Harvey – Havoc, Hardship, and Heroism

With the new threat this morning on the near horizon from Hurricane Irma and its expected impact to Florida later this week, we urge our readers to closely track the storm’s progress by way of the National Hurricane Center Tropical-Storm-Force Winds Prediction Map. Out of respect for our fellow Americans in Texas and those Floridians who’ve traveled there to help, we want to open this edition of our newsletter honoring the brave men and women who are continuing to work tirelessly in the Houston & Southeast Texas rescue and recovery efforts. The scenes on the internet and television have made us all cry – cry for the victims and cry for the heroes saving them. “The word catastrophic does not appropriately describe what we’re facing,” said U.S. Rep. Sheila Jackson Lee, D-Texas. “We just don’t know when it’s going to end.” As officials are forced to release water from burgeoning reservoirs, flooding will continue.

As of yesterday, 50 people have perished. More than 50,000 homes have suffered major damage or were destroyed entirely. More than 200,000 other homes sustained minor damage or were otherwise impacted.

The slow-moving nature of the storm – it traveled about 3 mph, human walking speed – fueled the stupendous rain and flooding. Governor Greg Abbott called the flood “the worst we’ve ever seen in the state of Texas” and an “unprecedented” event, echoing the word used by the National Weather Service. On August 30, a rain gauge near Cedar Bayou, Texas, measured 51.88 inches of rainfall, breaking the record for the continental United States set in 1978. Some climatologists are calling Hurricane Harvey the worst rainfall event in U.S. history.

And what heroes and strength Texans have demonstrated to the rest of us! “You have to be proud to see the way our fellow Texans have responded,” Governor Abbott said, “whether they be the first responders or just neighbors helping neighbors to deal with this overwhelming catastrophe.” We have been glued to the Texas Emergency Management website https://emergency.portal.texas.gov/ where you can monitor recovery efforts that will surely be measured by months and not weeks. It’s also the go-to website to find legitimate organizations needing donations, including the Red Cross and Salvation Army.

We’re reminded that Florida’s entire east coast dodged a bullet last year with Hurricane Matthew, but for a mere 30-mile deviation in course path. With the tropics heating up and more storms heading our way at this writing, we know that the Tampa Bay area and its three million residents are especially vulnerable. A recent CoreLogic report shows that the Tampa Bay area is the third most at-risk area in the country for flood, with almost 460,000 homes at risk from tidal storm surge from the Gulf of Mexico and Tampa and Hillsborough Bays. The cost to rebuild those homes is estimated at nearly $81 billion.

Hurricane Harvey has Congress talking about the National Flood Insurance Program reauthorization more earnestly now, after a mid-summer malaise of progress. The current program expires at the end of this month and there is much at stake. We share in our good friend and Florida Realtors president Maria Wells’ sentiment that hopefully awareness of what’s going on in Texas will make Congress do something to reauthorize the program, but in a way that is more sustainable. In the meantime, we hope you will visit the Texas Emergency Management website and select an organization for your donation. For our friends and colleagues in Texas, we continue to pray without ceasing!

Water Finds Its Way Inland, Too

By Nina Lam, Louisiana State University

A Houston, Texas home nearly flooded by Hurricane Harvey

Catastrophic flooding in Houston from Hurricane Harvey sends us a clear message: floods kill more people in the United States than any other type of natural disaster and are the most common natural disaster worldwide. Many communities along U.S. coastlines have begun to take heed and have slowed development in coastal flood zones. The bad news, as Harvey shows, is that inland communities are also at risk – and in some, development in flood zones is increasing.

With post-doctoral research associate Yi Qiang and graduate students, LSU’s Dr. Lam recently studied development patterns in the United States from 2001 to 2011. We found that while new urban development in flood zones near coasts has generally declined, it has grown in inland counties. This is a worrisome trend. It implies that people who have experienced flooding on the coast migrate inland, but may not realize that they are still vulnerable if they relocate to an inland flood zone. That’s what we have seen firsthand here in Louisiana. Thousands of people fled New Orleans after Hurricane Katrina in August 2005 and settled 80 miles inland in Baton Rouge. A decade later, many of these same people lost everything again when a 500-year flood event struck Baton Rouge in August 2016. Climate change effects, such as sea level rise and potentially more extreme weather, are increasing the risk of flooding, hurricanes and storm surges in coastal areas. Some communities are considering moving coastal populations inland to protect them. However, our research shows that people should be very careful about moving inland. They can still face flood hazards if their property is located in a high-risk flood zone.

