50%+ rate requests considered

Two property insurance companies explain at public hearings the reasons they need 50%-plus rate increases on their Florida policies, reinsurance companies express concern to Florida insurance carriers about potential loss creep from Hurricane Ian, plus a …

Two property insurance companies explain at public hearings the reasons they need 50%-plus rate increases on their Florida policies, reinsurance companies express concern to Florida insurance carriers about potential loss creep from Hurricane Ian, plus a …

It’s not just the weather

Florida isn’t alone in big double-digit hikes in property insurance rates, surplus lines insurance companies continue to see huge premium growth and especially in Florida, the important distinction in seeking prejudgment interest on a claim, …

Florida isn’t alone in big double-digit hikes in property insurance rates, surplus lines insurance companies continue to see huge premium growth and especially in Florida, the important distinction in seeking prejudgment interest on a claim, …

Encouraging news on reinsurance pricing

A new poll showing inflation and rising property insurance prices are the biggest motivators for Florida voters this November, a new forecast for reinsurance pricing and commercial property rates this year, plus a big insurance …

A new poll showing inflation and rising property insurance prices are the biggest motivators for Florida voters this November, a new forecast for reinsurance pricing and commercial property rates this year, plus a big insurance …

Includes ending federal flood insurance

Although we are seeing a leveling off of reinsurance costs as of the January 2024 renewals, Congress has initiated legislation to stem reinsurance prices. A bill introduced in Congress last week would establish a federal …

Homeowners rates, real estate impacted

A new survey shows reinsurance prices in the upcoming renewal will be upwards of 30% more expensive than this year, catastrophe exposed commercial properties are expected to see the biggest reinsurance rate hikes, reinsurance prices …

A new survey shows reinsurance prices in the upcoming renewal will be upwards of 30% more expensive than this year, catastrophe exposed commercial properties are expected to see the biggest reinsurance rate hikes, reinsurance prices …

Another big Cat year in the making, renewed uncertainty for reinsurance pricing

The very latest on Hurricane Idalia and Ian claims, how natural catastrophes are on track to set another record this year, the impact of those natural disasters on …

The very latest on Hurricane Idalia and Ian claims, how natural catastrophes are on track to set another record this year, the impact of those natural disasters on …

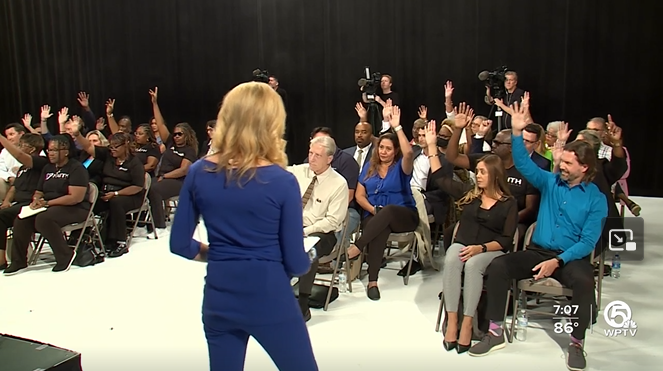

Important questions and answers

The insurance consumer and market reforms passed by the Florida Legislature last year and this year are starting to make a difference already but we are another good 12-18 months away from seeing the impact on …

By Tim Molony, AIC, MGA

The Reinsurance Podcast Episode #62 is thought provoking. Jerad Leigh and Ben Rose dig into the current hard market. To me, some of the discussion begs the question, “Why does it seem that the insurance/reinsurance …

Yaworsky leads, surplus lines gain ground

Florida’s insurance commissioner comments on claims being closed without payment as he approves more roof endorsements restricting non-storm claims, more Citizens Insurance takeouts are approved, and the surge of surplus lines carriers in the …

Florida’s insurance commissioner comments on claims being closed without payment as he approves more roof endorsements restricting non-storm claims, more Citizens Insurance takeouts are approved, and the surge of surplus lines carriers in the …

Focus now turns to storm claims preparation

When LMA asked many of Florida’s stakeholders about this year’s reinsurance purchase for hurricane season, the sentiment was that the negotiations started out rocky and the finish was expensive, with the 2023 reinsurance …

Two property insurance companies explain at public hearings the reasons they need 50%-plus rate increases on their Florida policies, reinsurance companies express concern to Florida insurance carriers about potential loss creep from Hurricane Ian, plus a …

Two property insurance companies explain at public hearings the reasons they need 50%-plus rate increases on their Florida policies, reinsurance companies express concern to Florida insurance carriers about potential loss creep from Hurricane Ian, plus a …

Florida isn’t alone in big double-digit hikes in property insurance rates, surplus lines insurance companies continue to see huge premium growth and especially in Florida, the important distinction in seeking prejudgment interest on a claim, …

Florida isn’t alone in big double-digit hikes in property insurance rates, surplus lines insurance companies continue to see huge premium growth and especially in Florida, the important distinction in seeking prejudgment interest on a claim, …

The very latest on Hurricane Idalia and Ian claims, how natural catastrophes are on track to set another record this year, the impact of those natural disasters on …

The very latest on Hurricane Idalia and Ian claims, how natural catastrophes are on track to set another record this year, the impact of those natural disasters on …