Trial Bar reveals new tactics

Governor DeSantis has signed the Assignment of Benefits (AOB) reform bill into law as well as another bill that eliminated the one-way attorney fee incentive in AOBs immediately, even before the AOB reform law itself takes effect on July 1. Those attorneys who make their living suing insurance companies over AOB contracts have already plotted their next strategy – and it doesn’t involve AOBs.

Governor DeSantis has signed the Assignment of Benefits (AOB) reform bill into law as well as another bill that eliminated the one-way attorney fee incentive in AOBs immediately, even before the AOB reform law itself takes effect on July 1. Those attorneys who make their living suing insurance companies over AOB contracts have already plotted their next strategy – and it doesn’t involve AOBs.

The Governor signed HB 7065 on May 23, which establishes a series of reforms we’ve outlined in our Bill Watch, the most important of which, is the end of one-way attorney fees. The law is effective July 1. “I thank the Florida Legislature for passing meaningful AOB reform, which has become a racket in recent years,” DeSantis said in a statement. “This legislation will protect Florida consumers from predatory insurance practices.”

However, the next day, the Governor signed HB 337, which contains a brief clause (lines 1368-1371) which makes the one-way attorney fee section of HB 7065 effective immediately upon the signature of the Governor. So May 23 was the last day unscrupulous vendors and their attorneys could file AOB lawsuits under the old, corrupt system and expect one-way fees. Despite the trial bar encouraging public adjusters and contractors to file their AOB lawsuits as fast as they can to beat the presumed July 1 deadline (including this video by the “father of AOB”), their efforts have been thwarted!

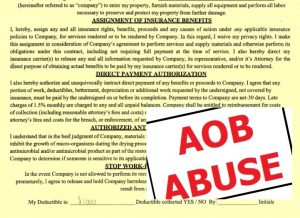

But alas, the clever trial lawyers and vendors haven’t given up their seemingly continuous quest to try to game the system and make a quick buck. They’re holding strategy seminars outlining the next get-rich-quick scheme. One was held recently in South Florida, hosted by one of the big AOB law firms.

Here’s what we learned: The AOB is essentially dead to the trial bar, due to the end of their guaranteed payday of one-way attorney fees and the fact that carriers under HB 7065 can now begin offering policies disallowing AOBs. The new model has attorneys and contractors joining together without the public adjusters, whose association supported AOB reform. The contractor responding to the emergency call or post-disaster damage urges the homeowner to sign an “agreement” directly with an attorney to presumably help the homeowner through the claims process and get their rightful insurance settlement. A general contractor or building contractor is engaged instead to write the Scope of Work and manage it (and will presumably be licensed assessors).

There’s plenty of time to pitch the attorney and take care of the homeowner’s emergency water extraction, for example, because HB 7065 still allows AOBs so long as such emergency services are limited to $3,000 or 1% of Coverage A policy limits. Well worth getting out of bed at 2am. There are other questions raised by this new model, including what the “sweet spot” is, in terms of job-size, to make the payoff worthwhile.

I’ve been helping insurance carriers hold their own seminars exploring loopholes that may exist in the new AOB reform law and other ways homeowners may be exploited by these bad actors. It’s also the topic of our latest episode of The Florida Insurance Roundup podcast, available here. Please contact me to arrange your own briefing to develop your future strategy.

LMA Newsletter of 6-3-19