Of Technology and Road Trips

Since 2000, my smartphone of choice was the Blackberry. I was one of the first to use one in the fortune 500 companies I worked for and then when I returned to state government in the insurance regulatory arena, I was one of the first in the state agencies to have the device so I could be 24/7 which was unheard of in public service.

Since 2000, my smartphone of choice was the Blackberry. I was one of the first to use one in the fortune 500 companies I worked for and then when I returned to state government in the insurance regulatory arena, I was one of the first in the state agencies to have the device so I could be 24/7 which was unheard of in public service.

Sadly, when I recently approached my cell phone provider to replace my current Blackberry, I was told that they were no longer sold through this provider and worse, there was no one to service it locally. So I succumbed to an iPhone and all my colleagues told me about all of the apps that go with it. One of them was a program that could tell me all about current road construction and where law enforcement might be stationed along the way as I traveled.

So as I embarked upon a trip north of Tallahassee, I commenced to download the app and check the route for construction and troopers. About 30 miles north of town I stopped in a small town at a coffee shop and the shop owner asked where I was headed. I shared with him my phone and showed him my route and he said, “Oh no ma’am…you don’t want to take that route.” I was puzzled and he went on to tell me about all the construction he and his buddies confronted in the past few days. Luckily, he gave me a better route and I was on my way.

So, while we rely on our smartphones for everything to counting calories and tracking steps, we just might want to stop and think about the old ways and days of a simple conversation telling us what we really need to know. Enjoy the read today and have a great week!

Leave the Driving to Us

But Get your wallets out to pay for it!

Hopefully, this summer, you were able to vacation or maybe even staycation, meaning you stayed at home or stayed in Florida if you live here to explore our beautiful beaches and theme parks. And as you drove the byways and highways of Florida, you probably came across a toll road or two with Florida’s turnpike being the most costly from start to finish. There is a philosophy that mandating user or driver fees provides a sense of driving “value” among car owners versus having states pay for infrastructure from a general revenue fund. Often we see signs that say, “Tolls from this road pay for x project” and studies have shown that this type of messaging resonates. Other countries have implemented per-mile driving fees, and congestion pricing, but these are untested in the U.S.

In the old days, Florida’s toll roads paid for a lot of its road construction but nowadays with cars getting better gas mileage being those of choice, the federal gas taxes are shrinking and states like Florida bank on the fact that tolls and other fees can pick up the slack.

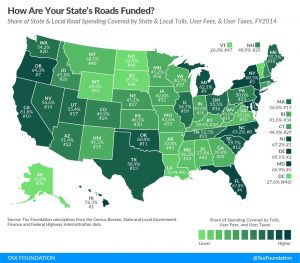

Take a peek at this map from the Tax Foundation (click on the map for a larger version) which gives us a snapshot into how highway tolls, state gas taxes, and license registration and other fees pay for a state’s road needs.

Take a peek at this map from the Tax Foundation (click on the map for a larger version) which gives us a snapshot into how highway tolls, state gas taxes, and license registration and other fees pay for a state’s road needs.

Hawaii leads the pack in paying for its roads out of its own budget and the state uses a tax based on a vehicle’s weight and gas tax rates like no other state. Delaware comes in second in what they charge their drivers in taxes and fees and New York collects about $3 billion annually from its bridges, tunnels and Port Authority collections. Florida has the most toll roads in the country, however, and New Jersey, Maryland, Oregon, North Carolina, Michigan and California follow.

State-based transportation funding does not equate to adequate funding, although several states have increased their driver fee structure since the beginning of this year. But again, changing automotive technology (hybrids and electric vehicles) may negate the fee increase goals. The bottom line is there never seems to be enough money, roads always seem to be under construction and we must find new ways to get there from here!

One Swipe Crime Up

Crooks skim to win

As you drive, know that Florida gas station and convenience stores are increasingly prime targets for skimming devices that “harvest” credit card information instantly when the card is inserted at the pump. Florida’s Agriculture Commissioner and candidate for governor, Adam Putnam, who is responsible for attempting to stop this fraud scam, said that 315 skimmers were confiscated from Florida gas pumps since January of this year compared to 120 in 2016 over the same timeframe.

As you drive, know that Florida gas station and convenience stores are increasingly prime targets for skimming devices that “harvest” credit card information instantly when the card is inserted at the pump. Florida’s Agriculture Commissioner and candidate for governor, Adam Putnam, who is responsible for attempting to stop this fraud scam, said that 315 skimmers were confiscated from Florida gas pumps since January of this year compared to 120 in 2016 over the same timeframe.

