Trial Lawyers Stopped from Intruding on Policyholders

I had the privilege of serving as Chief of Staff to the Department of Financial Services (DFS) and those of us who have served in that position have different priorities during![]() the two to four year tenure of the job. My priority during my term was to help the Divisions of Consumer Services, Agent and Agency Services and Insurance Fraud with good public policy decisions. My reasoning? Because that is where the rubber met the road and listening to policyholders, insurance agents/adjusters and victims of insurance fraud gave me tremendous perspective as a regulator back then.

the two to four year tenure of the job. My priority during my term was to help the Divisions of Consumer Services, Agent and Agency Services and Insurance Fraud with good public policy decisions. My reasoning? Because that is where the rubber met the road and listening to policyholders, insurance agents/adjusters and victims of insurance fraud gave me tremendous perspective as a regulator back then.

So it is no surprise that I was shocked to find out that a Floridian’s contact information was a public record when they engaged DFS’ help with mediation of a sinkhole neutral evaluation. It was even more frustrating when Floridians called me and complained that they had been solicited by lawyers almost immediately after they filed documents seeking DFS assistance and I could do nothing to keep their identity confidential.

My DFS team and I tried without success to convince the Legislature to shield these records from the public records law because there was no public necessity to release them to a lawyer or anyone else for that matter.

Fast forward 10 years and this past week, the First District Court of Appeals “got it.” In an eight-page decision, the appeals court sided with a DFS ruling against Danahy & Murray, P.A., and Bennett Dennison, PLLC who routinely filed public-records requests seeking information about participants in the programs.

The ruling said, “It is logical that disclosure of personal identifying information could be used for fraud or identity theft, especially when disclosed in this context where the entity requesting the information also knows that a consumer has an insurance policy and has been involved in a dispute with an insurance company,” said the decision, written by appeals court Judge Clay Roberts and joined by Judges Susan Kelsey and M. Kemmerly Thomas. “The Legislature stated a specific justification – prevention of fraud and identity theft as well as protection of a person’s privacy – that justified denying public access to personal financial information. The public necessity statement also explained that disclosure of this information could be used for fraudulent and other illegal purposes, including identity theft, and could result in substantial financial harm.”

Score one for the good guys – the policyholders!

Judge Approves Growing Your Own Medical Marijuana

Florida Health Department appealing decision

A Leon County Circuit Court Judge has cleared the way for a Tampa cancer patient – who also co-owns a medical marijuana treatment clinic – to grow his own marijuana plants for the purpose of juicing them in a blender and consuming them in accordance with his doctor’s orders. The Florida Department of Health has appealed the decision to the First District Court of Appeal as well as the judge’s recent decision to lift a stay of her own order in the case.

A Leon County Circuit Court Judge has cleared the way for a Tampa cancer patient – who also co-owns a medical marijuana treatment clinic – to grow his own marijuana plants for the purpose of juicing them in a blender and consuming them in accordance with his doctor’s orders. The Florida Department of Health has appealed the decision to the First District Court of Appeal as well as the judge’s recent decision to lift a stay of her own order in the case.

Judge Karen Gievers ruled that 77 year-old Joe Redner can go ahead and grow his own because current state rules prohibit licensed clinics from selling whole plant marijuana. Redner, a strip-club owner in Tampa, has testified that he has Stage 4 lung cancer and that his physician has determined the most effective way for him to get treatment is by emulsification, or juicing of the biomass of the marijuana plant.

The Department of Health is developing rules for licensed clinics based on a law passed last year by the Florida Legislature, following passage of Amendment 2 by Florida voters in November of 2016, which authorized the use of medical marijuana by qualified patients. Current rules prohibit clinics from selling whole plants and patients from using smokeable marijuana.

“Nothing in the amendment authorizes the Department of Health (or any other part of Florida’s government) to ignore the rights of qualifying patients to access the medical marijuana treatment to which they are entitled under the Florida Constitution, or to exclude any method by which qualifying patients may take their medicine,” Judge Gievers wrote in her April 11 order.

The Health Department appealed the decision, which triggered an automatic stay. But last week, Judge Gievers formally ruled against the request for the stay. Health officials are appealing that ruling – and the original one allowing Redner to grow his own plants – to the First DCA, arguing it “opens the door for plaintiff and other qualified patients to grow medical marijuana unchecked from any state regulation.”

Redner’s attorney said Redner would require 40 marijuana plants in different stages of growth at all times to create the three pounds of plant material he needs to make the eight ounces of juice his doctors prescribed he consumer daily.