Not just a coastal issue: Flooding can happen wherever large rainstorms stall over an area, as we have seen in Boulder, Colorado in 2013; in Texas and Louisiana in 2016; and over Houston now. However, if communities take steps to reduce flood risk, they can mitigate the danger to people and property.

When we assess flood risk in a given location, we consider three questions.

– Hazard: How likely is a flood event?

– Exposure: How many people and physical assets are located there?

– Vulnerability: Do people have the capacity to deal with the event?

Flood risk is the product of these three elements: We can decrease flood risk by reducing any of the three elements. For example, communities can reduce hazard by building flood control structures, such as dams and levees. They can use laws and policies, such as land use controls, to reduce exposure by steering housing development away from flood zones. And they can make people and property less vulnerable through other measures, such as elevating houses and developing better flood warning systems and emergency preparedness plans. How can people learn about flood risks where they live? The Federal Emergency Management Agency has created flood zone maps for most parts of the United States. The maps are based on models that consider factors such as elevation, average rainfall and whether a location is near a river or lake that could overflow. Others believe that using catastrophe flood models are a better tool because FEMA maps are outdated when they are released, i.e., it takes about five to seven years to perfect and update a map because of the “process” of releasing a newly drawn map.

Moving into harm’s way: We undertook this study because we wanted to develop a clear baseline showing how Americans’ exposure to flood hazards has changed over the past decade. To assess levels of exposure to flood hazards nationwide, we compiled urban development, flood zone and census data and overlaid them on a county map of the nation. Overall, we estimated that as of 2011, more than 25 million Americans lived in flood zones. We also found that inland communities were less responsive to flood hazards than coastal communities and were doing a poorer job of steering development out of flood-prone areas. The three U.S. counties with the largest concentrations of people living in flood zones are located on the Gulf of Mexico. They are Cameron Parish, Louisiana (population 6,401, with 93.6 percent in flood zones); Monroe County, Florida (population 66,804, with 91.4 percent in flood zones); and Galveston County, Texas (population 241,204, with 82.8 percent in flood zones).

These are all coastal communities, where flood risks should be well-known to all residents. But we also found inland counties where the share of the total population living in flood zones increased over the decade we examined. A number of those with the largest increases are bordered by rivers, such as Marshall County in western Kentucky, which sits between Kentucky Lake and the Ohio River. We also identified several hot spots where urban development has increased in coastal flood zones, including New York City and Miami.

Reducing exposure now: This alarming trend points to a need for more awareness, education and communication about flood risk, especially in inland counties. More affordable housing in non-flood zones and strategies to mitigate floods are also needed, especially inland. Why would people move to inland flood zone areas? Some may be unaware of the risk. Others may plan to adapt through steps such as elevating their houses or buying flood insurance. Still others may accept the risk because they want to be closer to relatives or workplaces, or for other cultural, political or institutional reasons.

Our analysis has pinpointed a number of regions of concern. The next step is to produce in-depth analyses of these regions, in order to understand why people are locating in flood zones there, and to devise local strategies to reduce overall U.S. flood risks. Climate change, land subsidence or sinking, and construction of new levees and dams will change long-term flood exposure in these areas over time. Therefore, local governments, mortgage lenders and homeowners should review current FEMA flood hazard maps for accuracy.

The Conversation: This research provides national context for a detailed study that we are carrying out examining resilience and sustainability in the Mississippi River Delta. Our goal is to understand how human actions combined with natural environmental conditions may have caused land to sink in the Mississippi Delta. Our research on development in flood zones reminds us that flooding problems in low-lying coastal regions are not unique and also affect areas well away from the shore.

It’s a Bird, No It’s a Plane – No, It’s My Insurer!

Insurance companies turn to drones to assess Harvey damage

The same predictive modeling technology used to assess flood risk is also being used in Texas to pay claims from Hurricane Harvey. Insurers are using maps, aerial photos, customer-sent photos with location meta-data, and hope to add drones to their claims processing arsenal, as soon as the FAA clears resumption of drone flights in the greater Houston area.

