Citizens seeks max increase

Another property insurance company is pulling out of Florida while another has its ratings stripped, the big migration of policies to Citizens Property Insurance has it seeking its largest rate hike in recent years, and a third roofer is arrested in an ongoing insurance fraud investigation in Southwest Florida. It’s all in this week’s Property Insurance News digest.

Down & Out: Ratings agency Demotech pulled its Financial Stability Rating for Lighthouse Property Insurance and sister company Lighthouse Excalibur Insurance on March 30. Lighthouse announced last month it was halting new policy writing in Florida. The company had about 13,000 policies in Florida as of the end of 2021. It also does business in North and South Carolina, Louisiana, and Texas. The last two companies that lost their ratings (St. Johns & Avatar) went into receivership shortly thereafter. Demotech warned that a number of other companies may lose their rating in the near future, in a recent letter to the Governor, Senate President Simpson, and House Speaker Sprowls. Lexington Insurance, part of AIG, has announced it is pulling out of Florida as well. It’s the first surplus lines company to do so in this market downturn and has about 8,000 mostly high-end homeowners policies in the state.

Down & Out: Ratings agency Demotech pulled its Financial Stability Rating for Lighthouse Property Insurance and sister company Lighthouse Excalibur Insurance on March 30. Lighthouse announced last month it was halting new policy writing in Florida. The company had about 13,000 policies in Florida as of the end of 2021. It also does business in North and South Carolina, Louisiana, and Texas. The last two companies that lost their ratings (St. Johns & Avatar) went into receivership shortly thereafter. Demotech warned that a number of other companies may lose their rating in the near future, in a recent letter to the Governor, Senate President Simpson, and House Speaker Sprowls. Lexington Insurance, part of AIG, has announced it is pulling out of Florida as well. It’s the first surplus lines company to do so in this market downturn and has about 8,000 mostly high-end homeowners policies in the state.

Citizens Rate Request: Citizens Property Insurance Corporation, the state’s taxpayer-backed insurer of last resort, went before the Florida Office of Insurance Regulation (OIR) at a public hearing on March 30 requesting a nearly 11% increase across all accounts, the maximum allowed under current state law.

Citizens Rate Request: Citizens Property Insurance Corporation, the state’s taxpayer-backed insurer of last resort, went before the Florida Office of Insurance Regulation (OIR) at a public hearing on March 30 requesting a nearly 11% increase across all accounts, the maximum allowed under current state law.

“It was never intended by the Legislature that Citizens openly and aggressively compete with the private market insurance, but that is exactly what we’re doing today,” said Citizens CEO Barry Gilway told OIR. Citizens had 818,000 policies at the end of March, rising by 5,500 per week due to migration of customers from private companies that have either gone out of business or have stopped writing/renewing policies. Citizens projects it will have more than 1 million policyholders by year’s end. All that growth means Citizens may have to levy assessments if just a single 1-in-100 storm hits the state this hurricane season.

