Rate requests reduced, too

Citizens Property Insurance Corporation, Florida’s insurer of last resort, lost out last week on its attempt with regulators to apply actuarially-sound rates to its new customers, while allowing existing policyholders to continue enjoying a legislatively-set 10% rate hike cap. The company also had its proposed rate increase on multi-peril homeowners insurance cut almost in half.

Citizens Property Insurance Corporation, Florida’s insurer of last resort, lost out last week on its attempt with regulators to apply actuarially-sound rates to its new customers, while allowing existing policyholders to continue enjoying a legislatively-set 10% rate hike cap. The company also had its proposed rate increase on multi-peril homeowners insurance cut almost in half.

During its March 15 rate hearing, Citizens asked the Florida Office of Insurance Regulation (OIR) for rate cap flexibility for new customers, saying its interpretation of the statute capping annual increases at 10% can be interpreted as only applying to existing customers. The company also cited a November 2020 report by the FSU Florida Catastrophic Storm Risk Management Center supporting the need to reduce Citizens exposure by changing the 10% cap. The request would have increased rates for new business by an average of 21%, Citizens testified.

OIR, in its rate Order released last week denied the request, noting it “finds the justification for this provision to be insufficient and that all policies, whether new or renewal, should be subject to the same capping under … Florida (law).” OIR also noted that when the glidepath was initially recommended by the Citizens Property Insurance Corp. Mission Review Task Force in 2009, “there was no distinction between new and renewal rates in the final report of the task force.”

Citizens President & CEO Barry Gilway told OIR regulators that the company needed the cap to help stem the 5,000 new policies it’s been getting every week from the private market. “The reality is the marketplace in Florida is shutting down,” Gilway said.

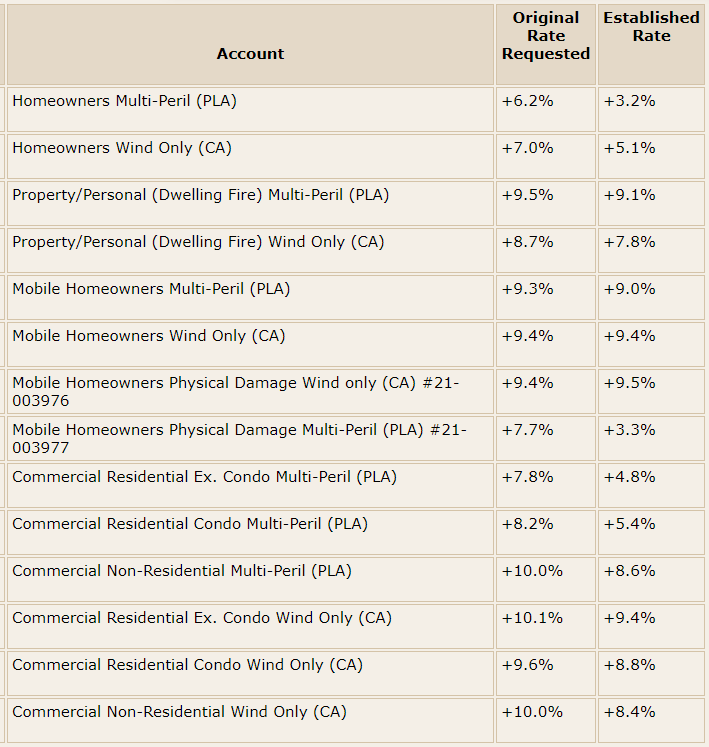

Citizens was seeking an overall statewide rate hike of 6.2% with the largest individual policy rate increase to be capped at 10%. What it got was a 3.2% increase instead. OIR also significantly lowered Citizens’ Commercial Residential Condo Mult-Peril rate request, from a 7.8% to 4.8% increase. The chart below provides the overall estimated statewide average rate changes for all of Citizens personal lines accounts (PLA) and coastal accounts (CA).

From Florida Office of Insurance Regulation, April 20, 2021

OIR also disapproved Citizens’ request to add a risk factor provision, which Citizens said is an estimate of an extra amount the carrier should charge for the cost of catastrophic risk it is assuming. You can read more of the backstory from our past newsletter here.

So Citizens only hope for now in gaining flexibility over the mandated 10% rate cap rests with SB 1574 by Senator Jeff Brandes which passed its last stop in the Appropriations Committee last week and is ready for consideration by the full Senate.

LMA Newsletter of 4-26-21