Another carrier stops writing new business

Another Florida property insurance company has joined more than a dozen others in the last year who placed moratoriums on writing new business or left the state altogether. People’s Trust Insurance told insurance agencies …

Another Florida property insurance company has joined more than a dozen others in the last year who placed moratoriums on writing new business or left the state altogether. People’s Trust Insurance told insurance agencies …

South Florida homeowners under arrest

A Florida insurance agent is sentenced to 14 years in prison for diverting premiums for his personal use, a Miami homeowner gets caught for allegedly claiming old damage on an insurance claim, and why a …

A Florida insurance agent is sentenced to 14 years in prison for diverting premiums for his personal use, a Miami homeowner gets caught for allegedly claiming old damage on an insurance claim, and why a …

Commissioner Yaworsky acknowledges reinsurance dilemma

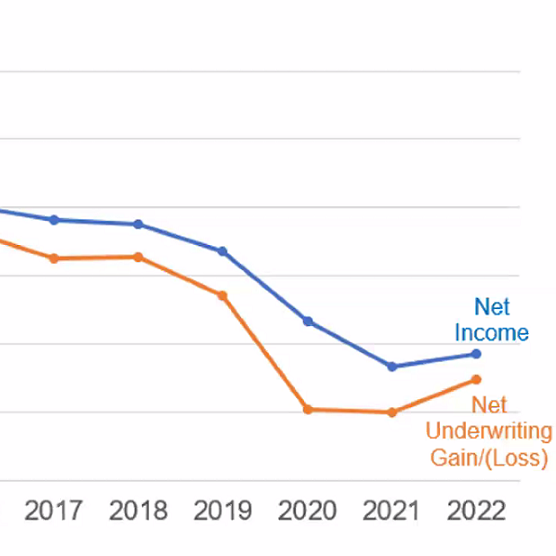

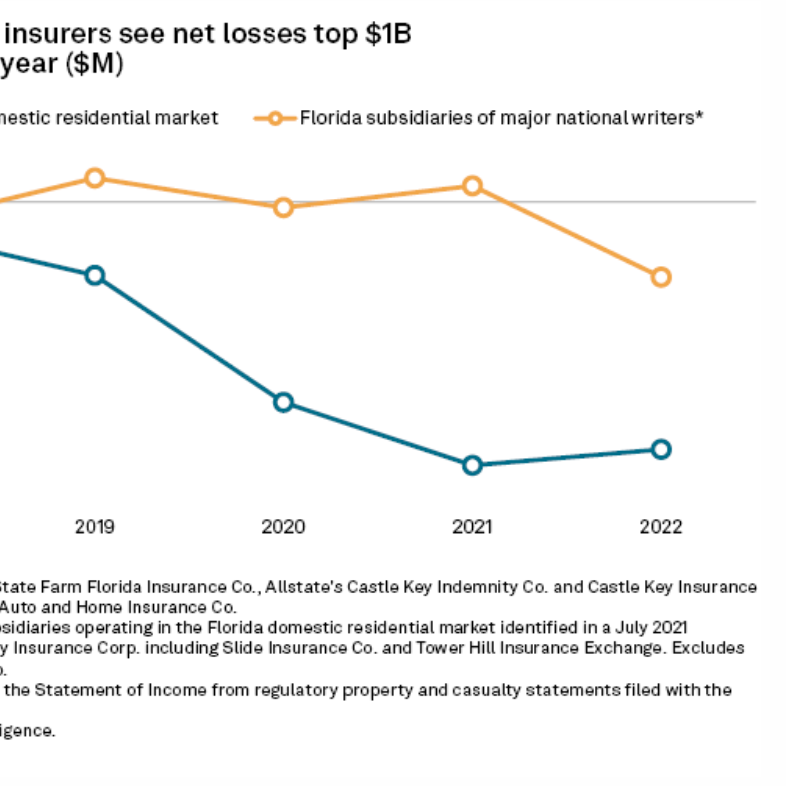

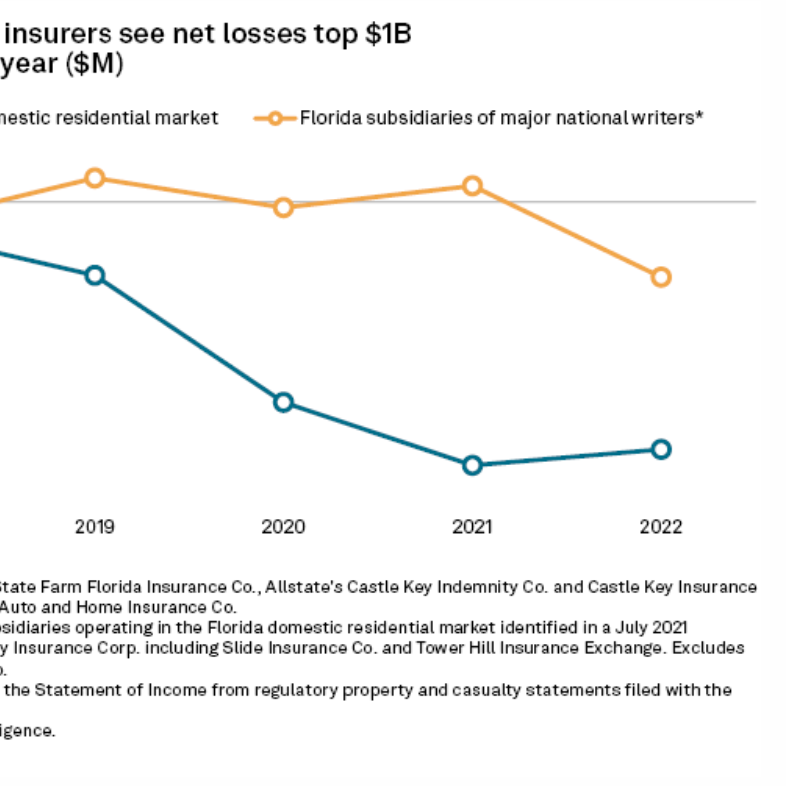

Florida’s property insurance market posts another year of $1 billion-plus losses, the insurance commissioner weighs-in on the reinsurance scarcity challenge, while consumers look for ways to reduce coverage and price. It’s all in this week’s …

Florida’s property insurance market posts another year of $1 billion-plus losses, the insurance commissioner weighs-in on the reinsurance scarcity challenge, while consumers look for ways to reduce coverage and price. It’s all in this week’s …

I follow several Florida insurance agents and their dedication to their customers and the overall insurance market. One of these agent leaders is Jake Holehouse whose dad was an icon in the industry. I have known Jake since he was …

Emergency assessment ordered

Florida is in store for a whopping 76% increase in homeowners insurance premiums in 2023 over last year, insurance regulators approve an emergency assessment on almost all Florida insurance policies to pay for the most recent carrier …

Florida is in store for a whopping 76% increase in homeowners insurance premiums in 2023 over last year, insurance regulators approve an emergency assessment on almost all Florida insurance policies to pay for the most recent carrier …

Plus, more property rate hikes & reinsurance hardening

The rush of lawsuits filed in Florida courts to beat the effective date of the new tort reform law has one South Florida court considering staying all new cases, two more Florida …

