The Only Constant is Change

![]() As we enter the New Year, I am reminded of an old saying that “The Only Constant is Change”. What will you change or what will change you? I think many of us have a love-hate relationship with change. I know I do. Certainly when things are going poorly, I take solace in the fact that, no matter what, things are not going to stay the same. They might get better, or they might get worse, but they are going to be different.

As we enter the New Year, I am reminded of an old saying that “The Only Constant is Change”. What will you change or what will change you? I think many of us have a love-hate relationship with change. I know I do. Certainly when things are going poorly, I take solace in the fact that, no matter what, things are not going to stay the same. They might get better, or they might get worse, but they are going to be different.

Conversely, when life is going great for us, we “want things to stay this way forever.” Let’s just keep everything the same, and these happy times will continue indefinitely. Unfortunately, that’s not the way life works. Again, whether we actively try to keep things as they are or not, change is going to happen.

If change is unavoidable, what’s the point of even talking about it? Well, we are all not only affected by change, but by how we feel about change. Do we embrace it? Fear it? Resist it? Avoid it as much as possible? The happenings in 2018 will change many things in our state, particularly in elected office with all our statewide cabinet seats up for grabs and most legislative seats. We will talk more about that as we communicate with you in the coming months, but as you scroll through this 2018 inaugural edition of the LMA newsletter, do your best to have a healthy attitude toward the idea of change and enjoy the ride!

Bill Watch

The start of the 2018 Legislative Session

The Florida Legislature begins its 2018 session tomorrow morning, earlier in the year than normal and with six empty seats due to resignations and the recent death of Representative Don Hahnfeldt. A seventh (Rep. Trujillo of Miami) will resign if he is confirmed for a U.S. Ambassadorship. The state constitution requires the 60-day session in odd number years to begin in March, but even number years are up to the Legislature. This year a prominent South Florida Senator wanted to spend spring break in March with the family. Critics of January session point to “freezing” North Florida winter temperatures and that it’s a downer as well for the local Tallahassee economy, with fewer people staying the weekends and going to restaurants and other businesses.

The Florida Legislature begins its 2018 session tomorrow morning, earlier in the year than normal and with six empty seats due to resignations and the recent death of Representative Don Hahnfeldt. A seventh (Rep. Trujillo of Miami) will resign if he is confirmed for a U.S. Ambassadorship. The state constitution requires the 60-day session in odd number years to begin in March, but even number years are up to the Legislature. This year a prominent South Florida Senator wanted to spend spring break in March with the family. Critics of January session point to “freezing” North Florida winter temperatures and that it’s a downer as well for the local Tallahassee economy, with fewer people staying the weekends and going to restaurants and other businesses.

So as of now, the Senate will have 38 of its 40 Senators and the House 116 of its 120 Representatives. Don’t look for the balance of power to change significantly in the two dominantly Republican chambers. Of the 2,830 bills filed to date, the only bill the Legislature by law is required to pass in its 60-day session is the appropriations bill funding the state budget for the next fiscal year, which begins July 1 (aka The Tallahassee New Year).

Governor Scott tomorrow morning is scheduled to deliver his last State of the State address, which will include his proposed budget of $87.4 billion, an increase from the current year’s $82.4 billion budget. Given extremely limited revenue surpluses going into the next fiscal year, look for that number to be trimmed significantly, especially in the very conservative House. In addition to the budget, the big issues this session will include public education and hurricane preparedness, going into the next hurricane season which is now less than five months away!

On the major insurance issues (Assignment of Benefits, Personal Injury Protection auto insurance, and Workers’ Compensation insurance) the House is leading the way, with bills in all those areas successfully through committees and ready for full votes of the House. Meanwhile, the Senate not so much so – still seemingly struggling with how seriously to take these threats to the insurance marketplace. The House is also showing bold leadership on innovative bills this session, including Direct Primary Care as an alternative to Obamacare and the private health insurance markets, and tackling improvements needed to strengthen Florida’s response to the next big hurricane.

We have captured the insurance bills at this inaugural edition that we think are interesting and MIGHT have a chance of either moving through the process or even making it to the Governor’s desk. There may be others that we see get “in the game” as we carefully and actively engage in all things 2018 session. So our readers might see new bills added, as well as changes in existing bills’ status as we progress the next 60 days. The deadline for bill filing is tomorrow.

Here’s a look at just where things stand from last fall’s committee meetings going into tomorrow’s 2018 session in this week’s 2018 Bill Watch:

Assignment of Benefits (AOB) – The differences between the House and Senate seem to boil down to how to handle attorney fees in third-party disputes (the same differences that sunk reform efforts last year). Rep. Jay Trumbull (R-Panama City) who is leading the AOB reform effort in the House with his bill, HB 7015, has received approval by its only committee of reference and is ready for a full vote of the House, possibly as early as Thursday. The bill addresses AOB abuses and enhances consumer/policyholder protections. It’s a replica of last session’s HB 1421, which had passed the House but was never heard in the Senate. The bill allows AOBs to exist under certain conditions, and requires that they be in writing, contain an estimate of services, notice the insurer, and allow the policyholder 7 days to rescind the AOB. It prohibits specified fees as part of an AOB as well as any policy changes related to a managed repair program. It requires a 10-business day notice prior to filing suit against an insurer, an assignee’s pre-suit settlement demand and insurer’s pre-suit settlement offer, and puts parameters around attorney fees. There would be consumer disclosure language so the consumer is fully aware of the consequences when executing an AOB and would limit an assignee from recovering certain costs directly from the policyholder. Beginning in 2020, insurers would be required to report to OIR their data on claims paid via AOBs.

