Affordability & availability at issue

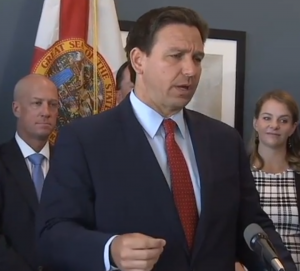

Governor Ron DeSantis

We’re still awaiting this morning the exact dates of next month’s announced special session of the Florida Legislature to address Florida’s increasingly dire homeowners insurance market (the rumor is May 23-27). After weeks of saying he’d leave it up to legislative leaders to call a session, the Governor last Monday did so himself, saying it was time to “bring some sanity and stabilize” Florida’s property insurance market. (For our new readers, see Here’s why Florida’s property insurance market is a dumpster fire by Brian Burgess.)

The next special session comes on the heels of this past week’s special session to re-draw congressional redistricting maps for this fall’s election and a mandatory review of Florida’s independent special taxing districts. The Governor’s announcement came just in the nick of time: Senator Jeff Brandes recent effort to have lawmakers call a session on their own failed. Although he received the required support to poll both chambers, in the end, the majority of lawmakers failed to even respond to the poll by the Secretary of State’s office (only 17 of 40 Senators with 16 voting for a session; and only 52 of 120 Representatives responded with 48 in favor of a session). So what proposals are planned in this next special session?

Roofing and reinsurance are certainly two of the issues being discussed behind the scenes right now. The Senate’s main reform bill in the regular session, SB 1728 had a mandatory 2% roof deductible for roof replacement claims (excepting total losses and hurricane damage) and a series of roof advertisement disclosures to clarify 2021’s SB 76 reform law that a federal judge enjoined from enforcement last summer on free-speech grounds. House leadership nixed the 2% deductible requirement, wanting to make it optional instead (which it already is).

State Senator Jeff Brandes (R-Pinellas County)

With reinsurance renewals right around the corner on June 1 for many insurance companies, look for Senator Brandes to renew his push to lower the retention level of catastrophic losses companies must incur before tapping into the Florida Hurricane Catastrophe Fund. He also wants to suspend the Rapid Cash Buildup Factor, known as the “hurricane tax” on insurance companies that they in turn pass to their policyholders, designed to help the Fund grow. The resulting savings by law would be passed along to policyholders (a point made in our January 3 newsletter story). The investment analytics firm JMP Securities recently reported that “Many primary insurers rely on the availability and affordability of low layers of reinsurance protection – the very layers that have been destroyed by the recent elevated frequency of loss events, which has led to reinsurers running away from these layers as quickly as possible.” Price increases will make reinsurance unaffordable for some companies, the report warned.

Tackling further litigation reform would be helpful, too. Analytics firm CaseGlide reports the 17 largest property insurance companies in Florida saw March claims lawsuits rise 12% over February and Notices of Intent to Litigate increase 24%. The percentage of Assignment of Benefits (AOB) claims continue to increase as well, despite the 2019 reform. We remind readers that Florida has 8% of all homeowners’ claims in the U.S., yet 76% of all homeowners’ claims lawsuits.

House Appropriations Chairman Jay Trumbull (R-Panama City) will be the point-person in the House on these issues. Senate President Wilton Simpson hasn’t revealed his lead person, but look for Senator Jim Boyd (R-Bradenton), an insurance agent, to take a prominent role. He told reporters last week that “In order to get anything done that will make a difference in the market, we’re going to have to address roofs.”

Given the disagreements during regulation session, can the House & Senate come together on a common solution? We humbly suggest during next month’s special session that a “Don’t Say Nay” attitude prevail instead among our 160 elected lawmakers – especially House Speaker Chris Sprowls (R- Palm Harbor) who chose not to hear any of the meaningful insurance bills sent over by the Senate during the final week of the regular session, necessitating yet another session.

LMA Newsletter of 4-25-22