The rush of lawsuits filed in Florida courts to beat the effective date of the new tort reform law has one South Florida court considering staying all new cases, two more Florida …

New focus & help

Springtime is bringing the return of insurance villages to Southwest Florida together with added help to streamline Hurricane Ian claim payments and a reminder from regulators, Citizens is breaking from tradition to help some hurricane victims, …

Springtime is bringing the return of insurance villages to Southwest Florida together with added help to streamline Hurricane Ian claim payments and a reminder from regulators, Citizens is breaking from tradition to help some hurricane victims, …

No longer playing nice?

After Governor DeSantis a week ago Friday signed tort reform bill HB 837 into law, some in the trial bar went into a bit of a meltdown, threatening to play hardball with the insurance industry, whom …

Rising reinsurance costs a factor

Allstate’s Castle Key subsidiary is asking for a 53.5% rate increase after shedding 33,000 condo policies, another Florida insurance company goes into a policy runoff while another calls it quits altogether, plus how the high …

Another Florida property insurance company has joined more than a dozen others in the last year who placed moratoriums on writing new business or left the state altogether. People’s Trust Insurance told insurance agencies …

Another Florida property insurance company has joined more than a dozen others in the last year who placed moratoriums on writing new business or left the state altogether. People’s Trust Insurance told insurance agencies …

A Florida insurance agent is sentenced to 14 years in prison for diverting premiums for his personal use, a Miami homeowner gets caught for allegedly claiming old damage on an insurance claim, and why a …

A Florida insurance agent is sentenced to 14 years in prison for diverting premiums for his personal use, a Miami homeowner gets caught for allegedly claiming old damage on an insurance claim, and why a …

Florida’s property insurance market posts another year of $1 billion-plus losses, the insurance commissioner weighs-in on the reinsurance scarcity challenge, while consumers look for ways to reduce coverage and price. It’s all in this week’s …

Florida’s property insurance market posts another year of $1 billion-plus losses, the insurance commissioner weighs-in on the reinsurance scarcity challenge, while consumers look for ways to reduce coverage and price. It’s all in this week’s …