While one-way attorney fees would continue to exist for first-party claims filed by a policyholder against an insurer, this bill sets special two-way attorney fees for third-party claims. Insurance Commissioner David Altmaier said consumers would be held harmless regardless of who wins the lawsuit and described the bill as a balance between discouraging abusive vendor claims while still allowing contractors to go after insurers who low-ball claims and settlement offers. Here’s how (from the bill):

“If the parties fail to settle and litigation results in a judgment, the bill provides the exclusive means for either party to recover attorney fees. The bill defines the difference between the insurer’s pre-suit settlement offer and the assignor’s pre-suit settlement demand as “the disputed amount.” The award of fees are as follows:

- If the difference between the judgment and the settlement offer is less than 25 percent of the disputed amount, then the insurer is entitled to attorney fees.

- If the difference between the judgment and the settlement offer is at least 25 percent but less than 50 percent of the disputed amount, neither party is entitled to fees.

- If the difference between the judgment and the settlement offer is at least 50 percent of the disputed amount, the assignee is entitled to attorney fees.”

Rep. Trumbull said the bill protects consumers, pointing out that the number of residential water loss claims jumped 46% from 2010 to 2016, “and it’s not because it was raining harder.” An amendment to limit to one the number of under-oath examinations and statements an insurer might demand of a vendor failed to pass. (see New Data on AOB Abuse Outlines Real Problem in Florida in this edition of the LMA Newsletter)

In the Senate, Banking & Insurance Committee Chair Anitere Flores (R-Miami) took testimony last fall from various sides over several weeks to try to broker an AOB reform compromise bill – and Senator Greg Steube’s bill, filed right at the end of the last committee week in December may apparently be it. Steube (R-Sarasota) released SB 1168, which has good and bad elements in it. The conservative senator often puzzles many of us following his work. He is a brilliant attorney and great fun to work with on projects of public policy. What is puzzling is his version of AOB reform. SB 1168 indeed has some key reforms but one item shared among some AOB experts falls under the heading of “spoiler alert.” It’s language that prohibits insurance companies from including the costs of attorney fees paid in losing cases into their rate base or future rate requests. That idea, originally floated by Democratic Senator Gary Farmer in SB 256 (see below) prompted Insurance Commissioner David Altmaier in a Senate Banking and Insurance committee meeting in October to call it “one of the worst ideas he’s heard.” The reason the commissioner has this opinion is that insurance companies, for the most part, are not the instigator of litigation; the vast majority of AOB suits are from AOB law firm “factories,” much like the home foreclosure saga where trial lawyer firms filed thousands of suits against banks. Trust that the LMA team will work with Senator Steube to educate him on life in the field that so many of you face every day in the insurance industry.

There are other AOB bills in the Senate, but they are all stalled. They include SB 62 by Senator Dorothy Hukill (R-Port Orange). The bill prohibits certain attorney fees and requires those vendors that execute the AOB to comply with certain requirements prior to filing suit. HB 7015 has some elements of this bill.

Likewise stalled is SB 256 by Senator Gary Farmer (D-Ft. Lauderdale), which would prohibit insurer managed repair programs and prevent most property insurance policies from prohibiting or limiting AOB. But it would also require the AOB be in writing, be limited to an accurate scope of work to be performed, and allow the policyholder to cancel the AOB within seven days without penalty and otherwise, be shared with the insurer within seven days of execution. A final repair bill would be required to both policyholder and insurer within 7 days of work completed. Referral fees would be limited to $750 and require water damage remediation assignees to be ANSI certified. Insurance companies would be required to offer any settlement within 10 days of assignee filing suit over an AOB dispute. It also prohibits insurers from including the costs of attorney fees paid in losing cases into their rate base or future rate requests. Under the bill, OIR would be required to conduct an annual AOB data call beginning in 2020. HB 7015 has some elements of this bill, but not the attorney fee rate recoupment.

Back in the House, Rep. David Santiago (R-Deltona), who has been a champion in the fight against the abuse of assignment of benefits for the past several years, in early November filed a catch-all insurance bill (HB 465), known as an “omnibus” bill to change several provisions of the insurance code. The bill covers several insurance topics such as property, auto, surplus lines and some general regulatory provisions. One of the most interesting is that it excludes from the Department of Financial Services complaint registry complaints filed by third parties who are not satisfied with an insurance company’s claims handling when an assignment of benefits is involved. The thinking is that there is an incentive by third party vendors to dispute the claim to delay it, which drives up the cost of the claim. The bill also makes a priority the use of the Department of Financial Services mediation program for property insurance claims disputes involving an assignment of benefits. This bill, too, is stalled as is its identical companion bill in the Senate (SB 784) by Senator Brandes.

Windshield AOB – Assignment of Benefits abuse is now occurring in the auto insurance lines, as insurance companies note an increase in customers being solicited out of the blue for a “free windshield” with accompanying exorbitant claims costs. Senator Hukill’s SB 396, would allow auto insurers to require an inspection of the damaged windshield of a covered motor vehicle before the windshield repair or replacement is authorized. The bill is scheduled to get its first hearing Wednesday before the Senate Banking and Insurance Committee. It has an identical companion bill in the House (HB 811) by Rep. Plasencia, which is still awaiting its first of three committee hearings.

Workers’ Compensation – Like AOB reform, Workers’ Comp reform is another issue being fast-tracked by the Florida House, with HB 7009 by Rep. Danny Burgess (R-Zephyrhills) ready for a House floor vote. It’s a near replica of HB 7085 from last session that died over disputes on maximum hourly attorney fees. This is by far one of the most contentious – and by court rulings, most immediate – issues facing the legislature after the state Supreme Court’s 2016 ruling that our workers’ comp system was unconstitutional.

Last year’s bill came on the heels of a 14.5% average increase in workers’ comp rates – adding to the urgency. This fall, however, OIR approved decreased rates averaging 9.5%. Rep. Burgess has warned that those decreased rates don’t reflect the lagging cost increases still anticipated from state Supreme Court decisions throwing out limits on attorney fees and extending certain disability payments. And he’s right (see New Report Shows Increase in Workers’ Comp Legal Fees in this edition of the LMA Newsletter). Rep. Burgess said it was important to be proactive and pass reforms now, before the next rate increase. The bill eliminates fee schedules but puts a cap of $150/hour on plaintiff (workers) attorney fees.

