Florida Governor Ron DeSantis, in his recently proposed budget for the 2024/2025 fiscal year, included two of the five steps needed to lower homeowners insurance rates in Florida:

Florida Governor Ron DeSantis, in his recently proposed budget for the 2024/2025 fiscal year, included two of the five steps needed to lower homeowners insurance rates in Florida:

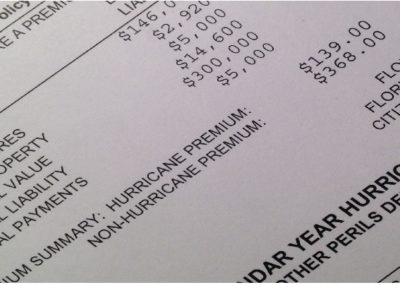

- A one-year exemption of the premium tax that insurance companies would issue as a credit on homeowners insurance bills for policy coverages of $750,000 or less. The tax accounts for about 2% of a premium and would save the average homeowner about $240.

- Eliminating the current 1% assessment on all homeowners policies by the Florida Insurance Guaranty Association (FIGA) that is paying the $1.6 billion in losses from past insurance company insolvencies; instead using the state’s excess general revenue. This represents another 2% of premium costs.

FIGA Director Corey Neal told the Insurance Journal that this “helps consumers by not having to pay the assessment, so that’s a positive. I think it’s a good idea,” adding that the loss of the assessment funding won’t have a big impact on FIGA’s resources at this time.

These two steps, together with an exemption on the State Fire Marshall Assessment, would save Florida policyholders $409 million. The Governor also proposes a permanent exemption of the premium tax on flood insurance policies, amounting to another $22 million in consumer savings or about $160 on average per policy.

But there’s even more that can be – and should be – done to accelerate the homeowners insurance market recovery and mitigate the ongoing rate increases on Florida consumers – some as high as 65% in 2023 and anticipated to grow another 20% to 40% in 2024.

Why are homeowners insurance premiums so high? The simple answer is that in addition to the litigation factories accounting for millions in attorney fees that were paid by higher insurance rates, inflation in the past couple years has caused about 75% of the increase in the amount paid for homeowners insurance by the average Florida homeowner. Walk in any big box hardware and lumber store and note the increased costs of construction materials …as much as 40% since 2017. That tracks with the 45% increase in the average insured value of Florida single family homes. During the same time period, the average annual premium paid by single family homeowners has increased 61%. The difference, about 25% of the price increase, is attributable to increased weather losses, the increased cost of reinsurance, and litigation.

Has litigation contributed to the high cost of homeowners insurance in Florida? Yes. Florida’s litigation rate, according to those analyzing litigation trends, is about 10 times that of other states. And if you listen to any Citizens Property Insurance Corporation claims committee meeting, the numbers are staggering for dollars paid for litigated versus non litigated claims. A litigated claim costs about seven times more than a non-litigated claim and boosted the overall cost of recent hurricane claims by 30% to 50%. Prior to the litigation reforms adopted in 2023, testimony in legislative committees indicated that litigation increased the cost to insurance consumers by 50%.

What else should the legislature do to help Florida’s homeowners? Besides following the Governor’s recommendations to repeal the premium tax and eliminate the FIGA assessment, there are three more steps that can reduce homeowners insurance rates. All have to do with making reinsurance more available and affordable:

- Freeze the attachment point of the Florida Hurricane Catastrophe Fund (FHCF) to its 2023-24 contract year and repeal the rapid cash buildup factor (the “hurricane tax”) charged by the FHCF. Florida insurance companies saw a 40% to 60% price increase in the cost of their reinsurance at the June 1, 2023 renewal, which they passed on to consumers. Reinsurers also generally shifted capacity upwards, above the FHCF attachment point. Insurance consumers will benefit directly if insurance companies can purchase the lower layers of their reinsurance tower at a lower price. Freezing the attachment point will allow insurance carriers to access this much less expensive source of reinsurance and save homeowners money. According to Gallagher Re, reinsurance prices in the upcoming 2024 renewal will be up, so these actions can temper the increase.

- Reauthorize the Reinsurance to Assist Policyholders Program (RAP). In May 2022, the legislature agreed to provide $2 billion of reinsurance coverage to the insurance industry in return for an immediate rate reduction.

- Reduce the attachment point of the Florida Optional Reinsurance Assistance (FORA) to a figure the legislature deems will benefit insurance consumers. This program, passed by the legislature in December 2022, while also intended to reduce reinsurance costs, did not provide the coverage that reinsurers are most unwilling to provide. It was also priced too high (60% or more) when in reality FORA should have been priced at 20% to 35% to bring down reinsurance and ultimately insurance costs. The proposed Florida Insurance Rate Reduction Mechanism (FIRRM) contains many of these concepts.

By providing these three additional steps, the legislature can create more state-backed reinsurance at about 10-15 cents of every premium dollar we pay versus private reinsurance at 35-40 cents of every dollar we pay.

There are some other related questions that may come up during the upcoming 2024 Florida legislative session that are worth addressing.

Are homeowners insurance companies making money in Florida? No. Homeowners insurance companies in Florida have been losing money since 2016. This has caused well-known companies like Progressive, Farmers, and Castle Key (a subsidiary of Allstate) to cancel hundreds of thousands of policies. These losses have also caused nine companies in the last three years to go bankrupt and left the people of Florida to pick up $1.6 billion in claim losses that the insolvent companies are unable to pay.

Are Florida homeowners insurance companies hiding money in their subsidiaries or affiliates? No. Every transaction between a Florida homeowners insurance company and a subsidiary or affiliate requires approval by the Office of Insurance Regulation (OIR). A summary of the annual flow of money between a company and its subsidiaries or affiliates is reported on the insurance company’s annual financial statement which is filed under oath and is publicly available. The OIR requires all subsidiaries and affiliates of Florida insurance companies to file audited financial statements with the Office. Owners of 10% or more of a Florida insurance company are required to file financial disclosure information with the OIR.

Did the legislature make it harder to sue an insurance company in 2022? No. The legislature changed the way attorneys are paid when they file a claim against a homeowners insurance company. In most cases, attorneys will be paid from the amount of money paid for damage to a home. This is the same way that a public adjuster is paid. It’s like the way in which attorneys are paid after an auto accident or other liability claim. In those cases, attorneys are paid from the amount of the settlement. Under prior law, attorneys who sued a homeowners insurance company were paid their fees in addition to the amount of money paid to the homeowner. Florida was the only state in the United States that paid attorneys who sued homeowners insurance companies in that way.

While the 2022 and 2023 insurance market reforms passed by the legislature take time to become effective in all policies, there is much that the 2024 Florida Legislature can do to provide more immediate and needed rate relief for Florida homeowners.