Each skimmer can, on average, collect credit and debit card information from 100 consumers and south Florida counties lead the state in skimmer fraud. Florida law requires security devices on gas pumps and security tape to reveal pump tampering. In addition, it is illegal in Florida to possess skimming equipment. However, these laws may quickly become outdated as advances in Bluetooth technology are making it easy for criminals to walk up to devices and transfer data in seconds without having to remove the illegally installed skimmers.

Identity theft insurance is selling at an all-time high, typically as an endorsement to an existing policy, to cover identity theft as a result of skimming. But according to the Identity Theft Resource Center (ITRC), the best way to avoid being a skimming victim at a gas station is to pump your gas nearest the storefront versus a remote pump or pay cash! Besides gas stations, the ITRC lists ATM machines, restaurants/bars, and department stores as popular and potential skimming locations.

Life Insurance Companies – The Right Hand vs. the Left Hand

The right hand vs. the left hand

Many of you commented after we reported the passage of Senate Bill 966 in the 2016 session: a bill that mandates that life insurance companies’ right hand know what their left hand is doing. Passionate testimony during legislative committee hearings from then Insurance Commissioner Kevin McCarty and then CFO Jeff Atwater excoriated the life insurance industry’s past practices of using the Social Security Death Master File to stop annuity payments when an insured dies but not using the federal database to pay death benefits to loved ones upon an insured’s death.

The law requires life insurance companies to proactively track records and pay life insurance proceeds to beneficiaries back to 1992 versus beneficiaries or their survivors having to do so and, going forward, that insurance companies must, annually, find beneficiaries to pay them. If beneficiaries can’t be found, the insurance proceeds must be turned over to the state as unclaimed property.

Commentary to LMA went like this: There were those who said it was ridiculous for the legislature to think that the new law was a remedy for what some called “just administrative insurance company bureaucracy” of the industry and that a better remedy was for the insurance companies to pay into a “superfund” so beneficiaries could access what is rightfully theirs if they believe they had claim. Others wrote us and said that whatever the life insurance companies had coming to them, they deserved it.

Such was the debate in the Leon County court case that has ensued between several life insurers balking at the new law and Florida’s Chief Financial Officer who oversees the Department of Financial Services (DFS). Lawyers representing three insurance companies claim the companies had no past duty under law to find beneficiaries. Judge Terry Lewis, a 28 year Leon County veteran jurist said, when DFS presented its argument in favor of the new law to remedy prior wrongs and gain depositions from company employees for its case, “I just don’t see it … It just doesn’t make logical sense to me” and ruled in favor of the insurance companies. DFS has vowed to appeal the decision. The original issue made CBS’ “60 minutes” last year.

New Hangouts

CouchSurfing and alternatives to hotels

A popular way to earn a little extra cash is to join the millions of Americans who allow couch surfers or other boarders in their home in the same vein a hotel welcomes guests. We are all familiar with Airbnb and other home sharing sites that connect those with lodging to those who are seeking it. In fact, experts are predicting vacation home rentals will increase 25% this year. But what are the risks in renting your home to outsiders? Are there homeowners insurance exclusions that could prevent you, the property owner, from recovering expenses in the event of damage from or injury to a guest in your home?

Assurant, a specialty property insurance company among other business interests, published findings in its recent survey of homeowners who had no idea of the risks involved in home-sharing, many thinking their property insurance company would be there for them in the event of an issue with their guest.

According to the survey, nearly two-thirds (63%) of the 1,000 homeowners polled said they were not sure whether their homeowners insurance policy would cover vacation renters and about that many didn’t know who was responsible or liable when an accident occurs. Additionally, 55% indicated they have no idea who is responsible or liable if a guest is injured. These statistics underscore how property insurance companies need a widespread education campaign to share with their policyholders that there are limitations for recovery when a house guest staying in the home on a social basis versus one for “commercial” purposes has a claim.

Reminding policyholders about a policy’s commercial-use exclusion clause in their homeowners policy is a start. But different companies approach the exclusions in different ways. One can pull 10 different policies and see 10 different exclusion clauses so it’s vital that there be no ambiguity in the policy language. Other issues can involve stolen jewelry and other valuables not to mention the liability claims that could arise and not be covered.

Court case after court case in all sorts of claims litigation will have judgments entered against insurance companies for policy language that is “ambiguous.” A consistent and clear definition of what a commercial use is so homeowners completely understand whether and how they’re covered when renting out their properties is the key to success.

According to Assurant experts, the home-sharing movement is just that and it is growing every day. But the insurance industry must make it a priority to educate policyholders and other stakeholders about how insurance policies treat the commercial rental of someone’s private dwelling and the options available to mitigate those risks.

For an excellent read on this and other home-based uses that may not be covered, Assurant’s Vice President for Innovation, Kunal Malhotra, wrote this recent piece in Property Casualty 360.

