Remembering Mom

In our last newsletter’s closing, we honored First Lady Barbara Bush, and I asked our readers to share stories of Mom memories. The many responses I received were![]() heartfelt and inspiring. From the reader who said he lost his mom recently and appreciated the opportunity to share, to the reader whose Mom is 92 and “still going” complete with a picture of her in her rose garden. I wish I could print them all! So I picked one that I thought would give all of you a smile as we start our week.

heartfelt and inspiring. From the reader who said he lost his mom recently and appreciated the opportunity to share, to the reader whose Mom is 92 and “still going” complete with a picture of her in her rose garden. I wish I could print them all! So I picked one that I thought would give all of you a smile as we start our week.

Here it is: “Dear Lisa, your newsletter is the first email I read when it arrives in my inbox on Mondays because not only do I love the technical tidbits but so enjoy the personal touches you share with us about life and living.

When I read your Barbara Bush tribute, I couldn’t help but tear up because my mom loved pearls! In fact I have the long strand she wore every Sunday and kept on as she made Sunday dinner for us. I can still see her in the kitchen (Frigidaire refrigerator and avocado green and harvest gold vinyl flooring) as she pulled the pot roast out of the oven.

Although I miss her every day, I make sure to say something about her often to a co-worker, a customer or for that matter, in meetings. To honor her, I have a habit of saying, “My mama used to say…” or “My mama taught me that…” or my favorite as I’m making a connection with a customer who likes something she liked, “My mama loved that too…she used to talk about…” So for all of your readers, I would like to suggest that we think about honoring our mom’s more often than just on Mother’s Day in this simple way whether mama’s with us or an angel watching over us.”

Thank you to the reader who shared this and appreciate all of you for being a part of the LMA family. Enjoy this edition’s technical tidbits!

Florida Workers’ Comp Rates Reduced Again

Second reduction in a year credited to federal tax cuts while DFS launches study

The Florida Office of Insurance Regulation (OIR) last week announced it approved a rate decrease of 1.8% on Workers’ Compensation insurance rates, as filed by the National Council on Compensation Insurance (NCCI) on behalf of about 250 insurance companies. NCCI said the reduction results from the effects of the Federal Tax Cuts and Jobs Act on corporate profits. It follows a November 2017 rate reduction by OIR of 9.5%.

Florida Insurance Commissioner David Altmaier called it “an actuarially-sound response to the savings workers’ compensation insurers have realized as a result of recent federal legislation. The data indicates that passing the savings along to businesses through a rate decrease is an appropriate response at this time,” in an OIR statement.

The 1.8% decrease could result in a savings of $79.5 million to Florida businesses, who purchase the insurance on their employees, according to the state Department of Financial Services (DFS).

The decrease is due specifically to a change in the Profit and Contingency (P&C) Factor to 0.5% from 1.85%. NCCI’s analysis to determine the revised P&C reflects provisions from the recently-passed federal Act, including top corporate tax rate decreases, changes to reserve discount factors, and other factors. This applies to both new and renewal workers’ compensation insurance policies effective in Florida as of June 1, 2018.

DFS has announced its intent to spend nearly $200,000 on a study by the nonprofit Compensation Research Institute to study how Florida’s workers’ comp market performs compared to other states. The move comes as various stakeholders – from insurance companies to business lobbyist groups – have tried to figure out exactly what impact recent state Supreme Court rulings will have on the future cost of insurance. Those rulings included one striking down attorney fee caps on employee counsel. Legislative bills reforming the system failed to pass again this year, despite concern that the rulings would result in double-digit rate increases. Recent statistics do show increases in workers’ comp legal fees, as previously reported in the LMA Newsletter.

There is also a push for Florida to change to a different system for setting rates. Florida is one of seven states solely using a “Full Rate” or administered system that takes into account an insurer’s extraneous expenses and profit. Thirty-eight states instead use a “Loss Cost” or competitive system which limits insurers to a rate necessary to cover losses and benefit costs and only expenses directly related to claims settlement.

