Phishing for Trouble

In the June 2018 edition of Florida Trend, there’s a fascinating 30-page insert about the University of Florida’s (UF) research community and how the scientists who are![]() a part of that are shaping our future to make it safer, easier, more connected and well, just plain cool! In several of the pages are articles about cyber security and here’s a startling fact reported: UF received about 80 million emails in 2017 and about 64 million were phishing emails from mostly internet-surfing bots just waiting for the one click on the phishing email link!

a part of that are shaping our future to make it safer, easier, more connected and well, just plain cool! In several of the pages are articles about cyber security and here’s a startling fact reported: UF received about 80 million emails in 2017 and about 64 million were phishing emails from mostly internet-surfing bots just waiting for the one click on the phishing email link!

One of the studies highlights, according to UF Professor Daniela Oliveiro, that, “as we age, our cognitive abilities declines and …that sensitivity to deception decreases as (we) age.” She goes on to add, “What a dangerous combination,” because people in this age group occupy many positions of power – elected officials and corporate CEOs, as examples, who are making societal decisions in finance, insurance, politics and the law.

Oliveiro and her research partner Natalie Ebner examined seven “weapons of influence” that are used by hackers to convince us via email to open that one email note that can devastate personally and corporately even the strongest of secure environments. For example, one of the weapons is “authority” as we often say “yes” to requests from authority figures when the “from” field has a government or corporate entity name. We may open an email that makes us think the opportunity is “just for us” and a rarity and we can also be duped if we see the sender as someone we like that is our similar age or went to the same university.

They warn that social media is the feeder for phishing attacks such as employees taking pictures that contain company badges, or clients tagging a company on Twitter or Facebook. I highly recommend you subscribe to Florida Trend even if you don’t live in our state. You will be glad you did and LMA will be reaching out to UF to talk further with these incredible scientists. Links for you to explore: the UF Multi-functional Integrated System Technology Center and the Warren B. Nelms Institute for the Connected World

And up next? More news you can use!

Hurricane Season Already Underway

Recent storms growing stronger more quickly

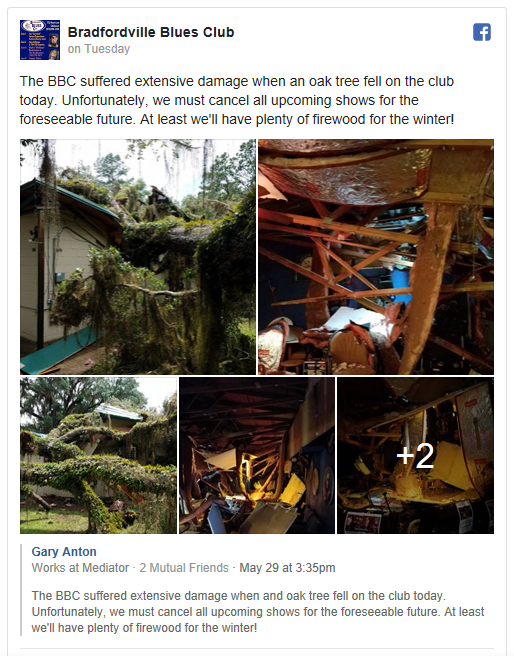

Although the official start to the sixth-month Atlantic hurricane season was this past Friday, the season got off to an early start with last week’s subtropical storm Alberto. The storm made landfall west of Panama City and for two days prior and afterward, brought heavy rain, gusty winds, and flash flooding to a wide swath of Florida and the Southeast. Insured losses are upwards of $50 million. This videoshows a vicious vortex forming at the Shores of Panama, a U-shaped resort on Panama City Beach, while in Tallahassee, high winds destroyed the Bradfordville Blues Club, a national historical landmark (see picture). The video shows people standing around watching, rather than running for their lives, proof that storm education is a never-ending task.

Recent storms

Experts are calling for a normal to above-normal hurricane season and the watchword is “prepare”. At the recent Governor’s Conference on Hurricanes, FEMA Director Brock Long made it clear to us that FEMA is often stretched thin, and will need local and state governments to be prepared to supply water and other essentials for the first few days following a disaster.

Meanwhile, new research shows that hurricanes have been getting stronger faster over the past 30 years. A study published in Geophysical Research Lettersreviewed hurricanes from 1986 to 2015. They found that wind speed is an average 13 mph faster during the intensification period of storm development than the average wind speeds prior to 30 years ago. The reason: warming of the upper ocean coinciding with a positive shift in the phase of the Atlantic Multidecadal Oscillation (aka climate variability).

Of course, one of the biggest challenges Florida faced during the last hurricane season was the shortage of claims adjusters. Hurricanes Harvey, Irma, and Maria saw six states and Puerto Rico competing for a finite supply of regional adjusters. We have read with interest this news releaseon how Allstate Insurance is using artificial intelligence (AI) to streamline first notice of loss and other customer interactions.