Judge Gievers ruling has broader implications. Although it applies only to Redner, it could open the door for other patients to request to grow their own plants. Meanwhile, Trulieve, a medical marijuana company, has asked the health department to allow it to sell whole flower plants to patients and has filed suit to strike down the state law that limits the number of dispensaries marijuana companies can operate. Trial attorney John Morgan, the principal backer of Amendment 2, has also sued the state, saying the legislature’s prohibition against smokeable marijuana is counter to the constitutional amendment. Those cases are pending before Judge Gievers.

NFIP Restrictions Easing on Homeowners and Agents

“No Flood Insurance Required”?

While Congressional inaction continues on needed reforms to the National Flood Insurance Program (NFIP), its parent FEMA has made additional program changes to encourage private flood insurance market alternatives. It’s part of the NFIP’sbi-annual program changes impacting its 5.2 million policyholders, 1.8 million of them here in Florida.

We reported here last month that FEMA has finally loosened its grip and is now allowing WYOs (Write Your Own) insurance companies (those insurance companies that serve as claims and policy administrators for NFIP) to sell private insurance, eliminating a longstanding “non-compete” provision. Now FEMA is allowing NFIP policyholders to give up their policies mid-term and switch to private policies. Prior to this, homeowners had to finish paying out their federal policy even after switching to private coverage.

FEMA continues to re-map flood areas here in Florida and across the U.S., updating maps and procedures that in some cases were nearly 25 years old. It’s now applying those procedures to more properties, which will allow those owners to start their NFIP premiums at a lower subsidized rate and take advantage of the multi-year glide path toward full premiums.

Another break for homeowners: if they live in Florida or another state that uses LiDAR technology to collect elevation data, they can now use that data in their case against needing flood insurance. That’s a much cheaper alternative than getting a flood elevation certificate. The NFIP’s current authorization expires July 31 and we’ll continue to follow developments in Congress.

In the meantime, the need for flood insurance in Florida has never been greater. That’s according to the state of Florida! The state’s newly updated hazard mitigation plan notes “the entire state of Florida is particularly susceptible to flooding due to the large amounts of coastline, significant drainage systems and the relatively low elevations.” That doesn’t include this current period of gradual sea level rise nor the heavier rainfall that’s forecast in the future. It’s especially true for inland communities. Of Florida’s 67 counties, 49 are considered at high risk of flooding. You can read more about this “wake-up call”in this excellent article from the Daytona Beach News Journal. It contains observations from emergency managers across the state on risk, mitigation, and resiliency.

While FEMA’s new maps are placing new properties into special flood risk zones, it’s also taking previously high-risk properties and placing them outside the special zone – meaning flood insurance is not required in order to qualify for a federally-backed mortgage. In a literal “sign of the times” at least one entrepreneurial Tampa Bay area real estate firm is using that as a selling point for certain properties (see photo at right taken earlier this month).

One other update of note. In the last newsletter, we reported that NFIP was due to deliver to the NAIC by the end of last month the first batch of previously unshared data on details of its flood program, including how rates are set. We called the NAIC this past week and the data hasn’t arrived, but we remain hopeful.

Constitution Revision Commission Adds 8 Proposed Amendments to November’s Ballot

Concern of “log-rolling” more than 20 proposals into 8 measures

Florida’s Constitution Revision Commission last week gave final approval to put eight proposed amendments to the state constitution on the ballot this November for Florida voters to consider. They will join five others placed on the ballot by the Legislature or citizens’ initiatives. But because many of the eight actually contain multiple proposals, there is concern they are essentially “take it or leave it”, as they may contain an idea you like combined with one or two that you don’t like. Yet, you’ll have to vote them up or down – or skip it.

The Commission meets every 20 years to consider changes to the state constitution. It’s spent the last 16 months considering more than 900 proposals from its own 37 members – political appointees and elected officials – and from the general public. Proposed amendments by the Commission, unlike those by citizens’ initiatives, don’t have to comply with the single-subject rule nor do they carry a fiscal impact statement. That distinction played out over the past several weeks as critics accused the Commission of ultimately logrolling more than 20 separate proposals into these final eight proposed constitutional amendments:

P 6001: Rights of Crime Victims; Judges– This is three proposals in one amendment. It would revise and establish new rights for crime victims, based in part on the national push for Marsy’s Law; require an administrative law judge to interpret state statute or rule instead of letting an agency do so; and create a retirement age of 75 for judges.