In a posting last week about the pending study, DFS noted that participants in Florida’s system will “benefit from research that assists in monitoring the effects of legislation and administrative changes and from the comparison of legislative and administrative strategies of other states to better forecast necessary policy changes.”

High Housing Costs in the Florida Keys

Resolving post-Hurricane Irma economic recovery challenges

A community group in the Florida Keys has lost its latest legal challenge to property insurance rates set by Citizens Property Insurance Corporation, the state’s insurer of last resort and the only company that will insure much of the Keys. Barely above sea level, the Keys is high-risk and suffered a direct hit in last September’s Hurricane Irma. But higher insurance rates is just one of the challenges facing the Keys, which already short on affordable workforce housing prior to Irma, is in a real dilemma. Now Governor Scott has stepped in to help.

A three-judge panel last week rejected the legal challenge from Fair Insurance Rates in Monroe, a group of residents and other interested parties who have tried for years to seek property insurance rate relief. The group claimed that Citizens was relying upon unreasonably pessimistic models in formulating its rates. The panel ruled that the state insurance code, which allows challenges to rate setting, doesn’t apply to Citizens due to changes made in 2007 by the state legislature.

Meanwhile, what to do about the 10,000+ Keys residents displaced from their homes and apartments by Hurricane Irma’s damage? (The entire Monroe County population is only 79,000 for perspective.) In all, 4,156 homes were destroyed or had major damage, many in Big Pine Key and Cudjoe Key, ground zero for the little working-class housing there is on the Keys. Temporary rental assistance for 9,000 people has ended. Some are living in cars or tents or the shells of their homes while others have moved to the mainland and commute an hour or more to their jobs supporting the Keys tourist economy.

By law, homes or trailers with more than 50% damage must be rebuilt to tougher code and elevated – out of reach financially for some – with the only other options being to repair or rebuild and hope inspectors don’t notice or move out of the Keys. New affordable housing is certainly needed, but state law limits growth in the Keys to ensure that residents can evacuate safely within 24 hours in advance of a hurricane. The building height limit is generally 25 feet, with few exceptions granted. So what can be done – who can help our friends in the Florida Keys?

Last week, Governor Scott directed the Department of Economic Opportunity to create a Keys Workforce Housing Initiative. It would allow local governments to grant additional building permits for rental properties, so long as the new construction allows renters to evacuate within a 48-hour window, according to a release from the Governor’s office. “The initiative will allow up to 1,300 new building permits for workforce housing throughout the Florida Keys. Local governments that choose to participate in the initiative will work with DEO to amend their comprehensive plans to allow for additional building permits that meet these safety requirements,” according to the release.

Monroe County has been exploring alternatives, too, including modular homes. It’s asked the state for an initial $20 million to purchase vacant lots throughout the Keys, on which affordable housing could be built.

Florida Home Sales Down, Prices Up

The beginning of a trend?

When we talk about property and casualty insurance, the first word we literally talk about is “property” – the dwelling and the land upon which it sits. So our real estate and insurance markets are intertwined. Our next few stories impact both sectors. In a sea change from the Great Recession of 2008 to 2015, we’ve now gone from having too many properties on the market to too few. As a result, March single-family home sales slumped 3.5% after months of modest gains. Simply put, say our friends at the Florida Realtors®, there’s not enough homes for sale in the Sunshine State, leading in turn, to rising prices.

Statewide median prices are up 8.2% for single-family homes and 7% for townhouse-condominiums year-over-year. The average sales price was $250,800 and $183,000 respectively.

Florida Realtors President Christine Hansen summed-up the situation this way: “As the ongoing supply of for-sale homes continues to tighten, it can create a cycle of frustration for homebuyers, especially those trying to become a first-time homeowner,” she said in a release. “If move-up buyers can’t find a home in their desired price range, then they aren’t likely to leave their current home, which in turn makes entry-level properties even more scarce. Buyer demand is high, but the shortfall of inventory – particularly around $250,000 and under – is impacting affordability in many areas.”