“Amelia” is an AI platform that walks call center employees step by step through various customer calls, in part through an instant message interface. It’s especially useful in keeping track of rules and regulations that vary from state to state, helping keep call center reps from potential missteps. “Amelia’s machine learning capability allows her to improve her ability to answer customer questions by “listening” to interactions she doesn’t understand and with Allstate experts’ help quickly expanding her knowledge,” according to the release.

We can expect more innovation in various insurance lines and processes as AI development accelerates in the coming years, along with other technological advances, including drones. LMA is an advisor to an AI company that revolutionized the U.S. Army recruiting function and this firm is working in the insurance industry to bring about this very transformation. Please email me to learn more.

Commonsense Ideas for the Cat Fund

Excess reserves are better in the policyholders’ pockets

Of course, when the big hurricane hits Florida – or even a series of more modest ones – Florida’s Hurricane Catastrophe Fund (Cat Fund) is ready to provide the backing insurance companies may need to pay policyholder claims. This state program was created after the devastation of 1992’s Hurricane Andrew and reimburses residential property insurers in Florida for a portion of their losses from hurricanes. The program is funded by insurers through premiums and is currently awash with reserves – as much as $300 million now in excess of its $17 billion statutory limit. There’s an ongoing debate whether to reduce the premium contribution – letting Floridians keep more of their hard earned money – or continue current collections and sock it away, in the very slight chance of a future mega storm

course, when the big hurricane hits Florida – or even a series of more modest ones – Florida’s Hurricane Catastrophe Fund (Cat Fund) is ready to provide the backing insurance companies may need to pay policyholder claims. This state program was created after the devastation of 1992’s Hurricane Andrew and reimburses residential property insurers in Florida for a portion of their losses from hurricanes. The program is funded by insurers through premiums and is currently awash with reserves – as much as $300 million now in excess of its $17 billion statutory limit. There’s an ongoing debate whether to reduce the premium contribution – letting Floridians keep more of their hard earned money – or continue current collections and sock it away, in the very slight chance of a future mega storm

The Cat Fund has grown ever bigger because it has collected premiums for more than a decade without having to make a major payout because of the lack of storms. The 2016 storms of Hermine and Matthew had little consequence on the fund and last year’s Irma prompted a modest payout. At a recent meeting of the Fund’s advisory council, members were told by COO Anne Bert that the fund is very healthy and would face a potential shortfall only in “a really bad-case scenario.” Yet there is hesitancy to mess with the current premium contribution, given the impact the series of 8 hurricanes over the 2004-2005 season collectively had on the fund. Any shortfalls in the fund would be made up through special assessments on a wide-range of insurance policyholders.

There was an effort in the Florida legislature this year to tweak the Cat Fund, to allow rate relief to policyholders during quieter storm years by reducing or eliminating the so-called “hurricane tax”, but it ultimately failed. The bill would havechanged the premium formula through changes in the rapid cash build-up factor based on the projected fund balance each year. The factor would vary, from 25% when the fund balance is less than $14 billion, to 0% when the fund balance is at least $16 billion. The elimination of this “hurricane tax” as the rapid cash build-up factor is often described, would have reduced rates approximately 4%, notwithstanding AOB or other rate drivers.

Jay Neal of the Florida Association for Insurance Reform, who supported the bill, noted the average policyholder pays an extra 4% now for the rare possibility of a catastrophic event. “When fund balances are high, we don’t see the need to have the assessment and instead let the consumer spend that money elsewhere in the economy,” he testified before a legislative committee. Well said.

Our take: it makes no sense to keep stockpiling money when the odds don’t warrant it!

The Push by the Plaintiff Bar for Public Insurance Complaints

Ever heard of billboards and TV?

LMA has been following the insurance records dispute case that is now headed to the Florida Supreme Court. In essence, plaintiff lawyers are miffed that they can no longer access the Department of Financial Services (DFS) records of those seeking free help for insurance disputes. When I served as DFS Chief of Staff, I was the one that ultimately got calls from consumers, angry that they were contacted by a law firm trying to solicit legal business from the consumer who went to DFS in the first place to NOT deal with a lawyer and instead use the processes put in place to help.

Kudos to DFS for understanding and protecting consumers by shielding them from unwanted law firm solicitations. Ironically, the plaintiff lawyers crying foul are saying that if they can’t get the list of consumers, then these consumers won’t know they have a right to legal counsel. I don’t know about you but every other billboard and radio and television commercial don’t make it a secret that anyone can hire a lawyer at any time for any single thing!