Rep. Jamie Grant (R-Tampa) has noted this bill does not include a competitive rate making process that was in last year’s bill at one point. Florida is one of seven states solely using a “Full Rate” or administered system that takes into account an insurer’s extraneous expenses and profit. Thirty-eight states instead use a “Loss Cost” or competitive system which limits insurers to a rate necessary to cover losses and benefit costs and only expenses directly related to claims settlement. “Every dollar spent unnecessarily is another dollar not spent on workers care,” said Rep. Grant. “A competitive rate making process will go a long way to reducing rates.” HB 7009 has no Senate companion – not a good sign for any bill’s future success – and time has just about run out for one, but anything can happen with bills becoming amendments and tacked onto other bills and other maneuvers.

Workers’ Compensation for First Responders – CS/SB 376 by Senator Lauren Book (D-Plantation) removes the requirement in some on first responders that there be a physical injury in some circumstances in order to receive medical benefits for a “mental or nervous injury”, so long as the responder witnessed a specified traumatic event. The bill passed the Senate Banking and Insurance Committee in December after an emotional 90-minutes of testimony from a parade of firefighters and other first responders, who shared personal stories of anguish on the job. These efforts are inspired, in part, by the city of Orlando’s refusal to pay such benefits to a police officer reportedly diagnosed with PTSD after responding to the Pulse nightclub shootings. The bill now goes to the Commerce and Tourism committee. House bill HB 227 by Rep. Matt Willhite (D-Royal Palm Beach) and SB 126 by Senator Victor Torres (D-Kissimmee), which would require treatment begin within 15 days, have not been heard

Regulation of Workers’ Compensation Insurance – Filed by Senator Lee on the Friday before Session began, SB 1634 authorizes the Insurance Consumer Advocate to intervene as a party in certain proceedings relating to the regulation of workers’ comp insurance or to seek review of certain agency actions before the Division of Administrative Hearings (DOAH). The bill also specifies requirements and procedures for the consumer advocate in the examination of workers’ compensation rates or form filings. There is no House companion bill.

Personal Injury Protection (PIP), also called No Fault Insurance – Various bills under consideration would eliminate the state requirement that motorists carry $10,000 in PIP insurance and put responsibility for vehicle accidents on the party at fault. At this point, the House is making much more progress with PIP reform than the Senate. House bill HB 19 is ready for a full House floor vote, possibly as early as this Thursday. The bill eliminates PIP and would require motorists instead to carry Bodily Injury liability insurance at a minimum $25K/$50K level. Rep. Erin Grall (R-Vero Beach) who is sponsoring this bill for second year in a row, has noted that despite various PIP reforms in the past, costs keep going up, driven partly by fraud. OIR and committee staff analysis show auto rates would go down (5.6% overall) if the bill passes and should encourage those driving illegally without proper insurance (22% of Florida drivers she has said) to get coverage. The bill also revises the uninsured and underinsured coverage legal damage thresholds.

The Senate’s answer to PIP reform is SB 150, by Senator Tom Lee (R-Brandon), who is scheduled to finish his bill presentation at Wednesday’s meeting of the Senate Banking and Insurance Committee. It goes beyond the House bill and replaces PIP with mandatory $5,000 of Med Pay coverage (and loses the consumer savings as a result) and varying amounts of Bodily Injury liability limits which appears to give consumers choices:

- 20/40/10 minimum coverage from 1/1/19-12/31/20 or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $50,000 for one crash;

- 25/50/10 minimum coverage from 1/1/21-12/31/22 or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $60,000 for one crash; and

- 30/60/10 minimum coverage from 1/1/23 and thereafter or a Med Pay and motor vehicle liability policy with a combined property damage and bodily injury coverage of $70,000 for one crash.

HB 6011 by Rep. Julio Gonzalez (R-Venice) deletes the requirement for policyholders & health care providers to execute disclosure & acknowledgment forms to claim personal injury protection benefits. These requirements were originally established to help prevent fraud and include verification that actual services were rendered and weren’t solicited by the provider. The bill has been referred to the House Insurance and Banking Subcommittee but is still stalled. HB 6011 has no Senate companion – not a good sign for any bill’s future success – and time has just about run out for one, but again, anything can happen with bills becoming amendments and tacked onto other bills and other maneuvers.

Hurricane Irma Damage – The House Select Committee on Hurricane Response and Preparedness last month listened to a recap of the 141 member recommendations to date for responding to Hurricane Irma and preparing for future storms. They include extending the Suncoast Parkway from Citrus County to the Georgia line to aid in evacuations, using cruise ships to evacuate the Keys, burying more electric utility lines, and toughening penalties in state contracts for vendors that don’t deliver what they promise (such as debris cleanup). Most don’t have price tags attached. This caps two months of fall committee hearings on various ideas from government and private interests. Of interest to insurance interests, Rep. Holly Raschein (R-Key Largo) suggests high-risk areas not be rebuilt after storms and instead, could be part of a state buyout program, with the land to revert to natural buffers. (This is an idea that will be familiar to newsletter readers from this past summer’s report Aligning Natural Resource Conservation, Flood Hazard Mitigation, and Social Vulnerability Remediation in Florida which found Florida has 15,000 “Repetitive Loss Properties”.) Committee Chairwoman Jeanette Nunez (R-Miami) said she expects the committee will deliver its report to House Speaker Richard Corcoran by January 8, the day before the 2018 legislative session begins. Speaker Corcoran has made clear the House spending priorities this upcoming session will be for hurricane relief, noting specifically the Suncoast Parkway extension and underground utilities during a December appearance on C-SPAN.

