THE FLORIDA INSURANCE ROUNDUP PODCAST

The Florida Insurance Roundup podcast from Lisa Miller & Associates, is your program on the people, issues, and regulations shaping Florida’s Insurance Market. It’s the only podcast devoted exclusively to Florida insurance issues. Lisa, a former deputy insurance commissioner, brings you the latest developments in Property & Casualty, Healthcare, Workers’ Compensation, Litigation, and Surplus Lines insurance from around the Sunshine State. She is a nationally-recognized disaster insurance and recovery expert who devotes a percentage of her time to volunteer advocacy helping consumers. There is a Listener Call-In Line for your recorded questions and comments to air in future episodes at 850-388-8002 or you may send email to [email protected]

The Florida Insurance Roundup was named to the “Top 20 Insurance Law Podcasts You Must Follow in 2023,” by Feedspot, an internet content reader service that ranks blogs, podcasts and YouTube channels in several niche categories.

The opinions, beliefs and viewpoints expressed during The Florida Insurance Roundup podcast are solely those of the individuals and guests involved, and do not necessarily represent the opinions, beliefs and viewpoints of Lisa Miller & Associates, LLC or its affiliates. The information, opinions, beliefs, and viewpoints are based on personal experiences and information the host and guest participants consider reliable, but neither Lisa Miller & Associates, LLC nor its affiliates warrant for completeness or accuracy, and it should not be relied upon as such. © Copyright 2017-2024 Lisa Miller & Associates, All Rights Reserved

Subscribe:

Email RSS iTunes Android Google Podcasts Spotify![]() Pandora

Pandora![]() Amazon

Amazon![]() Audible

Audible

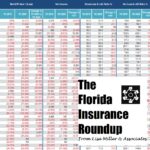

| Episode 49 – When Insurers Exit | 4-19-24 | Listen/Read More |

| Episode 48 – 2024 Legislative Roundup | 3-11-24 | Listen/Read More |

| Episode 47 – Stress & Strain of Adjusting | 2-23-24 | Listen/Read More |

| Episode 46 – Insurers: Know the Building AND The Board | 11-2-23 | Listen/Read More |

| Episode 45 – Insurance Claim Estimates Change & Are Supposed to! | 6-1-23 | Listen/Read More |

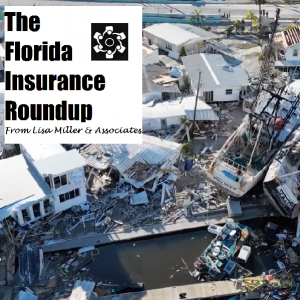

| Episode 44 – Dynamic Duo: Ian Hit Hard | 5-14-23 | Listen/Read More |

| Episode 43 – Future of Florida Insurance Litigation | 2-14-23 | Listen/Read More |

| Episode 42 – Barry Gilway: Florida's New Law is a Profound Change | 12/29/22 | Listen/Read More |

| Episode 41 – Special Session Preview | 12/2/22 | Listen/Read More |

| Episode 40 – Hurricane Ian: Was the Damage Flood or Wind? | 10/30/22 | Listen/Read More |

| Episode 39 – Take Care of the Insurance Customer: Job One | 9/1/22 | Listen/Read More |

| Episode 38 – New Property Insurance Reforms | 6/22/22 | Listen/Read More |

| Episode 37 – Special Session on Property Insurance | 5/4/22 | Listen/Read More |

| Episode 36 – A Conversation with Real Estate Agents about Property Insurance | 2/11/22 | Listen/Read More |

| Episode 35 – Florida Legislative Preview 2022 | 12/21/21 | Listen/Read More |

| Episode 34 – Legal Challenges to SB 76 | 10/26/21 | Listen/Read More |

| Episode 33 – Condo Underwriting & Presuit Settlements | 08/30/21 | Listen/Read More |

| Episode 32 – Defense Attorneys’ Take on SB 76 | 06/23/21 | Listen/Read More |

| Episode 31 – Property Insurance Reform | 05/23/21 | Listen/Read More |

| Episode 30 – Florida’s Property Insurance Dilemma | 03/26/21 | Listen/Read More |

| Episode 29 – 2021’s Insurance Consumer | 12/20/20 | Listen/Read More |

| Episode 28 – Our Cities Are Flooding | 07/26/20 | Listen/Read More |

| Episode 27 – Coronavirus Insurance Challenges | 05/03/20 | Listen/Read More |

| Episode 26 – AOB Reform: Did Consumers Win? | 02/02/20 | Listen/Read More |

| Episode 25 – Florida Legislative Preview 2020 | 01/10/20 | Listen/Read More |

| Episode 24 – Making the Call on Flood Insurance | 11/24/19 | Listen/Read More |

| Episode 23 – Mediating Open Claims | 10/31/19 | Listen/Read More |

| Episode 22 – Why the Panhandle Wasn’t Hurricane Strong for Michael | 09/15/19 | Listen/Read More |

| Episode 21 – Is Florida’s Building Code Protecting All of Us? | 08/31/19 | Listen/Read More |

| Episode 20 – Wind vs. Earthquake: Who Wins? | 07/31/19 | Listen/Read More |

| Episode 19 – New AOB Law: Putting Consumers on Offense | 05/13/19 | Listen/Read More |

| Episode 18 – The AOB Problem | 04/05/19 | Listen/Read More |

| Episode 17 – Florida Legislative Preview | 02/28/19 | Listen/Read More |

| Episode 16 – Flood Follies | 12/16/18 | Listen/Read More |

| Episode 15 – Active Shooter Insurance | 11/26/18 | Listen/Read More |

| Episode 14 – Hurricane Michael’s Construction Lessons | 10/26/18 | Listen/Read More |

| Episode 13 – Insurance Nerds | 08/08/18 | Listen/Read More |

| Episode 12 – The Prize in Real Estate | 06/06/18 | Listen/Read More |

| Episode 11 – Driving Blockchain Home | 04/17/18 | Listen/Read More |

| Episode 10 – Modeling for School Shootings | 04/03/18 | Listen/Read More |

| Episode 8 – National Flood Insurance Reform | 12/07/17 | Listen/Read More |

| Episode 7 – Irma’s Claims Challenge | 09/15/17 | Listen/Read More |

| Episode 6 – Citizens Managed Repair Program | 08/21/17 | Listen/Read More |

| Episode 5 Part Two – Growing Florida’s Private Flood Market | 07/16/17 | Listen/Read More |

| Episode 5 Part One – Growing Florida’s Private Flood Market | 06/20/17 | Listen/Read More |

| Episode 4 – Legislative Session Roundup | 05/09/17 | Listen/Read More |

| Episode 3 – Bad Faith | 04/25/17 | Listen/Read More |

| Episode 2 – The Abusive Roofer | 04/07/17 | Listen/Read More |

| Episode 1 – Beating Back Flood Rates | 03/05/17 | Listen/Read More |