We spoke with a seasoned veteran insurance attorney who makes the case here that the plaintiff lawyers’ arguments are not persuasive. Simply put, he points out:

- The stated purpose of the mediation program is set forth in 627.7015(1). In sum, the mediation process is meant to be a non-adversarial, dispute resolution forum. Involving attorneys into the mix allows for neither. In that regard, insurers do not send attorneys to DFS mediation unless there is an attorney on the other side. I’m curious to know how many claims were resolved by these firms at DFS mediation. My guess is 0%.

- The statute and DFS informational materials advise all participants of their right to retain counsel. So to act like participants do not know they could retain counsel is not accurate.

- Moreover, 627.7015(2) requires carriers to advise all claimants of the mediation process, including a consumer’s right to retain counsel. Typically, a mediation letter will contain a paragraph such as the following:

- If you choose to bring representation with you to the mediation conference, you must notify the mediator 14 days before the conference unless we, (insert name of insurance company here), waive the right to the notice of representation. Upon receipt of such notice from you, the mediator shall provide notice to us that you will be represented at the mediation conference.

- Finally, the insurer is required to pay the entire bill for mediation. Consumers do not bear any significant costs or expenses associated with the process.

This veteran attorney who doesgreat work on behalf of policyholders and insurance companies fighting abusive contractors, concludes by saying the goal for plaintiff attorneys here is simple: if they are allowed access to public records, they are permitted by the Florida Bar to directly solicit those consumers without repercussion by the Florida Bar.

Folks, now do you see why the plaintiff lawyers want to push this issue to Florida’s highest court? If any of you with insurance carriers have questions about this, I’m happy to refer you to our source. As always here on the LMA Newsletter, we welcome replies and different perspectives on this and all issues! Please write to me at [email protected]

DOJ to The Florida Bar: Oh no you don’t!

The Bar is not immune to U.S. anti-trust law say Feds

While plaintiff attorneys vigorously covet any public records from which they can potentially pluck clients, they also don’t want anyone infringing on their turf either, and lately they’ve had the powerful Florida Bar Association behind them in an effort to put a Miami tech startup out of business. Now the U.S. Department of Justice (DOJ) has intervened in the Florida Bar’s action, essentially saying “not so fast!”

TIKD Servicesis a Miami company founded and operated by a non-lawyer that offers a mobile phone app, matching drivers who have gotten traffic tickets with lawyers who agree to defend them for a fixed price. Shortly after TIKD’s launch, the Florida Bar launched an investigation to determine if the service amounted to an unlicensed practice of law. Last November, TIKD sued the Bar, alleging the Bar and a private law firm are unlawfully obstructing TIKD’s entry into the Florida market, in violation of federal and state antitrust laws. The lawsuit is pending in Miami federal court.

In December, the Florida Bar asked the court to dismiss TIKD’s lawsuit, arguing it doesn’t have to comply with federal anti-trust laws because it is an “arm of the state”. That got the attention of the DOJ’s anti-trust division, which in March filed a 13-page “Statement of Interest” in the case. The filing supports TIKD’s position that the Florida Bar cannot claim “state action immunity” from federal antitrust laws just because it’s an arm of the state supreme court without proving two conditions: that it was following a “‘clearly articulated and affirmatively expressed’ state policy” to displace competition and that its conduct was “actively supervised by the state itself.”

Those two conditions come directly from the U.S. Supreme Court in a similar 2015 case (North Carolina State Board of Dental Examiners v. Federal Trade Commission) in which the justices said the state dental board was not immune from antitrust claims by non-dentists offering tooth-whitening services. Among those filing amicus briefs in that case on behalf of the Dental Examiners: The Florida Bar. Stay tuned!

The Welfare Mom Making Six Figures

Tales of Florida fraud while cryptocurrency buyers beware

If you were wondering if fraud has stemmed at all here in the Sunshine State, it has not. It’s a big state, after all, with creative criminal minds. We start this week at ground zero: Miami-Dade and Broward Counties. The ongoing and well-chronicled Medicaid Fraud problem has now gotten so bad, that the state Agency for Healthcare Administration (AHCA) has had to call a time-out to catch up on its investigations and prosecutions. AHCA recently instituted a six-month moratorium on enrolling new behavioral health providers in the Medicaid program in those two counties. Among the red flags: 8,175 behavioral health providers for 5,676 Medicaid recipients receiving those services. Really? Really.

Citing its desire to “prevent significant fraud”, AHCA’s temporary moratorium follows an investigation that uncovered providers who appeared to have falsified their credentials, tried to bill the state for working more than 24 hours per day, more than 40 hours per week, or billing for 31 consecutive days. One provider tried to bill more than 250 days in a row. In all, AHCA has referred about a dozen large behavioral health providers to local prosecutors for investigation of suspected criminal activity.

“This temporary moratorium will allow the agency an opportunity to complete a comprehensive assessment of the current provider population and remove from the provider network those individuals and entities who are not qualified to participate or whose participation is believed to have been based solely to commit fraud,” AHCA said in a statement.