Florida Consumer Confidence & GSP Up

Rising like summer temperatures

The University of Florida has an excellent economic analysis program in its Bureau of Economic and Business Research (BEBR). Its latest research report indicated consumer sentiment rose 1.5 points to 97.7, the second-highest reading since March 2002. Among the five components that make up the index, three increased and two decreased. (The data was from about 500 calls to Floridians’ cell phones among a broad cross section.)

The University of Florida has an excellent economic analysis program in its Bureau of Economic and Business Research (BEBR). Its latest research report indicated consumer sentiment rose 1.5 points to 97.7, the second-highest reading since March 2002. Among the five components that make up the index, three increased and two decreased. (The data was from about 500 calls to Floridians’ cell phones among a broad cross section.)

Perceptions of one’s personal financial situation now compared with a year ago showed the greatest drop in this month’s reading, down 2.7 points from 91.1 last year to 88.4 in July. Women, people 60 and older, and those with annual income under $50,000 held very positive views about their personal finance situation. Opinions as to whether it’s a good time to buy a major household item such as an appliance increased 1.5 points, from 102.1 to 103.6.

Expectations of U.S. economic conditions over the next year showed the greatest increase in this month’s reading, up six points from 91.8 to 97.8. Additionally, expectations of U.S. economic conditions over the next five years rose 4.1 points, from 91.1 to 95.2.

Since the beginning of the year, Florida’s labor market has strengthened, with solid job gains every month. Between January and June, the Florida unemployment rate declined by nine-tenths of a percentage point, from 5% to 4.1%. The unemployment rate is now at its lowest rate in a decade – since July 2007 on the cusp of the Great Recession.

Moreover, the labor force in Florida reached over 10 million workers in February. According to the U.S. Bureau of Economic Analysis, Florida’s gross state domestic product (GSP) increased 1.4% and personal income grew 1.3% in the first quarter of 2017. The leading contributors to personal income growth for Florida were net earnings and transfer receipts, which include benefits received by persons from federal, state and local governments, and from businesses for which no current services are performed.

In view of the labor market conditions and inflation nationwide, last week the Federal Reserve decided to maintain the target range of the federal funds rate between 1% and 1.25% to support further strengthening in the labor market.

“The positive economic outlook in the first half of the year brought consumer sentiment in Florida to its highest levels in the last 15 years. There’s no evidence that economic conditions will change in the short run, thus high sentiment levels should persist in the second half of the year,” according to the report.

Fannie Mae Erases Student Debt

At least when it comes to home ownership

Fannie Mae announced last week that it is adopting immediately some new procedures that should make it easier for many borrowers with student debt, and those who cosigned for them such as their parents, to qualify for a home loan. Large student debt is one of the barriers for many young people trying to qualify for a mortgage.

Fannie Mae is expanding cash-out refinancing that lets borrowers use the lower interest rate equity in their home to pay off higher interest rate student debt. While the cash-out refi program will enable many borrowers to trade higher interest student loans for low interest mortgage debt, the program does carry some risk. Student loans are unsecured while mortgages are secured by the home. If the borrower runs into financial difficulty, the home could be at risk. Also, federal student loans come with protections like flexible repayment options and payment deferment if the borrower runs into financial trouble. Those protections end if the debt is refinanced into a mortgage. Private student loans, however, do not usually have those protections.

Another change allows borrowers applying for a mortgage to exclude debt being paid by others from their application, such as credit cards and student loans being paid by parents or employers. That change will help give these borrowers a better debt-to-income ratio, an important criteria in a mortgage application, thereby improving their chances of qualifying for a mortgage.

A third change will help borrowers with student loans on a flexible payment plan, which tie monthly payments to income. Previously, Fannie Mae required lenders to use higher monthly loan payments rather than borrowers’ lower flexible payments in determining debt-to-income. Now, lenders can use the lower payments which should help more borrowers qualify for a mortgage.

Freddie Mac Reasserts Down Payment Requirement

In a related story, Freddie Mac will tighten its restrictions on low-down payment mortgages starting this fall. Freddie is targeting mortgages that allow borrowers to purchase a home with a 1 percent down payment, and it says borrowers will now need to come up with at least a 3 percent down payment before receiving any kind of contribution from a lender.

Lenders often offer mortgages to homebuyers but then sell those mortgages to Freddie Mac or Fannie Mae. Once sold, the lender has more money to help other homebuyers. Now, new Freddie Mac rules must be followed if lenders prefer not to originate a loan and keep it on the bank’s books. Freddie Mac and Fannie Mae started offering low down payment mortgages in 2014 when they rolled out 3 percent down mortgages.