The 3.5% drop in single-family homes sales in March was the largest in more than a year, excluding last September, which was due to Hurricane Irma’s landfall. Year-to-date sales now are down just under 1%, so all eyes will be on April’s report, to see if the slowdown will continue. Interest rates, meanwhile, continue to climb. The interest rate for a 30-year fixed-rate mortgage averaged 4.44% in March, up from the 4.2% in March 2017, according to Freddie Mac.

Sea Level Rise Impacts on Insurance and Real Estate

The Miami & Beaches innovate idea to empower residents

Another question about the future of Florida real estate – and property insurance – is the effects that rising sea levels will have, especially on Florida’s coastal residents. As previously reported in the LMA Newsletter, scientists have confirmed by direct device measurement that sea levels around Florida are back on the upswing, whether from any global warming or not. It could mean more frequent and severe flooding if the trend continues. Now the cities of Miami and Miami Beach are partnering to create a tool that may one day show property owners what impact those rising sea levels may have on their land and structures – and mitigation measures available to reduce the risk and preserve home values.

Both coastal communities each recently received a $100,000 grant from the Bloomberg Philanthropies’ Mayors Challenge to create a beginning prototype that will bring together a myriad of different publicly-available databases into an easy to use tool for homeowners and others. Once the prototype is ready, the two cities will jointly apply for other grants to develop a full version tool that they hope can be used in the entire South Florida area.

Miami’s Bloomberg grant application noted that the city has more assets at risk from storm and sea level rise flooding than any other metropolitan area in the world, yet “our residents do not have a clear understanding of the risks related to sea level rise, particularly as it relates to their specific property, how they can mitigate those risks over time, and how to stay informed and engaged on city land use, code and infrastructure planning that may also mitigate those risks.”

While the data and technology already exists in the private sector for a price – you can purchase an individualized assessment on your property from third-party firms – Miami and Miami Beach officials hope to create a tool that’s not only free but more comprehensive than any other in existence today. It would include projected economic impacts to sea level rise on the local economy and could be used in the cities’ lobbying of the Florida legislature for future mitigation and infrastructure funding.

“We must look at flood risk through the lens of both an individual property owner and the community at-large,” adds Alec Bogdanoff, Ph.D., the Co-Founder of Brizaga, a South Florida engineering consulting company focused on building more resilient communities. “One without the other is basically meaningless. These efforts to improve engagement and understanding of our flood risks are essential to build the public’s desire to take action on sea level rise.”

Fleeing Florida Faster in Future Hurricanes

New Coastal Connector highway routes revealed

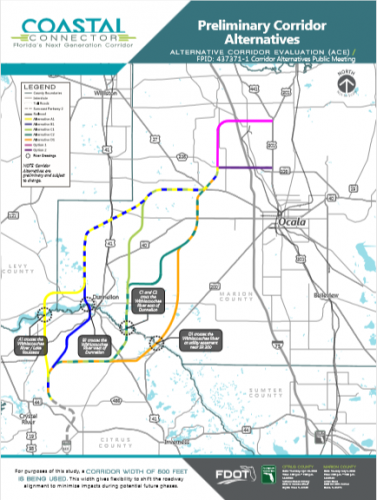

When the Florida House of Representative’s Select Committee on Hurricane Response and Preparedness issued its final report in January with 78 recommendations to make Florida a safer and better prepared state when the next big hurricane hits, one of those suggestions was extending the Suncoast Parkway from Citrus County to the Georgia line to aid in evacuations. While that remains an aspirational goal, we now have a look at the myriad of different routes being considered in the interim: linking the Suncoast Parkway to Interstate 75 north of Ocala.

When the Florida House of Representative’s Select Committee on Hurricane Response and Preparedness issued its final report in January with 78 recommendations to make Florida a safer and better prepared state when the next big hurricane hits, one of those suggestions was extending the Suncoast Parkway from Citrus County to the Georgia line to aid in evacuations. While that remains an aspirational goal, we now have a look at the myriad of different routes being considered in the interim: linking the Suncoast Parkway to Interstate 75 north of Ocala.

