that would reduce the Business Rent Tax but doesn’t affect the premium tax credit passed the Senate Community Affairs Committee. There was no movement with either bill last week. Medical Marijuana – SB 406 by Sen. Rob Bradley passed its second committee stop in the Senate Appropriations Subcommittee on Health and Human Services on April 18 with one more to go and HB 1397 by Sen. Rodrigues passed its second committee stop with one more to go. There were more opponents than supporters who publicly spoke about Rep. Rodrigues bill, including those with critical illnesses. HB 1397 would ban smokeable marijuana as well as prohibit edibles and vaping and would require a patient to wait 90 days before being eligible to have the drug. Rep. Jason Brodeur tried to clarify that it’s not actually 90 days – it’s only 90 days if the patient is seeing a new doctor. Patients with long physician relationships can access the drug more quickly. However, in reading the bill, the physician that recommends medical marijuana must take an education course before recommending the drug so there most likely would be a delay if the doctor hasn’t completed that requirement. Rep. Rodrigues was successful in securing passage of amendments that would appropriate approximately $10 million for drug abuse prevention education. One political observer said that in essence the restrictive nature of the House bill is, in itself, a drug prevention program. The Senate Bill has more flexible provisions that: -Would create a coalition for medical marijuana research through Tampa’s H. Lee Moffitt Center and Research Institute and another would allow a 90-day supply versus 45 days in an earlier version of the bill; -Would allow Florida nonresidents to access the drug as long as the prescription originates in their home state; – Would require a seed-to-sale tracking system overseen by the Department of Health who would also oversee independent labs to test the drug before distribution; and – Would allow for more licensees in addition to the 7 already doing business in the state. Personal Injury Protection (PIP), also called No Fault Insurance – Florida has been a no-fault (PIP) state since 1972, yet despite significant reforms in 2001, 2003, and most recently under 2012’s HB 119 intended to reduce fraud, rates keep rising – up 25% in 2015. HB 1063 (Grall) repeals the Florida Motor Vehicle No-Fault Law & eliminates the requirements for PIP coverage, along with a series of other provisions. Rep. Grall’s bill passed the entire House last week and as the saying goes, the House bill will “send” its bill to the Senate. So, in essence the PIP repeal issue will now rest with the Senate to see if the House and Senate can agree on what PIP repeal would look like. The House bill that passed its chamber requires at least $25,000 in coverage for bodily injury or death and $50,000 for bodily injury or death of two or more people. Many critics claimed jobs will be lost and other concerns that Rep. Grall said underscore the problems with PIP. She said it is not Florida’s responsibility for PIP coverage to provide jobs but those who claim it is a job creator are the very reason PIP needs repealing. The House Bill is different from the Senate version SB 1766 (Lee), which requires drivers to have $5,000 in medical payments coverage (just like with PIP) and $20,000 in personal bodily-injury coverage and $40,000 for multi-person bodily-injury coverage. The minimums would grow two years later to $25,000 and $50,000 and to $30,000 and $60,000 in 2022. The MAJOR difference between the House and Senate bills is the medical payment provision. The House sponsor called the Senate’s idea of $5,000 in medical payment nothing more than PIP renamed and refused to include this provision in her bill. SB 1766, after having passed the Senate Banking and Insurance Committee in mid-April, has not moved since but commentary from Senate Appropriations Chairman Jack Latvala included that he felt repealing PIP would likely favor trial lawyers at the expense of others. Workers’ Compensation – By far one of the most contentious – and by court rulings, most immediate – issues facing the legislature after the state Supreme Court last year ruled our workers’ comp system unconstitutional. Last week, the full Florida House approved changes to the state’s workers’ compensation insurance system with the passage of HB 7085 (Burgess). There are major differences between the House and Senate bills including what to pay attorneys who represent injured workers. The House wants fees capped at $150 an hour, while the Senate wants a cap of $250 an hour. During the House floor debate, several House Democrats offered amendments that would change the attorney fee cap and allow injured workers to choose their physician but all the amendments offered by the Democrats failed. In the end, the bill’s discussion was divided with the Democrats saying the bill doesn’t do enough to enhance injured worker benefits and Republicans saying insurance costs must be held down, which is what HB 7085 is designed to do. The Senate Rules Committee heard Sen. Rob Bradley’s version of the worker’s comp reform bill (SB 1582). No significant changes were made to the measure and it is now headed to the full Senate. Most speakers opposed the bill in committee testimony. Once the Senate passes its version of the bill, then both chambers will need to work out their differences before the regular legislative session ends May 5.We are at this point because two 2016 Florida Supreme Court decisions ruled parts of the current work comp law invalid causing an almost 15% rate increase because parts of the law simply “went away,” as one observer noted. “Poof – in two court opinions, the worker’s comp system was turned on its head,” according to a former regulator. Both bills address the Court’s attorney fee cap issue by keeping the current fee schedule but allowing a judge to decrease or increase attorney fees to a maximum hourly rate. The bills also increase temporary total disability benefits and temporary partial disability benefits from two years to five years, the Court’s other point of contention. The senate version converts Florida to a loss cost state to encourage greater competition among carriers and the house bill does not with the house sponsor saying the market is already competitive. The hourly attorney fee maximum caused angst during the committee meetings with one group saying that the rate shouldbe dynamic to reflect the geography of the attorney. Soon the negotiations begin. Workers’ Comp, like so many other public policy issues, will need to be hammered out and unless there’s House and Senate agreement, there will be no bill. General Insurance Bills – SB 454 (Brandes)/HB 359 (Santiago) are insurance “catchall” bills, also called “omnibus” bills. They provide insurers a $15 insufficient funds fee when a customer’s electronic payments bounce with some exceptions and add electronic checks and drafts to the list of allowable e-premium payments; allow medical malpractice insurers flexibility on their annual rate filings and a permanent exemption from having to pay assessments into the Florida Hurricane Cat Fund; and specifies procedures for insurance companies to send documents electronically to policyholders. Both bills passed a committee stop this past week and it appears they will pass the full Legislature at the conclusion of session. Bills We’re Monitoring But Have Had No Action – Include SB 1746 (Flores) Comprehensive reform of insurance regulation and practices; HB 1271 (Trumbull) “Right to Repair” construction defect claims law; SB 614 (Brandes), SB 1388 (Antiles), and SB 1472 (Galvano) all medical marijuana regulation; HB 191 (Beshears) and related SB 208 (Passidomo/Mayfield) on diligent effort; and HB 469 (Harrison)/SB 334 (Steube) Insurance Litigation/Prejudgment Interest. |