P 6002: First Responder and Military Member Survivor Benefits; Public Colleges and Universities– This is another three-for-one. It would require a supermajority vote of the state Board of Governors and local University Boards of Trustees to raise tuition or fees or impose new ones; would give the State College System its own governance, as the university system has; and provide college scholarships to survivors of first responders and military members.

P 6003: School Board Term Limits and Duties; Public Schools– This is another three-for-one. It would establish term limits on local school board members; allow the state to approve and supervise charter schools in place of local school districts; and require civic literacy education in public schools.

P 6004: Prohibits Offshore Oil and Gas Drilling; Prohibits Vaping in Enclosed Indoor Workplaces– This is two proposals in one amendment. It would prohibit offshore oil and gas drilling and prohibit vaping in indoor workplaces, including restaurants.

P 6005: State and Local Government Structure and Operation– This is a four-for-one. It would require the legislature to hold its annual session in January of even-numbered years (lawmakers currently choose for themselves); establish the Office of Domestic Security and Counterterrorism within FDLE; create the Office of Veterans’ Affairs to be headed by the Governor and Cabinet; and require charter counties to elect all officers, including tax collectors and sheriffs, rather than appointing them as some currently do.

P 6006: Property Rights; Removal of Obsolete Provision; Criminal Statutes– This is another three-for-one, but centers around eliminating obsolete sections of the constitution. It would eliminate a ban on non-citizens from owning land; establish that any repeal of criminal statute is not retroactive; and delete a provision regarding high-speed ground transportation;

P 6007: Lobbying and Abuse of Office by Public Officers– This single-subject amendment would require state and local officials to wait six years after leaving office before they could lobby their former government and would prohibit officials from using their office to receive a “disproportionate benefit” for themselves or relatives.

P 6012: Ends Dog Racing– The only other single-subject amendment, this would eliminate greyhound dog racing in Florida by the year 2020.

The proposed amendments have been sent to the Secretary of State, who will assign actual ballot numbers to each for the November election.

All proposed amendments to Florida’s constitution require a 60% majority vote to be approved. In the coming months leading to the November 6 election, future editions of this LMA Newsletterwill feature a focus story on each of the 13 proposed amendments on the ballot. As many of our readers are Floridians, it’s important to know how each of these measures can affect us and our families, businesses, and employees. Knowledge is power!

Could the Real Estate MLS System Change Again?

The fight between proprietary and unrestricted data

In real estate, as in insurance, data – good data – is a commodity and crucial to an organization’s success. Sometimes it’s proprietary and other times shared across an industry. So it is with the Multiple Listing Service (MLS) that real estate brokers use as a rich database of properties for sale and to establish contractual offers of compensation among themselves to help sell properties efficiently. But how important is free and open information sharing to ensure fair pricing and promote a competitive market and at what point does it actually infringe on proprietary rights, ultimately hurting the consumer? It’s a question the National Association of Realtors® (NAR) and the U.S. Justice Department will be asking again this fall, when a 10 year-old consent decree governing how listings are displayed by online brokerages expires.

It was the real estate boon of the early 2000’s that fueled the growth of online-only brokers and “For Sale by Owner” sellers. Both wanted access to the MLS and some traditional brokers offered the access in exchange for a flat fee or other compensation. MLSes took notice and changed their rules to discourage the practice, which resulted in a Federal Trade Commission investigation and subsequent finding of anti-trust violations. The FTC said there should be a free competition for such listings. NAR agreed to give Internet brokerages access to all the same listings that traditional brokerages are given.

With the consent decree nearing expiration, NAR has commissioned a report, Procompetitive Benefits of Policies Limiting Access to Local Multiple Listing Service Data. The report concludes that “In the end, allowing complete and open access to MLS data ultimately would not be in consumer interests, as economic incentives of real estate brokers are important in promoting consumer welfare. Local MLS databases require resources to be built, maintained, and distributed in a time-effective manner, and so properly incentivizing those who invest the resources is important to the continued vibrancy of the MLS.”

While the NAR says it has no plans to change MLS policies on how property listings are displayed by online brokerages when the consent decree expires in November, it says today’s real estate market is competitive with many channels of data.

“Technology innovation in the real estate industry is robust, and the notion that real estate isn’t highly competitive and listing data not readily available is unsubstantiated,” said Katie Johnson, NAR’s General Counsel in a release. “To the contrary, a wealth of listing data is available to consumers and technology companies from a multitude of sources, and Realtors®provide their clients and consumers with more real estate information today than has ever been available.”