“We were able to start settling claims without an inspection because we have maps with customer vehicle locations and sophisticated analytic models to predict total losses,” Esurance Chief Claims Officer Eric Brandt was quoted in Best’s News Service last week. Esurance says it’s treating completely submerged vehicles as total losses and paying customers immediately.

Other insurers, such as Allstate are also planning on using drone aircraft extensively for the ease and efficiency at which the unmanned planes can take pictures of rooftops looking for damage in which water could get in – one of the classic distinctions between paying a water claim under a homeowners policy. It’s also safer than putting human adjusters at risk in some still high-water areas. Most homeowners policies do not cover surface flood water damages, which usually requires flood insurance. Allstate says it’s planning hundreds of drone flights a day in the greater Houston area and plans to roll-out the aerial inspection service nationwide later this year.

This age of big-data holds promise for big results from an industry that sometimes has a reputation for slow-pay. A Farmers Insurance spokesman told Best’s News that drone cameras provide high-resolution 3-D images capable of detecting granular loss and physical damage above and around a structure and can generate analytic reports in mere minutes.

Florida’s 15,000 Chronic Flooders

Throwing good money after bad

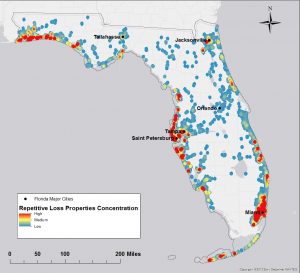

Of course, those of us in the insurance business know there are some things in life that in a perfect actuarial world just shouldn’t be insured anymore – better known in the P&C realm as repetitive loss properties. These are structures that, in the case of storms, flood over and over again, sometimes as total losses – yet the claim is paid and the home rebuilt – only to be damaged or destroyed in the next big storm. Florida alone has more than 15,000 of these properties according to a new study that offers some common sense advice going forward. (Check out the map showing locations of Florida properties with multiple flood claims.)

The study, Aligning Natural Resource Conservation, Flood Hazard Mitigation, and Social Vulnerability Remediation in Florida found those repetitive loss properties in Florida collectively filed more than 40,000 claims against the National Flood Insurance Program between 1978 and 2011 – more than 1,200 claims per year, on average. In some cases, the total claims paid well exceeded the value of the structure, meaning it would have been cheaper to raze the house and rebuild it at a higher elevation – or relocate it. That’s one of the recommendations of the study.

The study, Aligning Natural Resource Conservation, Flood Hazard Mitigation, and Social Vulnerability Remediation in Florida found those repetitive loss properties in Florida collectively filed more than 40,000 claims against the National Flood Insurance Program between 1978 and 2011 – more than 1,200 claims per year, on average. In some cases, the total claims paid well exceeded the value of the structure, meaning it would have been cheaper to raze the house and rebuild it at a higher elevation – or relocate it. That’s one of the recommendations of the study.

“This study identified properties and surrounding land in Florida where buyouts can reduce future flood risk to socially vulnerable communities and simultaneously promote the restoration of the floodplain to a more natural condition,” said lead author Juliano Calil of the University of California-Santa Cruz which co-produced the study with the Nature Conservancy. “We identified almost 150 properties in Miami-Dade County alone that are located in areas where these objectives are very well aligned.”

Calili said flood events cause disproportionate impacts on more vulnerable groups, such as the poor, minorities, the elderly, and the disabled because they tend to live in high-risk areas and lack the resources to prepare for floods and other natural disasters. Incorporating social vulnerability into the Florida analysis was an improvement over a 2015 California study, he noted.

According to FEMA, Flooding is the most common and damaging of all natural disasters in the United States, amounting to more than $17 billion in damages last year alone. The study proposes government-funded buyouts of property from willing sellers who have filed multiple flood claims, followed by structure demolition or relocation. Once destroyed, the scientists want to use the land to restore floodplain habitats.