| LMA in the Action on PIP and AOB |

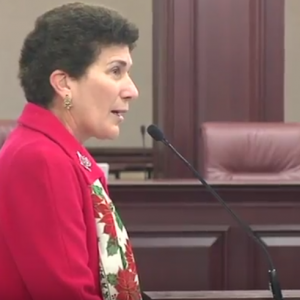

Lisa Miller Testifying Before the Florida Legislature, December 14, 2016 Tampa personal injury attorney Daniel Fernandez and I debated the pros and cons of current Personal Injury Protection (PIP) insurance reform bills before the Florida Legislature on WMFE-FM’s Intersection radio program. As I pointed out, the debate is spirited, and the sticking point is rates! While the PIP system may be broken, what will happen to rates if we make this change? Will it reduce fraud? Is it the best plan to provide adequate coverage, too? Listen to the conversation here LMA is also pleased to have recently worked with Jackie Callaway, the I-Team reporter for ABC Action News in Tampa. We put her onto the case of Kellie Clark, a Pinellas County school teacher who went for an unexpected and abusive AOB ride at the hands of a dubious roofer, which Jackie included in a comprehensive multi-line look at AOB practices in the Tampa Bay area. You can watch Jackie Callaway’s television news story on AOB abuse here For a more in-depth tale of Kellie Clark’s AOB misadventure – in her own words – listen to The Florida Insurance Roundup. |