In other fraud news, across the state near Tampa, a Brandon woman has been sentenced to an extended pre-trial intervention program for public assistance fraud after collecting $90,000 in benefits while earning a six-figure salary. Nadia Caraballo, 41, applied for food stamps and Medicaid, while failing to report that she was earning an annual salary of $110,000 to $139,000 for five years as an employee of Citigroup Technology. She’s been ordered to make full restitution and is disqualified from the food stamp program in the future.

Earlier in this newsletter, we pointed out that technological advances are leading to more innovation in various insurance lines and processes. Now comes this timely reminder from the Florida Department of Financial Services that one of those advances – cryptocurrency – continues to gain momentum in Florida for good and potentially bad results.

Tampa/St. Petersburg and Miami/Ft. Lauderdale were ranked seventh and eighth respectively in the top 10 bitcoin-friendly cities in the U.S. There are more than 160 bitcoin ATMs across Florida. The Seminole County Tax Collector recently announced that its office now accepts bitcoin and bitcoin cash to pay for property taxes, driver license and ID card fees, and vehicle tags and titles!

Cryptocurrency remains an unregulated currency. DFS advises that before investing in it, do your homework. Know that cryptocurrency values can be unstable and that they can be stolen and are uninsured against loss. Cryptocurrency transactions may be taxable, too. State and federal regulators are evaluating and developing approaches to regulating cryptocurrency and companies that deal in cryptocurrencies. Any company that offers to exchange, administer, or maintain cryptocurrencies may be subject to state regulation and licensing as well as federal regulation.

Revising Florida’s State Constitution

Amendment 7 all about higher education

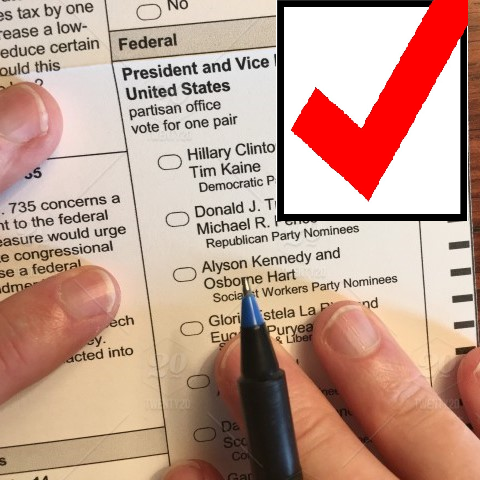

(Editor’s note: This is part of an ongoing series on the 13 proposed state constitutional amendments that will appear on this November’s ballot for Florida voters to consider.)

Amendment 7is actually three proposals in one amendment. It would require a supermajority vote of the state Board of Governors and local University Boards of Trustees to raise tuition or fees or impose new ones; would give the State College System its own governance, as the university system has; and provide college scholarships to survivors of first responders and military members.

What these three provisions have in common of course, is higher education. At least nine of the 13 members of a local University Board of Trustees or at least 12 of the 17-member state Board of Governors must agree before raising tuition or fees or creating new ones.

The state’s college system (which used to be known as “community colleges” until a few years ago when the legislature allowed them to offer four-year degrees) is made up of 28 colleges around the state. It has been under the governance of the state Board of Education, which also oversees K-12 education. Legislative pressure to reign-in the autonomy of those colleges, including their duplication of efforts in offering the same four year degrees as the universities, ultimately failed in the most recent session.

This amendment provides an independent system of governance, as the Universities have, to provide “pathways to a baccalaureate degree” and “respond quickly and efficiently to meet the demand of communities by aligning certificate and degree programs with local and regional workforce needs.” A local board of trustees would govern each college and the state board of education would still supervise the revamped state college system.

Amendment 7 also pays special tribute to fallen servicemen and women and first responders. It would require the payment of death benefits when law enforcement officers, paramedics, correctional officers and other first responders are killed while performing official duties. It would also apply to Florida National Guard and active-duty military members stationed in Florida. For their children or spouse, the state would waive certain educational expenses while obtaining a career certificate, an undergraduate education, or a postgraduate education.

Amendment 7 was placed on the November ballot by the Constitutional Revision Commission, a group that meets every 20 years to consider changes to the state constitution. Read more here on how this proposed amendment was created. All proposed amendments to Florida’s constitution require a 60% majority vote to be approved. As many of our readers are Floridians, it’s important to know how each of these measures can affect us and our families, businesses, and employees. Knowledge is power!

Sharing Great News

We opened the newsletter with some of the great things happening at the University of Florida and that means all of the Gator Nation are cheering this morning. I myself am a Florida State alumni so don’t think I am slighting my home turf and I bet so many of you have stories of tremendous technological or other strides of your favorite school. Tell us about them and we will publish for sure. We always love to hear from our readers. Have a great week and thanks for being our faithful supporters!

Lisa