Hurricane Flood Insurance – One of the bills out of the chute in Irma’s aftermath is HB 1011 by Rep. Janet Cruz (D-Tampa) which would require homeowners insurance policies that do not include flood insurance (most don’t) to so declare and would require policyholders to initial that declaration in acknowledgment. The bill and its Senate counterpart, SB 1282 by Senator Taddeo (D-Miami) were filed in December and prompted by two realities: upwards of 60% of Irma’s damage here was caused by water and up to 80% of Florida flood victims may not have either NFIP or private flood coverage. Insurance Commissioner Altmaier told legislators one month post-Irma that he believed flood losses alone in Florida could exceed $4.5 billion and that certain areas of the state could see flood losses that exceed wind losses.

Florida Hurricane Cat Fund – HB 97 by Rep. David Santiago (R-Deltona) adds an additional 10% charge to an insurer’s reimbursement premium with the money going to the Division of Emergency Management to fund a wind and flood mitigation program for residential structures. Additionally, a 5% rapid cash build-up factor, progressing to 15%, would be in place until the fund balance reaches $10 billion. It also contemplates OIR levying an emergency assessment to cure certain deficits in the fund. The bill revises reimbursements the SBA must make to insurers to add a 25% and 60% level of insurer’s losses from each covered event in excess of the insurer’s retention and the overall contract year obligation. So far, this bill is stalled. SB 1454 by Senator Brandes (R-St. Petersburg) has key similarities but would eliminate the rapid cash build-up factor. The factor was created by the legislature in 2002, raised to 25% in 2006, repealed in 2007, and re-introduced in 2009 at 5%, and increased in increments of 5% per year until it reached its current level of 25% in 2013. The elimination of this “hurricane tax” as it is described will reduce rates approximately 4% but may be offset by other rate increase drivers like the assignment of benefits.

Property Insurance – Filed by Senator Lee on the Friday before Session began, SB 1652 would prohibit property insurers who fail to make inspections within 45 days of notice of claim from denying or limiting payments for certain hurricane-related claims under certain circumstances. It also restricts insurers from requiring proof of loss and requires all these changes be added to Florida’s Homeowner Claims Bill of Rights and provided to the policyholder. The bill also requires property owners to disclose the sinkhole report in lease or lease/purchase agreements when an insurance claim has been paid for sinkhole damage. It has no House companion bill.

Florida Building Commission – The Florida Building Commission, which oversees state building codes – some of the toughest in the nation due to Florida’s susceptibility to hurricane damage – would be downsized under HB 299 by Rep. Stan McClain (R-Ocala), who is a residential contractor. The bill would cut the board more than in half, from 27 to 11 members, removing representation from several sectors in the building industry. The bill removes members representing: air conditioning, mechanical or electrical engineering, county code enforcement, those with disabilities, manufactured buildings, municipalities, building products, building owners/managers, the green building industry, natural gas distribution, the Department of Financial Services, the Department of Agriculture and Consumer Affairs, the Governor appointee as chair, and reduces from three members to one municipal code enforcement official and would no longer require a fire official. The bill also changes the qualifications of the architect member, removing the requirement of actively practicing in Florida. Rep. McClain said the bill is meant to remove any Commission members that aren’t directly involved in the building process but that he’s open to suggested changes. An amendment that would have removed the insurance representative was withdrawn this fall. HB 299 would leave the Commission comprised mostly of contractors. The bill is on its way to its last stop at the Commerce Committee but has no Senate companion.

Property Tax Exemption for Generators – Designed to help those who want to help themselves the next time a big hurricane or other calamity hits and the power goes out, SJR 974 by Senator Jeff Brandes (R-Pinellas) would place a constitutional amendment on the 2018 ballot for voters to consider a property tax exemption for the just value of a permanently installed stand-by generator system when assessing annual property taxes; a companion bill SB 976 (Brandes) would implement the measure.

Contractors Without Insurance – HB 89 by Rep. Ross Spano (R-Riverview) requires that contractors lacking public liability insurance shall be personally liable to a consumer for damages that having the proper insurance would have covered. The bill passed the Civil Justice & Claims Subcommittee in early November but has two more stops. Its Senate companion SB 604 by Senator Greg Steube (R-Sarasota) hasn’t had a hearing in any of its three committees yet.

Trade Secrets in Public Records – HB 459/HB 461 by Rep. Ralph Massullo (R-Beverly Hills) were filed in October following House Speaker Richard Corcoran’s press conference about his objection to state agencies who claim trade secret to shield contract and vendor information. Corcoran said that agencies should not be entitled to trade secret privileges if they “spend one penny of taxpayers’ dollars.” HB 459 repeals over 75 public records exemption references in current law, including the trade secret process used in the insurance code, Section 624.4213, Florida Statute. Interestingly, a “sister” bill to HB 459, HB 461 appears to re-enact a new trade secret process that is not unlike current law regulating insurance entities use of trade secrets now. So in essence, HB 459 repeals the current insurance entity trade secret practice and HB 461 restores it. Much of this is procedural and we will follow this closely. HB 459 and HB 461 are stalled. HB 459 has companion SB 956 and similar bill SB 958 (both filed by Senator Mayfield in November) and HB 461 has a similar bill in SB 958.

Insurance Rates – Like he’s tried to do with AOB, SB 258 by Senator Farmer would prohibit insurance companies from including the costs of attorney fees paid in losing cases into their rate base or future rate requests in Workers’ Compensation and Life policies. Farmer’s similar bill in the 2017 session failed. SB 258 has been referred to the Committees on Banking and Insurance, Appropriations, and Rules but has not been scheduled to be heard. It is stalled and has no House companion.