The current Suncoast Parkway (State Road 589) is presently undergoing a 13-mile extension north into Citrus County, to end at State Road 44. The DOT recently revealed five potential routes(graphic at right) for the Coastal Connectorthat will pick up from there and travel further north across the Withlacoochee River and end with a new Interstate 75 interchange between Ocala and Gainesville. The expansion would not only help ease traffic congestion on Interstate 75 from hurricane evacuations, but help the growing everyday congestion on the Interstate – and of course, spur further economic development in this quiet section of Florida.

Highway planners say the eventual route will likely be a toll road but is just at the initial stage right now and accepting public input. Construction isn’t expected at the earliest until 2045. Those attending a recent public hearing in Crystal River acknowledged the need for the expansion, but expressed concern about the impact on sensitive wildlife and bird habitats, according to published reports.

Revising Florida’s State Constitution

Five Citizens & Legislative Initiatives on the ballot, too

(Editor’s note: This is part of an ongoing serieson the 13 proposed state constitutional amendments that will appear on this November’s ballot for Florida voters to consider.) Last week, we shared the news of the final eight proposed amendments put forth by the Constitution Revision Commission. The Commission meets every 20 years to consider changes to the state constitution and one of those eight amendments has since drawn a legal challenge. In this segment, we share more about that and the five other amendments that voters will see on the ballot, generated by citizen initiatives and the Florida legislature.

One of the Commission’s eight proposed amendments is Amendment 13, which would outlaw dog racing in Florida. The Florida Greyhound Association has announced it will file a brief asking the Florida Supreme Court to strike down the proposed amendment, noting in a released statement that the proposal doesn’t meet the requirements for ballot placement. The protest comes after several other groups have complained about the Commission’s “log-rolling” of disparate issues into single proposed amendments.

The Florida Legislature also has the power to put proposed amendments on the ballot, as do Citizen Initiatives that have collected the necessary number of signatures of support and met other requirements. So in addition to the Commission’s eight, here are the five other proposed amendments, already approved and numbered for the fall ballot:

Amendment 1: Increased Homestead Property Tax Exemption– This proposal from the Florida Legislature would increase the homestead exemption from its current $50,000 to $75,000 on all levies except local school taxes and apply only to homes with at least $125,000 in value.

Amendment 2: Limitations on Property Tax Assessments– This legislative proposal would help non-homesteaded (commercial) property by limiting future property tax increases to 10% a year. A similar current cap expires in 2019.

Amendment 3: Voter Control of Gambling in Florida– This citizens’ initiative would give Florida voters the exclusive authority to decide whether casino gambling should be allowed in Florida beyond the current Indian reservations, which are controlled by federal laws.

Amendment 4: Voting Restoration Amendment– This citizens’ initiative would automatically restore the voting rights of felons after they serve all conditions of their sentences. Murderers and sex offenders, however, would continue to go before the Governor and Cabinet for restoration of their voting rights.

Amendment 5: Supermajority Vote Required to Impose, Authorize, or Raise State Taxes or Fees– This legislative proposal, as the title implies, would require a two-thirds vote of each chamber of the legislature to impose, authorize, or raise a statewide tax or fee.

Memorable Speeches: Commencement and Historic

A wise Tallahassee colleague, Jack Levine, is a gifted writer who I call an “inspirationalist.” You can learn more about Jack at http://www.4gen.org/and he recently wrote that this is the season of graduations and commencement addresses. Despite the wry quote of Doonesbury cartoonist Garry Trudeau, that “Commencement speeches were invented largely in the belief that outgoing college students should never be released into the world until they have been properly sedated,”Jack reminded us that so many speeches are motivational at a time when life’s transitions require special inspiration, and he shared three sources to access some memorable addresses, both commencement and historic:

I think you’ll be awed! So as you jump into this week, take a peek at some terrific messages and I would love to hear from you about a powerful commencement speech that moved you!

Have a great week on the trail!

Lisa