Déjà vu

Groundhog Day for Citizens Insurance

The Florida Office of Insurance Regulation hosted Citizens Property Insurance leadership to discuss, in a recent public hearing, why they need an average 6.7% statewide premium increase pointing to fraud and abuse in water-damage claims primarily in Southeast Florida. To those who participated, it was the same discussion as last year and the year before. The issue with water-damage claims is linked to assignment of benefits (AOB), and the hearing’s themes have been heard over and over again in various forums – legislative committee hearings, town hall meetings, and in the media.

The week before the public hearing, Citizens President & CEO Barry Gilway sat down with me on The Florida Insurance Roundup podcast to explain two recently-approved components of its managed repair program. Citizens will now be able to limit coverage on non-weather water claims to $10,000 unless the policyholder agrees to use Citizens’ approved contractors in its managed repair program. The company can also waive deductibles on such claims as a further incentive for its policyholders to use the program. The purpose is to stem AOB abuse and provide greater service to policyholders.

Speakers at the hearing, including Senate Banking and Insurance Committee Chairwoman Anitere Flores (R-Miami), shared that the proposed rate increase will be a hardship for Citizens policyholders. Chair Flores’ constituents are primarily insured by Citizens and as such, she pushed for a rate reduction instead, given Citizens new managed repair program requirements. Senator Flores expressed concerns about the Citizens coverage cap, saying it will add anxiety to homeowners who must do business with unknown contractors and not their own. Gilway on our podcast said that policyholders with pipes that have burst, for example, can simply call Citizens and it will take care of the claim, with a warranty for the work and will also waive any applicable deductible, no questions asked, with little obligation from the policyholder.

The benefits of Gilway’s idea doesn’t seem to be enough for Flores. “People just feel that they can’t get ahead,” said Flores, who opposes Citizens’ proposed rate increase, which OIR will decide on later this month.

Citizens and other insurers have been arguing for several years that changes are needed to Florida’s AOB laws, which allow homeowners to sign over their insurance benefits to contractors, who ultimately pursue payments from insurance companies. “The average cost of water claims has increased in South Florida from $10,000 to $20,000. That’s 100 percent,” Gilway said at the public hearing in North Miami. He again blamed claims abuses by water damage contractors and their attorneys who use “loss consultants” to “mine” South Florida neighborhoods for potential water damage victims, then perform costly work after persuading policyholders to sign an AOB.

AOB & Water Damage Fraud Cases Detailed

Citizens SIU is on the case!

Although the number of water claims has decreased as Citizens’ policy count has decreased by two-thirds since 2012, the average cost per water claim has doubled. Which makes the work of Citizens’ Special Investigations Unit more important than ever.

Although the number of water claims has decreased as Citizens’ policy count has decreased by two-thirds since 2012, the average cost per water claim has doubled. Which makes the work of Citizens’ Special Investigations Unit more important than ever.

These are their recent stories, titled Cases of Interest, which will be discussed on the Citizens Claims Committee conference call meeting this Wednesday afternoon (September 6). From bogus hotel receipts for additional living expenses to trying to cash in on slow leaks by claiming they’re sudden events, this is eye-opening reading folks! There’s even a few arrests sprinkled in here, too.

Details about the Citizens Claims Committee meeting, as well as how to join the call are available here.

The Grand Bargain

Workers’ Compensation Rates Going Down?

In the 2017, 60-day legislative session, many hours were spent in meetings and during floor debate discussing how to “fix” Florida’s worker’s compensation system. Senators and House members had heated discussions that our workers’ compensation system was the “grand bargain” for employees and employers because the arrangement was a win for both parties. In other words, to quote Florida’s Chief Judge of Compensation Claims, David Langham, “…both the employee and the employer enjoy benefits and suffer burdens. It is this mutuality that makes the bargain “grand,” and results in no one enjoying every benefit nor suffering every potential detriment.”

In the past 12 months, a series of Supreme Court decisions (see page 2 of House Bill 7085’s legislative summary) have given workers’ compensation stakeholders less than they “bargained” for with many saying rates would continue to escalate from the 14.5% that was approved by the Office of Insurance Regulation effective December 2016. But surprisingly, last week, the National Council on Compensation Insurance (NCCI), which proposes rates for workers’ compensation insurers and submits them to the Office of Insurance Regulation, requested an average premium decrease of 9.6 percent, effective January 1, 2018.