Insurance Reporting – Filed by Senator Farmer on the Friday before Session began, SB 1668, follows the same bent as his previous bills on verifying insurance litigation costs. It would require insurers filing rates with the Office of Insurance Regulation provide specified information and projections relating to claim litigation in their rate filings. This includes litigation costs and total dollar value of denied or limited claims where either party prevailed (insurer or insured) and those claims that reached settlement, along with attorney fee breakdowns for all parties. This information would be culled from the year prior to the rate filing, as well as projected costs for the following year. It has no House companion bill.

Direct Primary Care – SB 80 by Senator Lee, allows doctors to enter into monthly fee for service arrangements directly with individuals or employers, essentially bypassing health insurance organizations. Informally dubbed “concierge medicine for the masses”, the bill passed by unanimous votes in October out of the Banking and Insurance, as well as the Health Policy Committees and awaits action in the Appropriations Committee. SB 80 has a companion bill in the House (HB 37) by Rep. Burgess which passed the House Health and Human Services Committee unanimously in November – it’s only stop – and now awaits to be taken up by the full House, possibly as early as this Thursday.

Health Insurer Authorization – CS/SB 98 by Senator Steube passed unanimously out of the Senate Judiciary Committee in December. It and companion bill HB 199 by Rep. Shawn Harrison (R-Tampa) would prohibit prior authorization forms from requiring information not necessary to determine the medical necessity or coverage for a treatment or prescription. The bills would also require health insurers and their pharmacy benefits managers to provide requirements and restrictions on prior authorizations in understandable language and to make them available on the internet, along with a 60-day notice of any changes. There has been public question whether the House will take this up as it’s still awaiting its first hearing. Senator Steube is also sponsoring SB 162 that would prohibit health insurers and HMOs from retroactively denying insurance claims under certain circumstances. The bill passed unanimously out of the Senate Banking and Insurance Committee in December and now goes to the Health Policy Committee.

Flood Insurance and Mitigation – SB 158 by Senator Jeff Brandes (R-St. Petersburg) provides greater funding for flood mitigation so that more individuals and communities can meet NFIP flood insurance standards. The bill would allow flood mitigation projects to be funded by the Florida Communities Trust to reduce flood hazards. Senator Brandes has for the past 5 years taken the lead in Florida in the flood insurance arena. The bill has been referred to the Committees on Environmental Preservation and Conservation, Appropriations, and the Appropriations Subcommittee on the Environment and Natural Resources but has not been scheduled to be heard. An identical House companion, HB 1097 by Rep. Cyndi Stevenson (R-St. Augustine) was filed in later December.

Insurance Credit Scoring and Redlining – SB 414 by Senator Farmer would ban the use of credit scores as a determining factor in calculating auto insurance premiums. Currently, insurers are permitted to use a customer’s credit history as a justification for higher insurance rates. Statistically, drivers with poor credit scores pay more and according to Farmer “the use of credit scores as a determining factor for auto insurance rates has been found to disproportionately affect minority populations, with African American and non-white Hispanic policyholders often paying higher premiums, and is not a reliable indicator for increased risk.” Similarly, SB 410 would prohibit the use of zip codes as a determining factor in calculating auto insurance premiums, which Farmer called “de facto discrimination.” HB 659, which passed and became law in 2016, allows single zip code rating territories if they are actuarially sound and the rate is not excessive, inadequate, or unfairly discriminatory. Neither SB 414 nor SB 410 have had a hearing yet, and with no House Companion, their future is very uncertain.

Patient’s Choice of Providers – Dubbed the “Patient’s Freedom of Choice of Providers Act”, HB 143 by Rep. Ralph Massullo (R-Beverly Hills) prohibits a general health insurance plan from excluding willing and qualified health care provider from participating in a health insurer’s provider network so long as the provider is located within the plan’s geographic coverage area. The bill has been referred to the Health Innovation Subcommittee, but has stalled. There is a Senate companion, SB 714, which is also stalled.

Telehealth – SB 280 by Senator Aaron Bean (R-Fernandina Beach) is part of a continued effort to put remote health practitioner visits via the internet on an equal footing as in-office visits, in order to reduce health costs and provide parity of care to rural patients. A state panel in 2016 executed a list of legislative directives to help smooth the kinks and establish recommended procedures to help make this bill a reality. SB 280 would establish the standard of care for telehealth providers; encourage the state group health insurance program to include telehealth coverage for state employees; and encourage insurers offering certain workers’ compensation and employer’s liability insurance plans to include telehealth services. The bill has been referred to the Banking and Insurance; Health Policy; and Appropriations Committee, as well as the Appropriations Subcommittee on Health and Human Services, but no hearing has yet been scheduled. A companion, HB 793 by Rep. Massullo, was filed in late November and has been referred to the House Health Quality Subcommittee and the Health and Human Services Committee.

Texting While Driving – Moving Florida’s current ban on texting while driving from a secondary offense (where you can be ticketed during a traffic stop made for another reason) to a primary offense got a big boost in December, with House Speaker Richard Corcoran lending his support to newly filed HB 33 by Rep. Jackie Toledo (R-Tampa). First-time violators would face a $30 fine plus court costs for a non-moving violation. Second-time offenders would face a $60 fine plus court costs with a moving violation. Those involved in crashes or texting in school zones face additional penalties. Like SB 90 by Senator Keith Perry (R-Gainesville), this bill requires the officer notify the driver of the constitutional right not to have their cellphone examined by authorities. HB 33 has a hearing this Wednesday before the House Transportation & Infrastructure Subcommittee. SB 90 is scheduled for Thursday before the Senate Transportation Committee.

Controlled Substances – Florida has seen a huge increase in accidental drug overdose deaths. A recent report by the FDLE’s Medical Examiners Commission found the total number of drug-related deaths rose 22% from 2015 to 2016. The number of opioid deaths were up 35%, where opioids were either the cause of death or present in the decedents. And this whopper: deaths from the especially dangerous synthetic opioid fentanyl rose 97%. In fact, the report showed death from almost all kinds of drugs, prescription, street drugs, and alcohol – were all up. Deaths by cocaine jumped 83%. The Senate Health Policy Committee held a November hearing on the issue.