| Of Marijuana and Insurance |

| As the Florida Legislature makes its way through approving a set of guidelines for medical marijuana cultivation and distribution, we are often asked about the insurance implications to its growing legal use. How do insurance policies treat a substance – and the consequences of its use – when federal law (which classifies it as a Schedule 1 illegal drug) conflicts with an increasing number of state laws (which classify it as legal under certain circumstances and uses)? Reporter Andrew Simpson with our friends at the Insurance Journal recently wrote a terrific piece on this dilemma, including the scant history of court cases providing guidance, and its particular impact on automobile insurance when it comes to “driving under the influence” of marijuana. You can read the Insurance Journal story here. |

| Do You Use Your Phone While Driving? You Are Not Alone! |

| As reported in the Palm Beach Post, Everquote, a privately held Cambridge, Massachusetts company that compares rates for almost 100 auto insurance companies, recently released a study via an app of 2.7 million drivers with a not-so shocking statistic: 92 percent of U.S. drivers with cell phones have used them while moving in a car in the past 30 days, and Florida drivers are the second worst in the country, right behind Louisiana. The study showed southerners use cell phones more per mile driven. The app senses motion changes and assigns drivers a score based on things like phone use, hard braking and hard turning, speeding and acceleration. Americans were on the phone on average a half mile for every 11 miles driven and all of us know that using the phone behind the wheel is not a good idea! We will leave it at that. . Everquote’s website says that the company’s goal is to encourage safer habits by making drivers more self-aware. Read the Everquote Safe Driving Report here. |

| Florida is Burning |

| A warmer and unusually dry winter in Florida have combined to create extreme wildfire dangers. More than 100 wildfires continue to burn, charring at least 126,000 acres so far – up 250% over the same first quarter of last year and exceeding the five-year average of a typical year. The Governor has declared a state of emergency due to dry conditions for a large midsection of the state and there are now drought warnings for millions of residents. What we need is a good soaking rain, but none is forecast as of this writing.

The wildfires have promoted some road closures from time to time over the past few weeks but have not threatened homes or other structures so far. To make matters worse, arson wildfires are up almost 70% this year. Agriculture Commissioner Putnam reports more than 240 separate arson wildfires, which include reckless burnings. The dry conditions have also reduced groundwater levels which could eventually threaten Florida’s drinking water supply. The South Florida Water Management District issued a water shortage warning to the 8.1 million residents in the 16 counties in Southeastern Florida. The District is asking residents to voluntarily conserve water to reduce risk of mandatory water restrictions later. It also banned all open fires and campfires on district lands. Rainfall in South Florida has been only a third of what it normally is. Across the state, the Southwest Florida Water Management District is considering a water shortage order for the 16 counties in its jurisdiction. Weather forecasters say the warm, dry conditions are expected at least through early summer thanks to a weak El Niña this past fall into winter. While the Pacific weather pattern is now shifting toward the opposite extreme of El Niño, they say it will be serval months before the change of conditions will be felt here in the Sunshine State. It looks like there won’t be much tropical relief either this summer to quench the land’s thirst. Colorado State University hurricane forecasters are predicting a slightly below-average Atlantic hurricane season, citing the same El Nino phenomenon and cooling temperatures in the Atlantic Ocean. |

| Court rules against Strems Law Firm |

| In the five page order in Robinson v. Safepoint Insurance, the Court finds that “the only reasonable explanation (that telephone records revealed) for (the water mitigation company) to initiate contact with Plaintiffs BEFORE Plaintiffs ever had any alleged water damage or any alleged pipe leak was to contrive false water damage claims in order to fraudulently recover money under Plaintiffs homeowners insurance policy.” For those of you following the assignment of benefits claims explosion, this order clearly delineates the three main activities being perpetrated every day: a) unscrupulous vendors convince homeowners to participate in fraudulent/contrived claims practices; b) the intent is to file a claim that is false and receive claims payments not justified and c) a concentrated effort to receive attorney fees for a case that isn’t warranted. Strems is one of the top 5 firms in the state that has hundreds of lawsuits according to the Department of Financial Services records.