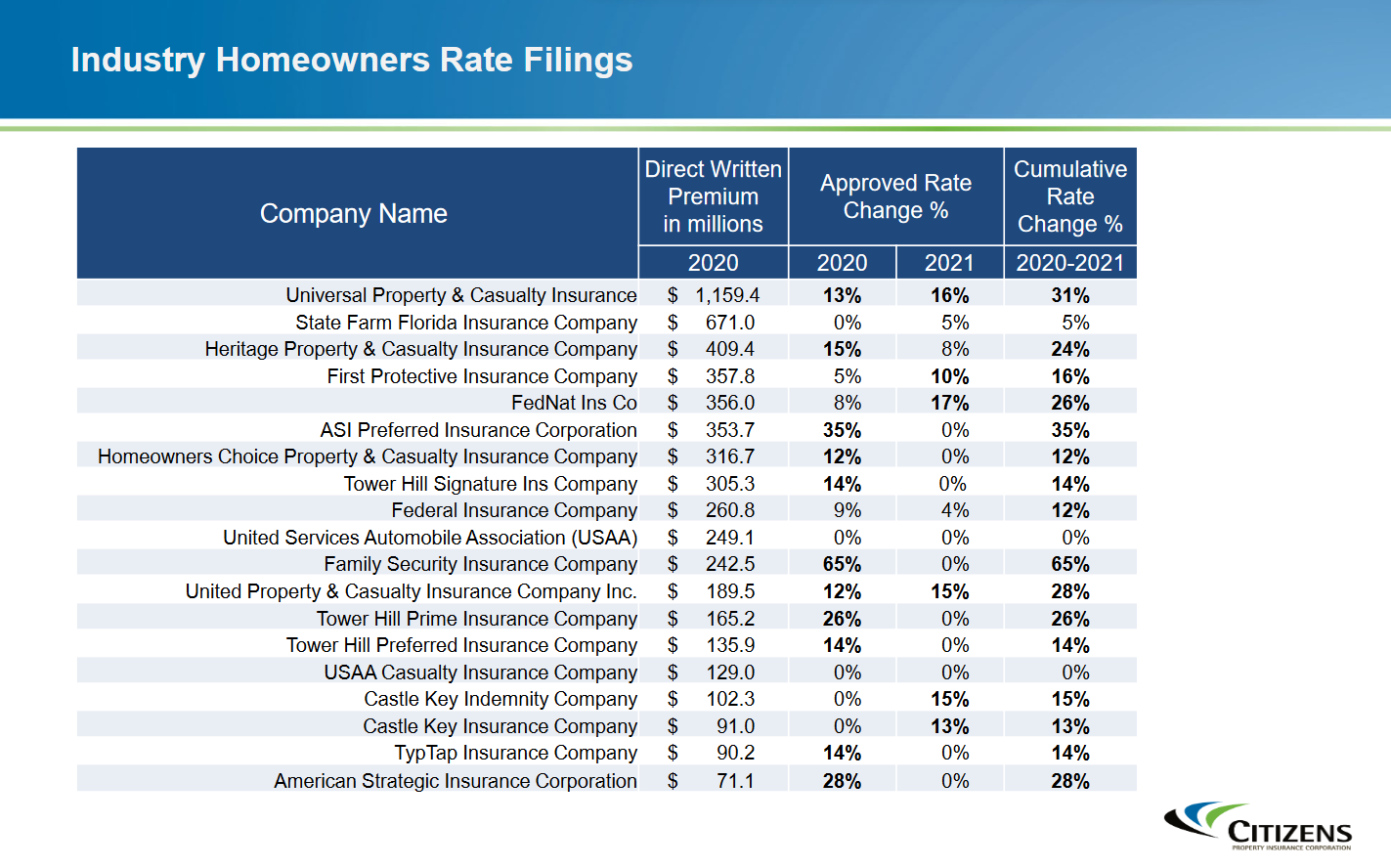

Gilway is urging OIR and the legislature to let Citizens start pricing rate to risk, one of the basic principles of insurance. It’s also losing money, as we reported in the last newsletter. His PowerPoint presentation during the hearing tells the story, including the chart below, which shows the cumulative double-digit rate increases of 12%-65% for the top 19 private insurance companies in Florida.

From: Citizens Property Insurance Corporation, March 30, 2022

Mugshot of William Buckridge of Webb Roofing & Construction

Roofing Contractor Fraud: A third roofer associated with Webb Roofing & Construction LLC of Ft. Myers has been arrested and charged with two counts of insurance fraud. William Ervin Buckridge of Estero now joins the firm’s two co-owners in being accused of running a homeowner solicitation scheme offering free roof replacements in lieu of paying the insurance policy deductible, as we recently reported.

Florida’s Insurance Consumer Advocate, Tasha Carter, is using this case to reach out to insurance consumers and companies to spread the word about insurance fraud. She is sharing this Consumer Alert with the media as well, to raise greater awareness. “These schemes are real and are happening more frequently,” she said, and urges homeowners to visit her Demolish Contractor Fraud: Steps to Avoid Falling Victim webpage to learn more.

Look at the Lawyers, too: Last year’s insurance consumer protection reform in SB 76 requires plaintiff attorneys to file a 10-day “Notice of Intent to Litigate” (NOITIL) with the insurance company before filing suit, to allow time to resolve the dispute. Here’s a look at first quarter 2022 litigation stats to see just how that’s working:

Look at the Lawyers, too: Last year’s insurance consumer protection reform in SB 76 requires plaintiff attorneys to file a 10-day “Notice of Intent to Litigate” (NOITIL) with the insurance company before filing suit, to allow time to resolve the dispute. Here’s a look at first quarter 2022 litigation stats to see just how that’s working:

- 26,937 claims were being disputed (16,283 lawsuits + 10,654 NOITILs). That’s an increase of 25.7% from the number of lawsuits in the same period last year.

- Plaintiff attorneys are filing NOITILs only 39.55% of the time and no one is enforcing the law that says they have to!

- 45.1% of the state’s litigation was filed in Miami-Dade, Broward, and Palm Beach counties.

- 40.7% of all litigation was filed by just 20 attorneys. Seven of the top 20 attorneys filed 2,931 lawsuits during the first quarter (that’s 225 per week – or an average of 32 per week per attorney) without filing a single NOITIL.

Talk about a litigation factory!

LMA Newsletter of 4-11-22