While some real estate interests are pushing for a single national database with unrestricted access, Johnson said that “may be unrealistic, as this could lead to a degradation of information, or a tragedy of the commons.”

For those who choose to up their professional game, such as gaining Realtor® credentials from national, state and local chapters, it makes sense that one of those credentials is the use of the MLS as a benefit of membership. A real estate agent who is not a part of the association is different than one who embraces a higher professional standard by being a member of, and observing the professional code of the Realtors®.

Ma, Pa, Grandma, and Jim-Bob Now Living Together

Multiple generations sharing one roof hits an all-time high

The number of Americans living in multigenerational households has hit a record high of 64 million people – 20% of the U.S. population. A new reportby the Pew Research Center says that despite improvements in the economy, so-called multigenerational living is growing among nearly all racial groups, Hispanics, most age groups, and men and women. Such households are defined as having two or more adult generations or as having grandparents and grandchildren younger than 25 living under the same roof. The numbers are growing, too.

The Pew analysis says the growing racial and ethnic diversity in the U.S. is part of the reason, as Asians and Hispanics are more likely than whites to live in multigenerational households, as are new immigrants to the U.S. It used to be the elderly that were most likely to move back with family. Now, it’s the young adults. A full third of adults 25-29 years old lived with mom and/or dad in 2016, the latest year Census data was available for the study.

Especially startling: Among a broader group of young adults, those ages 18 to 34, living with parents surpassed other living arrangementsin 2014 for the first time in more than 130 years. Education is a factor. Those without a college degree are more likely to be living with their parents than to be married or otherwise living in their own homes. The upside: fewer Americans over age 55 live alone now than they did in 1990.

Our take from the insurance perspective: increasing due diligence by auto insurers is advised. With more people of different ages living together under one roof than ever before, who is driving which vehicle becomes more important than ever. Some insurers hesitate to write everyone living in the same household because of driving records differing too greatly, while others offer exceptions or conditions where only certain household members are covered to drive certain vehicles.

Renewing Vehicle Registration in Florida Just Got Easier

Now there’s an app for that!

Florida motorists have an on-the-road and on-the-water alternative to renewing their vehicle and vessel registration. The Department of Highway Safety and Motor Vehicles has launched a new mobile app called MyFlorida, that’s expanding options for vehicle and vessel registration renewal services as well as offering additional conveniences to customers.

The app was created by Kansas City-based PayIt, who has discovered an innovative way to convert government-ese into a language that consumers can understand using their mobile devices: chat. They are sharing this videoon how it works. Users simply punch in their vehicle or vessel plate number and date of birth and select the payment option. The app is available on all mobile devices and can be downloaded via iTunesand Google Play.

The Department notes that if your renewal has been put on hold, that using the app provides greater clearance information to lift the hold. It allows renewal of up to five vehicles or vessels with one transaction.

Remembering Barbara Bush

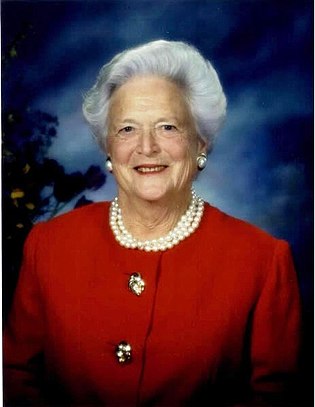

I opened the Tallahassee Democrat Saturday morning (yes, I still get a newspaper in my driveway every day!) and saw a picture of President Bush (Bush 41), with his daughter solemnly looking at Barbara Bush’s stately casket in Houston’s St. Martin Episcopal Church. And yesterday’s paper had an image of her 8 grandsons serving as pall bearers carrying her casket. Over the past week, I have read so many adjectives describing her – the enforcer, top advisor, role model, confidante, advocate, and my favorite, classy.

I am sure all of our readers reflected on how Barbara Bush’s qualities as a mother and grandmother may not be too different from our own Mom’s. In about 3 weeks we will celebrate our Mom’s – those still with us on this earth and those in heaven – and I would like to hear your stories of your Mom, Mama, Mother or whatever nickname you may have called her. We will share a few of those in an upcoming edition.

For now, take a look at how one incredible firm, Lamar Advertising Company, is honoring Barbara Bush’s memory with a graphic of a string of pearls. The billboard was created by graphic designer Shannon Ford. One of our readers captured it and sent it to us and we are grateful. Brought tears to my eyes!

Have a great week and call your Mom or that favorite, special lady in your life!

Lisa Miller