If approved, the vociferous fight between the business sector and insurance companies versus workers’ attorneys and labor unions could change from their dispute about rates and attorney’s fees to one about choice and transparency. The Florida Justice Association (the group representing workers’ comp attorneys among others) contends that injured workers should be able to choose their physicians and also that the NCCI ratemaking process should be more transparent. Business groups such as the Florida Chamber of Commerce contend that physician networks provide quality of service at reduced costs to the system and that NCCI’s ratemaking is a public record.

We will follow the 2018 worker’s compensation legislative debate closely and will keep you apprised of where it may land.

Florida’s Economy is Strong

All indicators going in the right direction

Ms. Proctor said “Florida’s rising consumer sentiment shows Floridians are confident in the state’s economic growth and I am proud that we’ve created an environment that fosters this confidence and encourages new business growth. DEO works to provide Floridians with as many tools as possible to help their businesses succeed and create jobs for families. In the future, we expect to continue making job gains and growing Florida’s economy at a faster pace than the nation’s gains.”

Ms. Proctor said “Florida’s rising consumer sentiment shows Floridians are confident in the state’s economic growth and I am proud that we’ve created an environment that fosters this confidence and encourages new business growth. DEO works to provide Floridians with as many tools as possible to help their businesses succeed and create jobs for families. In the future, we expect to continue making job gains and growing Florida’s economy at a faster pace than the nation’s gains.”

Specifics of all the great numbers, including Florida’s unemployment rate of 4.1% and growth by industry sector over the past year, can be viewed here.

State Attorney Loses Case Against Governor

Scott allowed to reassign potential death penalty cases

Earlier this year, we reported that Governor Scott had begun reassigning murder cases eligible for the death penalty out of the 9th Judicial Circuit of Orange and Osceola counties and giving them to State Attorney Brad King up the Turnpike in the 5th Judicial Circuit. He did so after recently elected 9th Circuit State Attorney Aramis Ayala publicly declared she wouldn’t be pursuing the death penalty for any murder cases under her watch – present or future – because research showed that the death penalty isn’t a deterrent to crime, discriminates against certain classes, costs too much, sometimes kills innocent people, and leaves victims’ families in limbo.

After the Governor’s decision, Ayala filed a lawsuit against him, saying he didn’t have the authority to take the cases away from her and that the duty to decide whether to pursue the death penalty in capital cases rest with each State Attorney. The suit was presented to the Florida Supreme Court which ruled last week in a 5-2 decision that the Governor did indeed have the authority.

Ayala’s refusal to seek the death penalty “does not reflect an exercise of prosecutorial discretion; it embodies, at best, a misunderstanding of Florida law,” Justice Alan Lawson wrote in a nine-page opinion. “Thanks for the clarification,” replied Ayala afterward in a statement, saying she will convene a panel of her assistant state attorneys to review all future murder cases eligible for the death penalty, in the hope of reestablishing her authority. The Governor’s Office said Scott will be watching.

The Miami Spirit of Love

This weekend a group of us worked to help a Miami-Dade senate candidate canvass neighborhoods and knock on doors. A team of 50 of us visited almost 3,000 homes and when we returned to the campaign office the stories of who said what inspired us all. Many of those homeowners we reached, to encourage them to vote for our candidate, engaged us about what they were doing to help the people of the Lone Star state.

This weekend a group of us worked to help a Miami-Dade senate candidate canvass neighborhoods and knock on doors. A team of 50 of us visited almost 3,000 homes and when we returned to the campaign office the stories of who said what inspired us all. Many of those homeowners we reached, to encourage them to vote for our candidate, engaged us about what they were doing to help the people of the Lone Star state.

One lady said she was calling all of her friends to tell them to send $20 each to the Salvation Army. Another said her husband had been in Texas for five days helping in the cleanup efforts. And still another said her church group was putting together care packages to send when they got the call from their “sister” church about the critical needs to include. Again, the amazing part of this was that we were in South Florida listening to stories about what good deeds Miami residents were doing for fellow Americans 1,200 miles away!

The spirit of love and caring for our fellow human beings is alive and well! Keep a good thought about Hurricane Irma please and stay updated for your protection and those you love by checking-in with the National Hurricane Center website for the very latest this week!!

Thank you,

Lisa