Last week, Senator Jose Javier Rodriguez (D-Miami) wrote to Florida Attorney General Pam Bondi asking for the status of her previously announced multistate investigation into potentially unlawful practices by drug companies in the distribution, marketing, and sales of opioids, because no updates have been forthcoming.

Proclaiming that opioids are “ravaging families and communities” in Florida, Senator Lizbeth Benacquisto (R-Ft. Myers) has filed SB 8 which would restrict opioid supply to three days for standard prescriptions but would allow doctors up to a seven-day supply in certain medical cases. Additionally, it provides for more continuing education for responsibly prescribing opioids and requires participation in the Prescription Drug Monitoring Program by all healthcare professionals that prescribe opiates. It comes on the heels of President Trump’s declaration of a national health emergency over opioid abuse. One of our readers sent us this research published in the Journal of the American Medical Association showing that states with any kind of medical marijuana law had a 25 percent lower rate of death from opioid overdoses than other states. The bill is scheduled to be heard this Wednesday by the Senate Health Policy Committee. A similar bill in the House (HB 21) by Rep. Jim Boyd (R-Bradenton) is still awaiting hearings before the Health Quality Subcommittee, the Appropriations Committee and the Health and Human Services Committee.

Meanwhile, insurers in December announced that they are seeking reimbursement for the high cost of opioid addictions: Opioid Pain Treatment Addiction Costs Workers’ Comp Carriers, Health Insurers Billions

Autonomous Vehicles – HB 353 by Rep. Jason Fischer (R-Jacksonville) authorizes the use of vehicles in autonomous mode. The autonomous technology would be considered the human operator of the motor vehicle and provides that various provisions of law regarding motor vehicles such as rendering aid in the event of a crash do not apply to vehicles in autonomous mode where a human operator is not physically present as long as the vehicle owner promptly contacts law enforcement. The bill also addresses the applicability of laws regarding unattended motor vehicles and passenger restraint requirements as they relate to vehicles operating in autonomous mode where a human operator is not physically present in the vehicle. The bill unanimously passed the House Transportation and Infrastructure Subcommittee in November and is awaiting a hearing before the Appropriations Committee. A Senate companion (SB 712) by Senator Brandes was filed in November and referred to the Transportation, Banking and Insurance, and Rules Committees.

Helpful Links:

New Data on AOB Abuse Outlines Real Problem in Florida

A retiree’s personal story on “The AOB Trap” reveals the true consumer impact

Assignment of Benefits (AOB) reform is again a big issue before the legislature this session, but what progress will be made toward enacting meaningful reforms remains very uncertain, given the differences between the House and Senate versions of bills (regarding attorney fees) outlined in this issue’s Bill Watch and the philosophical bents of key leadership. One point that is beyond debate though is that AOB abuse is an explosive epidemic in Florida, with new year-end 2017 information that paints a dismal picture for policyholders and insurers.

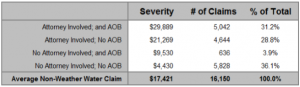

Citizens Property Insurance Corporation, the state government-created insurer of last resort, added more than 50,000 policies in the first ten months of 2017, after four years of successful depopulation with the private market absorbing those policies. Citizens President and CEO Barry Gilway noted at the company’s recent board meeting that Florida’s private domestic insurance market’s combined ratio and surplus have declined, with the majority of those companies experiencing negative net income for the first time in five years. The culprit: a rising number of lawsuits, many with AOBs, and a resulting higher net claim payout. Citizens is suffering as well. This chart at right that Gilway showed his board shows Citizens’ non-weather water claims cost is higher when AOBs or attorneys or both are involved.

Citizens Property Insurance Corporation, the state government-created insurer of last resort, added more than 50,000 policies in the first ten months of 2017, after four years of successful depopulation with the private market absorbing those policies. Citizens President and CEO Barry Gilway noted at the company’s recent board meeting that Florida’s private domestic insurance market’s combined ratio and surplus have declined, with the majority of those companies experiencing negative net income for the first time in five years. The culprit: a rising number of lawsuits, many with AOBs, and a resulting higher net claim payout. Citizens is suffering as well. This chart at right that Gilway showed his board shows Citizens’ non-weather water claims cost is higher when AOBs or attorneys or both are involved.

Gilway said because of that AOB abuse, combined with the impacts from last September’s Hurricane Irma, he expects Citizens will grow by around 66,000 policies in 2018. That, of course, will place additional potential burdens on the taxpayers of Florida, should there be a big event requiring premium assessments. The AOB problem prompted ratings firm Demotech to change its rating criteria for Florida insurers and reports that carriers it rates added $355 million in additional reserves and surplus in 2017 to avoid a ratings downgrade. Insurance Commissioner David Altmaier warns that annual recent 10% rate increases on homeowners insurance policies in Florida could become the norm.

Today, property insurance companies are bleeding surplus as a result of AOB –driven lawsuits and the ultimate drive for attorney fees. About a dozen law firms, exposed in numerous public hearings, have a laser focus to partner with vendors who use AOBs when either canvassing neighborhoods for work or responding to a policyholder’s call for help when water damage or other home repair problems occur.

One recent victim is Ft. Myers retiree Sandra Carlstrom, who fell into what I call “The AOB Trap”. She responded to a flyer in her mailbox from a contractor offering repairs to her roof and interior from water and wind damage from Hurricane Irma. He wanted to charge $191,000 for a roof replacement that should cost $30,000. We sat down with Sandra and her daughter Kirsten to talk about their tale of terror on this past week’s Florida Insurance Roundup podcast. Three months later, no repairs have been made and worse, Sandra’s been threatened with a lawsuit and lien on her house by the contractor – all because of an Assignment of Benefits contract she signed with him. I urge you to listen to this podcast conversation and review the additional statistics it provides on this important issue to Florida insurers and consumers. Please let us know if you have additional questions.

