In recent days, many of our readers who travel lived through the recent flight cancellations and confusion caused by the Microsoft disruption. The frustration and stress experienced by those who shared their experiences last week have been palpable, as they navigated the complexities of rescheduling flights, arranging accommodations, and dealing with the enormous uncertainty. The …

LMA NEWSLETTER July 22, 2024

Federal Flood Insurance Discounts Saved

FEMA: More work to be done in Southwest Florida

Local government officials in Southwest Florida and their nearly 127,000 residents affected are breathing a sigh of relief this morning at the news that FEMA has reversed its decision to eliminate their 25% discount on federal flood insurance policies. FEMA made the original decision in March, …

Hurricane Season Prediction Worsening

My Safe Florida Home short on money already

The 2024 hurricane season gets an even stormier forecast, Florida suspends further applications to the My Safe Florida Home program, and the Resilient Florida application portal is open for business. It’s all in this week’s Disaster Management Digest.

Beryl and Beyond: Experts at Colorado State …

FEMA Adopting New Flood Risk Management Standard

Climate change now incorporated

Each year, when FEMA helps rebuild communities after disaster, it spends millions of dollars to elevate and plan according to old floodplain data – long defined as an area with a 1% chance of flooding in a given year. But due to a new finalized rule from FEMA, this 100-year, rather …

Citizens Pressured to Write Condo Buildings

Plus, more homeowners market rate cuts

Citizens Property Insurance says it has submitted to political pressure to write commercial policies that it otherwise wouldn’t, another big Florida property insurance company announces rate cuts, the biggest jump in the Consumer Price Index is automobile insurance, plus Florida’s new insurance premium tax credit goes into effect. It’s …

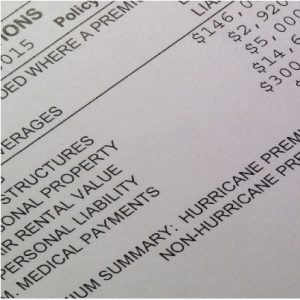

The Cost-Drivers in Homeowners Insurance

Everyone has felt the strain on homeowner’s insurance, something that has been steadily mounting nationally since the COVID-19 pandemic. A recent report from the Insurance Information Institute (Triple-I) looked for trends and dynamics and found that persistent inflation lingering from the COVID outbreak when combined with increasing natural catastrophe losses and widespread legal system abuse …