(This is an electronic version of an Article published in Risk Management & Insurance Review: © Risk Management and Insurance Review, 2019, Vol. 22, No. 1, 7-13 DOI: 10.1111/rmir.121 17) (March 2019)

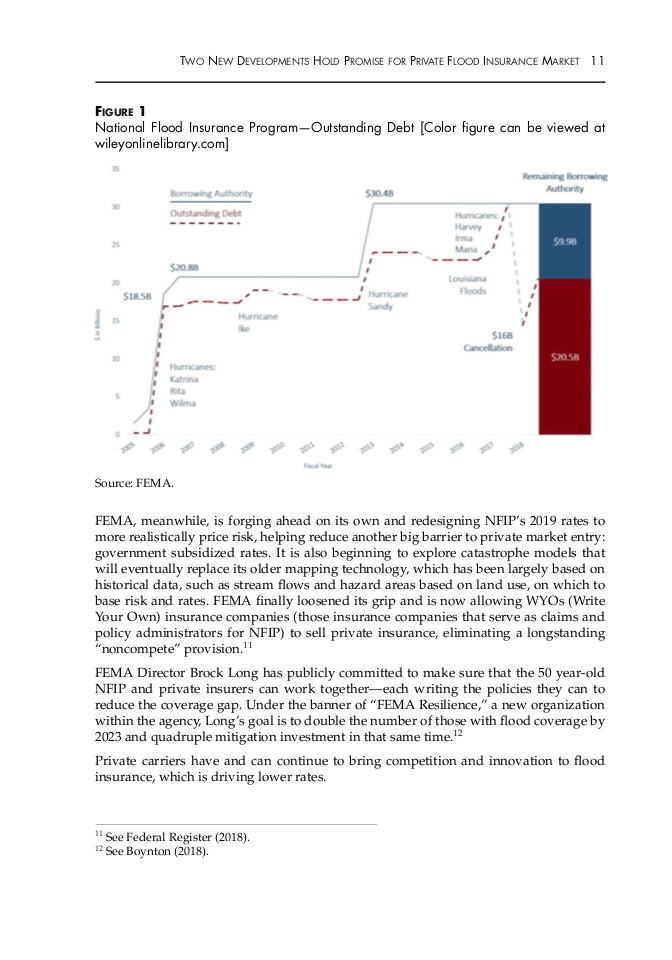

“With ever increasing NFIP rates, it’s only natural that a private market should relieve some of NFIP’s lower-risk portfolio. With the NFIP in debt to the tune of nearly $21 billion, shifting risk appropriately to the private market is both smart public policy and increases the availability and affordability of flood insurance for consumers.” – Lisa Miller