Nationwide Survey: Florida Courts Are the Biggest Loser

AOB abuse and court-mandated attorney fees play key role

The American Tort Reform Association is out with its annual survey of legal climates in the fifty states and this year Florida has risen to the top spot for litigation abuse for the first time in the report’s 16 year history. The Judicial Hellholes report notes the Florida Supreme Court’s “liability-expanding decisions and barely contained contempt for the lawmaking authority of legislators and the governor” have always ranked Florida high in the report, but recent 2017 court decisions, along with growing AOB abuse, have put the Sunshine State on top of the heap.

The American Tort Reform Association is out with its annual survey of legal climates in the fifty states and this year Florida has risen to the top spot for litigation abuse for the first time in the report’s 16 year history. The Judicial Hellholes report notes the Florida Supreme Court’s “liability-expanding decisions and barely contained contempt for the lawmaking authority of legislators and the governor” have always ranked Florida high in the report, but recent 2017 court decisions, along with growing AOB abuse, have put the Sunshine State on top of the heap.

Among those decisions:

- Information about adverse medical events that healthcare providers voluntarily share with patient safety organizations can be obtained by plaintiffs’ lawyers and used in litigation.

- The legislature could not maximize recoveries for injured patients by limiting attorney fees in malpractice claims against public hospitals. (The Court ruled that a law firm was constitutionally entitled to take 25% of a client’s $15 million recovery.)

- The state’s limit on noneconomic damage awards in medical liability cases was invalid.

- The Court invalidated a state law enacted to place plaintiffs and defendants on level ground when initially evaluating the merits of medical malpractice allegations and thus encourage settlement of valid claims without the need for litigation.

- Arbitration agreements between patients and doctors are void and violate public policy unless the agreement mirrors provisions included in Florida’s Medical Malpractice Act.

The uptick in Assignment of Benefits (AOB) abuse in Florida also receives coverage in the report, along with legislative leadership. It notes “some attorneys and contractors then use these agreements to inflate pricing, perform unnecessary repairs to homes following a storm, for example, and then sue insurers when the exorbitant charges are questioned.” The report also cites Florida’s PIP (Personal Injury Protection) Auto Insurance fraud, especially in South Florida. Readers of the LMA Newsletter will remember the September arrest of five South Florida personal injury lawyers for their alleged role in a $521,000 PIP fraud ring.

The report was the subject of a recent Wall Street Journal editorial, which concluded that “Florida has become a haven for taxpayers tired of being fleeced by politicians, but people may stop coming if they keep getting pick-pocketed by plaintiff attorneys.”

New Report Shows Increase in Workers’ Comp Legal Fees

Lagging increase expected to put upward pressure on insurance rates

The Florida Supreme Court’s 2016 decisions on Workers’ Compensation cases is also cited for a sizeable increase in legal fees reported over the past two years, according to a state report. The Office of the Judges of Compensation Claims annual report shows injured workers received in total $186 million in overall approved legal fees in 2016-2017, a 36% increase over the prior year. It’s the highest amount paid in almost a decade and a sign of things to come.

In April 2016 the state Supreme Court ruled that the legislatively-set mandatory attorney fees schedule was unconstitutional and a violation of a worker’s due process rights to secure the best attorney possible, in a system that is largely self-executing when there is a claim. That ruling was the basis for a 14.5% increase in workers’ comp rates in Florida for 2017, anticipating these higher attorney fees.

Florida enacted its current fee cap in 2003 to stem years of double-digit rate increases. The report shows that fees paid under that cap decreased 31%. But a growing number of exceptions were granted. In 2016-2017, about $75 million in hourly fees were approved for workers’ attorneys, which is almost a 200% increase from the $26 million paid out in the prior year. The report notes that “clearly there is a trend suggested of increasing claimant attorneys’ fees in the wake of” the 2016 ruling.

The legislature was expected last year to take up attorney fees, including a bill that would have at least limited the hourly rates that attorneys could charge, but failed to pass it. As noted in this issue’s Bill Watch, the legislature is trying again with HB 7009, which eliminates the unconstitutionally ruled fee schedule but puts a cap of $150/hour on plaintiff (workers) attorney fees. Although workers’ comp rates for 2018 have been reduced an average of 9.5%, there is concern in the industry that those decreased rates don’t reflect the lagging cost increases now chronicled in this report.

In addition to the $186 million in approved legal fees for injured workers, the report showed another $254 million was spent by employers defending those workers’ comp claims.

New Year Sees Reduction in Commercial Rent Tax

Modest decrease expected to be the first of many

Florida businesses that rent commercial properties will enjoy a tax decrease in this new year of 2018. The state sales tax on commercial real estate leases (also known as the business rent tax) was reduced from 6.0% to 5.8% effective January 1, due to legislation passed in last year’s session. The reduction does not impact any applicable local option sales tax, which can be as high as 2%. Florida is the only state to impose such a statewide tax, which amounts to $1.7 billion on Florida businesses. The Florida Realtors lead the charge in the business community in what is expected to be the first of several reductions in this tax, potentially leading to its elimination.

Florida businesses that rent commercial properties will enjoy a tax decrease in this new year of 2018. The state sales tax on commercial real estate leases (also known as the business rent tax) was reduced from 6.0% to 5.8% effective January 1, due to legislation passed in last year’s session. The reduction does not impact any applicable local option sales tax, which can be as high as 2%. Florida is the only state to impose such a statewide tax, which amounts to $1.7 billion on Florida businesses. The Florida Realtors lead the charge in the business community in what is expected to be the first of several reductions in this tax, potentially leading to its elimination.