However, some lenders – like Quicken Loans and Guaranteed Rate – then rolled out mortgages with down payments as low as 1 percent. To do that, the lenders used Freddie and Fannie’s 3 percent program but also “granted” 2 percent of the down payment to the borrower to arrive at the 3 percent needed to qualify for a Fannie or Freddie low down payment mortgage. Under the new guidelines, however, Freddie won’t allow lenders to arrive at the 3 percent down payment minimum this way.

The new updates take effect Nov. 1. Some lenders have already phased out seller-funded down payments. Freddie Mac’s full statement about the change is posted online.

A Truly Celestial Event

August 21, 2107: A total U.S. solar eclipse

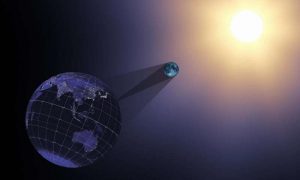

On August 21, 2017, the Earth will cross the shadow of the moon, creating a total solar eclipse. Eclipses happen about every six months, but this one is special. For the first time in almost 40 years, the path of the moon’s shadow passes through the continental United States. This total solar eclipse will be visible in totality within a band across the entire contiguous United States, and will only be visible in other countries as a partial eclipse.

It is being called the Great American Eclipse: The first total solar eclipse to cross the country from coast to coast since 1918. Two hundred million Americans live within a day’s drive of its path, which stretches from Oregon to South Carolina. Twelve states will experience complete darkness and the rest of the mainland will see a 70 to 99 percent partial eclipse.

This visualization shows the Earth, moon, and sun during the eclipse at 17:05:40 UTC or 1:05 p.m. Eastern Time. Source: NASA

State emergency managers are preparing for the onslaught of onlookers and tourists across the country. For example, Kentucky State Police have an incident action plan for the sun and what might happen here on earth when the moon moves between us and the sun. Christian County, Kentucky is point of greatest eclipse, with population of about 72,000. The county is anticipating 100,000 visitors and about 40,000 cars to carry them. And Nashville, Tennessee is about an hour away with their public officials anticipating hundreds of thousands of visitors as well.

The challenge is that emergency managers are having a difficult time predicting where the crowds will crowd, with some officials saying they wish the eclipse event was akin to a NASCAR race or other happening where participants go to one place. In other words, because this event is so spread out…over multiple venues, multiple counties, that means multiple risks on multiple fronts.

Traffic gridlock is what both Christian County Emergency Management and Kentucky State Police hope to avoid, and the Federal Highway Administration (FHWA) has asked that states declare Aug. 21 a no construction day. FHWA is also changing dynamic message boards nationwide to make sure drivers know the eclipse is coming so they don’t look up, see the sun disappear, then panic.

(Source: Emergency Management Magazine, July 21, 2017)

Talk, Smile and Communicate

I opened the newsletter reminding our readers that sometimes remembering some good old-fashioned communication and talking through an idea is best. Let me take you on a historic road that many of you experienced in your lifetimes, so you can reflect on where we were and where we are. Remember when all the kids on your block played outdoors most of the time? If you were like me, not a day went by when we were not out on the street or at the nearby playground, riding bikes, roller skating, playing one of many ball games, throwing snowballs in the winter, swimming at the beach or in the canal in the summer, fishing, flying kites, and playing all assortments of board games or card games on rainy days.

We governed ourselves in these activities, no umpires for softball, referees for basketball or football, or intervening mediators when we played Monopoly or Parcheesi. Some kids laughed, others cried, some kids were loud, others quiet, we won some, lost some and over the course of a week, it all seemed to balance out. We were innocent kids, and I went to church services every Sunday and rode bikes on Sunday afternoons. We lived in a cocoon of comfort and life was about listening to instructions and obeying most of them, but if there was something wrong, it got attended to. Not much slipped by! Moms knew where we were, who we were with and what we were doing….most of the time!

As I grew up from teen years to college then into adulthood, so much has changed, some things for the better, some for the worse, but among the most astonishing of all changes is the rising tide of technology, in all its forms. Phones are now smart…with apps and mega-byte memories. My trusty laptop lets me ask any question and every question has instant answers from limitless links. I can send a message to one person or thousands of contacts in a flash, and watch videos or movies, live ball games and 24-7 news anywhere I want or record them for later viewing.

What I worry about is that we’re transforming ourselves into captives of the beeps, buzzing, flickering lights and instant messages to the point of addiction and I don’t want us to lose a generation of emotionally competent communicators. Please do all you can to pick up a phone or drive to go see a pal…I will be curious to hear your feedback!

Lisa

P.S. Speaking of communicating, as summer is the season for preparing for fall’s busy meetings and key events, please consider me for inspirational keynote speeches, strategy seminars, and professional development leadership sessions. I welcome hearing how I may be of service to you!