The order dismisses a Strems/AIRS case for fraud on the court from Safepoint’s defense attorney Hope Zellinger with Bressler Amery and Ross. Additionally, Judge Cueto granted the insurer’s rights to attorney’s fees and costs. Please let us know if you have any questions. |

| Enforcement Against Short-Term Rentals Goes High-Tech |

| Last month here we reported that with the advent of websites such as Airbnb, condo owners are more easily able to rent their units short-term while they are away, contrary to many condo associations’ rules. While the associations usually rely on local ordinances that prohibit short-term renting (and there’s an on-going fight on the effectiveness of those local laws) some condo associations have turned to technology for a solution.

A phone/computer application called “The Parking Boss” is helping condo associations identify unknown cars that stay longer than they should in their parking lots, allowing the associations to call-out the tow trucks. It’s increasingly common for snowbirds to rent out their units when they return up north for periods longer than what the association declarations allow. Paper parking permits allowed the owner to easily pass along parking privileges to guests. With the new app, owners are instead issued decals that stick on the cars windows that have QR codes readable by a smart phone or tablet device. The app matches the scanned code to see if the car’s license plate number matches what’s on file in the association office. The system does allow guests to be entered into the system as well, but for a time limit of three or four days, depending on the condo’s rules. Several condo associations report they’ve discovered not only illegal long-term guests, but also condo owners with roommates who were never registered or had proper background checks as required by the rules. The cities of Miami and Miami Beach have recently put their residents on notice that short-term condo and home rentals are against local codes and are threatening big fines of up to $250 per day in Miami and up to $20,000 in Miami Beach. This past week Airbnb and five of its Miami home hosts filed suit against the city of Miami and won a restraining order, claiming the city’s ban is improper and its enforcement threats and fines are unlawful. Meanwhile, SB 188 by Senator Steube (R-Sarasota), which adopts a free-market approach by limiting local towns and counties from passing short-term rental restrictions, is making its way through legislative committees. If it passes, look for more condo boards to use innovative technology or shift their covenants to instead prohibit the advertising of short-term rentals, which is easier to prove occurred than the actual rentals themselves. |

| First DCA: Board of Medicine Can Charge $1/page for Public Records |

| Have you ever requested documents from a public agency? Was it a pain? Was it expensive? At the Florida Board of Medicine (Board), you may think it’s expensive! We found it interesting that recently the 1st District Court of Appeal’s ruling found in favor of the Board’s relatively new practice of charging $1 per page for producing public records.

The case against the Board of Medicine was brought by the Florida Justice Association (FJA) which represents plaintiff lawyers. One can only assume that FJA would want a less expensive public records cost for files it requests when suing doctors. In 2015, the Board approved a rule charging patients (and their lawyers) $1 a page vs it’s old pricing of $1 a page for the first 25 pages and 25-cents per page thereafter. The three-judge 1st DCA panel said they found nothing “in the record of these extensive rulemaking proceedings shows that the Board (of Medicine) failed to follow applicable rulemaking procedures or exceeded its rulemaking authority.” The court went further to say that “There are statutory deadlines for submission of a rule to the president of the Senate and speaker of the House for (rule) ratification (ratification is the method that some rules are “approved” by the legislature), but no deadline for the Legislature to act upon a rule submitted for ratification. Likewise there is no statutory requirement for the board to withdraw a rule which has been adopted but not ratified. A subsequent Legislature could decide to ratify the rule.” |

| Here’s the Point |

| We started this newsletter with a question asking “what’s the point” of staying engaged in the legislative process when it seems legislators aren’t listening. Democracy matters more than ever, as does participation. In fact, over the weekend, the “March for Science” movement launched and the participants’ theme was “It’s time to get off the sidelines and make a difference.” I can just see my 7th grade science teacher in line to share what she taught us – everything from preserving water drops to being respectful of animals. So here’s the point…as troubling as our democracy may seem to some, it is the best government structure in the world. We are fortunate to be a part of it and honor those who have made it possible. Each of you who take the time to comment and encourage our work are, in essence, participating with us as we do our best to make a difference. And we are grateful! My best for a great week!

Lisa and the gang |