The taxable rent applies to property taxes, as well as payments for services required by the lease, such as utilities, parking, and janitorial services. It doesn’t apply to residential rentals. According to our friends at Thomas Howell Ferguson CPA’s:

“Regardless of when the rent is paid, the state sales tax is due according to the rate in effect when the tenant occupies or has the right to utilize the property. As a result, rent paid on or after January 1, 2018, for a rental period that was in effect before January 1, 2018, is still subject to the state tax rate of 6.0%. Conversely, if rent is paid before January 1, 2018, by a tenant that will receive the privilege or right to utilize that property on or after January 1, 2018, the rent will be taxed at the reduced rate of 5.8%. The rent being taxed by the state rate will still be subject to the county sales surtax, as well.”

As always, if you have questions, be sure to consult with your Certified Public Accountant!

Driver’s License and Blockchain Please!

How new technology is changing how we manage insurance information

For the past several years, insurance interests have been working together as “The Institutes”, an industry educational and research organization tasked with figuring out if and how Blockchain, that mysterious distributed ledger software you’ve no doubt heard about, can work in the insurance marketplace. Now comes word of the debut of a new product that uses Blockchain for proof of automobile insurance.

The product developed by The Institutes is called RiskBlock, a Blockchain network designed for the risk management and insurance industry. Nationwide Insurance is currently in testing mode with the new tool. According to the Insurance Journal, the tool will help companies, policyholders, and law enforcement simplify verification of auto insurance coverage in real time and eliminate the need for paper ID cards.

Blockchain is a distributed ledger software that uses a continuously growing list of records – known as blocks – that don’t rely on a centralized third-party vendor to administer. Instead, each party to a financial or other transaction is networked and has the original and updated versions of the transaction which is contained on many different and anonymous blocks. By its design, it’s advertised as being highly resistant to any data modification by any single participant, once recorded.

So exchanging information at an accident scene, for instance, could be as easy has tapping your phone to the other motorist’s phone or scanning QR codes from each other’s phones. Insurance companies expect to enjoy greater efficiencies in not sending out so much paper via the U.S. mail.

The Institutes have also created the B3i Initiative, which is developing a blockchained reinsurance property excess of loss contract.

Multi-Million Dollar South Florida PIP Fraud Case Wrapping Up

Plus other tales of workers’ comp and annuities fraud

Fraud doesn’t take a break for the holidays, nor do Florida’s dedicated insurance fraud investigators. From just the past three weeks, we have news of the conviction of a ringleader in a $23 million auto insurance chiropractic fraud ring, a construction company owner looking to shave $700,000 off her workers’ comp premiums illegally, and an ex-insurance agent carpetbagger from the North accused of swindling senior citizens.

Fraud doesn’t take a break for the holidays, nor do Florida’s dedicated insurance fraud investigators. From just the past three weeks, we have news of the conviction of a ringleader in a $23 million auto insurance chiropractic fraud ring, a construction company owner looking to shave $700,000 off her workers’ comp premiums illegally, and an ex-insurance agent carpetbagger from the North accused of swindling senior citizens.

Felix Filenger has pled guilty to racketeering conspiracy for his role as one of the ringleaders of a group of medical clinics, chiropractors, and attorneys who operated in the tri-county area of South Florida. The U.S. Attorney’s office says the group would solicit tow truck drivers and mechanics for names and confidential crash reports of automobile accident victims, paying cash kickbacks, and then steering those patients into costly – and often unnecessary medical treatment, right up to the state PIP insurance limits of $10,000 per accident. Five other co-defendants in this and related cases are awaiting trial or sentencing. Total cost of this fraud was $23 million. More here from the Sun Sentinel.

Up the coast in Jacksonville, Maria Cristina Romero Zelaya was arrested for trying to save her company, Miochosis Construction, $700,000 in rightfully owed workers’ compensation insurance premiums by fudging the number of workers employed and the types of construction work performed. State fraud agents say Zelaya reported her annual payroll was $200,000 and her company provided only stucco and plastering services. Yet for a full year, surveillance shows her cashing hundreds of thousands of payroll checks through local cash checking businesses totaling more than $5 million. Her workers’ comp premium of $26,622 should have been $733,549. More here from the Insurance Journal.

And finally from Naples, the tale of the ex-insurance agent from New Jersey who allegedly used Florida as a sort of off-shore bank for his ill-gotten gains. Victor Rennols, formerly with Great American Insurance Group, is accused of selling fake annuities to three New Jersey senior citizens and then traveling to Naples where he had family to cash the checks into his own account. He’s accused of making off with $140,000 and now authorities in Virginia and New York are looking at him for similar criminal activity. More here from this state news release.

The Life of the Community

Remembering those we’ve lost

I think about the hundreds of folks that have descended on Tallahassee this week for our 2018 legislative session and the economic boon it creates for us. But most importantly, as one local long-time reporter said, whenever people talk about what makes Tallahassee special, it’s always the people. It’s the friendliness, the community spirit and the warmth of people.

Each year, new people move to Tallahassee for the legislative session, or relocate permanently, and embrace our local spirit. Often many volunteer their time and talents to local charities, they turn out for events, and they become a part of many, many public meetings. In a nutshell, many participate in the life of this community.

We have lost some very special people this past year and one of those was Representative Don Hahnfeldt from the Sumter/Lake County region, but who was in Tallahassee a lot. He was a great American, a retired Navy submarine commander, but more importantly someone I could go to, to be reminded of what it’s like to live in a democracy and why it’s the best government system in the world. It’s tough losing people that have contributed to America and specifically, Tallahassee, who have spent a lifetime helping building the spirit of our state. We will miss all of them.

Remember that we at Lisa Miller & Associates are just a phone call or email away to help answer your questions about session or challenges you face navigating the process, and of course, your business development needs.

Happy Session,

Lisa