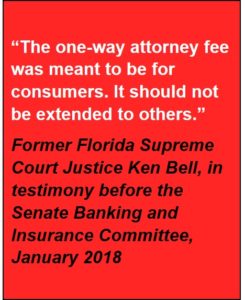

Under an Assignment of Benefits (AOB) contract, unsuspecting consumers are being duped into signing away all their insurance policy rights to a third-party repair or renovation contractor. When the contractor submits their often inflated claim to the insurance company and the insurer refuses to pay it – the contractor sues, aided by lawyers able to game Florida’s one-way attorney fees and bad faith laws to collect all their attorney fees.

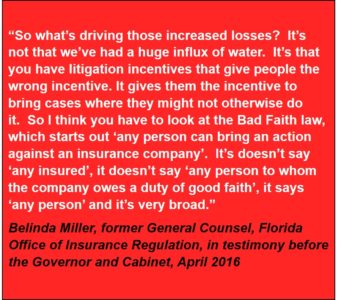

2019 legislative reforms are giving way to 2020 scheming by contractors and their lawyers using new tactics to try to get around the reforms. AOB automobile windshield abuse – not included in the 2019 reforms – is also a continuing problem for unsuspecting consumers. Insurance litigation reform is also needed. These include abuses of Florida’s one-way attorney fee statute, contingency fee multipliers, and bad faith statute.

Orlando Contractor Timothy Cox, arrested in June 2018 for a multi-county, multi-state AOB fraud and racketeering ring. Click here for his story

Jacksonville Contractor Wyatt Green, arrested in April 2019 for AOB fraud and forgery, and later charged with multiple grand theft counts. Click here for his story

The so-called “Johnny Appleseed of AOB Litigation” Orlando attorney Harvey Cohen. Click here to watch his pitch to contractors for business

It’s a vicious and costly game, where insurance companies settle frivolous lawsuits only because it’s cheaper than going to trial. AOB abuse has created an additional $1 billion of inflated insurance claims over recent years – costs eventually passed along to all homeowners through higher rates.

The 2019 Florida Legislature passed HB 7065 (now Florida Law Chapter 627.7152) which addresses the explosion of property insurance AOB lawsuits over the past decade – up 900% from 2008-2018 and up 8,000% when you include automobile glass AOB suits. It seeks to reduce the incentives fueling litigation and the “racket” as Governor DeSantis described it, that AOBs have become among contractors and trial lawyers.

While the new law enacted important reforms addressing AOB abuse in homeowners insurance claims, it did not address similar abuse in automobile insurance claims. The 2020 Legislature briefly considered, then shelved several bills that would have helped do just that (read our last 2020 Bill Watch). In February 2020, Florida insurance regulators issued a data call to help determine the state of the insurance market, pre-and post-reform. Read the 2021 Bill Watch.

Lisa Miller & Associates has been telling the story of AOB and litigation abuse through the policyholders, making sure legislators listen, calling out the bad actors, educating consumers and the news media, and helping insurance companies develop managed repair programs to help their policyholders find the most competent contractors who guarantee their work and don’t file bogus claims. And as always, we’re keeping our clients updated by the minute on any developments, including how Florida’s new AOB law may be exploited. Please check out our efforts and resources below.

At Lisa Miller & Associates, we have a passion for policy and client success. Put Our Passion to Work for You – Give Us a Call Today!

“I’m writing you this to let you know that I really appreciate all your assistance. It took me a while but I finally figured out that our attorneys were not working in our best interest. It’s very sad to think that after all this time and a ruined home, I’m more unhappy with our attorneys than the insurance companyI!!” Annette Ridley, Hurricane Michael survivor, Lynn Haven, FL – January 14, 2020.

Lisa Miller is also a featured panelist on this summer’s Demotech 2020 Storm Season webinar series on Florida’s homeowners property insurance market woes: June 16, 2020 webinar | August 18, 2020 webinar | October 13, 2020 webinar (click here to sign up) | December 1, 2020 webinar (click here to sign up)

A November 2019 Auto Glass AOB Data Update from the Florida Justice Reform Institute shows growth from about 400 auto glass AOB lawsuits in 2006 to 24,000 in 2017. While 2018 and 2019 leveled-off to about 17,000 suits each year, abuse is still rampant. Orange (Orlando) and Hillsborough (Tampa) Counties are the most popular spots for such litigation, with 15 firms accounting for 90% of the litigation. One firm (Malik Law) is responsible for filing nearly 30% of all lawsuits.

Learn how new tools and analytics are revealing hidden costs and changing the approach to solving Florida’s AOB abuse in 2018 and beyond.

Listen to a desperate conversation between husband and wife homeowners and their insurance company before the 2019 reform took effect :

Lisa Miller hosts The Florida Insurance Roundup podcast, regularly featuring the latest developments in insurance defense and helping consumers by raising awareness of AOB abuse so they don’t fall prey to the litigation explosion.

Listen to AOB Reform: Did Consumers Win? podcast (February 2020)

Listen to the Mediating Open Claims podcast (October 2019)

Listen to New AOB Law: Putting Consumers on Offense (May 2019)

Listen to The AOB Problem (April 2019)

Listen to Citizens Managed Repair Program podcast (August 2017)

Listen to The Abusive Roofer podcast (April 2017)

Listen to Bad Faith podcast (April 2017)

Watch ABC Action News Tampa story on AOB Abuse of Homeowner (March 2018) before the 2019 reform took effect

Watch Lisa’s interview with Tampa Bay homeowner Bill Poulos on his AOB experience (November 2017) before the 2019 reform took effect

Lisa’s Blog: How a $41,000 Plumbing Leak Turned Into a $1.2 Million Attorney Fee, March 12, 2020

Lisa’s Blog: Key AOB Reform Effective Immediately, May 24, 2019

Lisa’s Blog: AOB, Regulators & the Courts – Are we looking a gift horse in the mouth?, September 24, 2018

Lisa’s Blog: The Death of AOB Reform, May 18, 2017

Lisa’s Blog: AOB Reform Needed Now in Florida, March 24, 2017

Lisa talks with Rep. Rene “Coach P” Plasencia outside the Florida House chambers about the AOB bill (April 2017)

Lisa educating a community leader about AOB (November 2017)

Media Coverage of LMA Efforts on AOB & Insurance Litigation

- “Try as we might with AOB reform […] the real problem is that we have this idea that the minute you file a claim, you file a lawsuit,” Miller said. Looking ahead, Citizens could act as a bellwether for other Florida market participants, as claims related to hurricanes Michael and Irma continue, Miller said. Irma Lawsuits Continue In Run-Up to Hurricane Season, Trading Risk, June 23, 2020

- Lisa Miller, a former deputy insurance commissioner who now runs an insurance-focused consultancy firm, said insurers aren’t equipped to withstand the volume of lawsuits. “The red ink all over the financials of these insurance companies is dire,” she said. “It’s going to continue to hurt our consumers unless we do something about it.” Watch Out, Homeowners. Your Insurance Rates Are About to Jump, Sun-Sentinel, February 15, 2020

- Regarding the 20 percent of water claims that Edison officials said are filed by third party legal representatives, such as attorneys or public adjusters, Miller said: “Why on earth would others be filing claims other than the homeowner if it wasn’t driven by the need for fees — and greed?” She added, “We’re out of control in this state. Double-digit rate increases are going to happen again.” Home Insurer Seeks $30 a Month Average Statewide Price Hike, Sun-Sentinel, December 30, 2019

- “There’s no substitute for face to face. You can email, you can talk by phone. But to sit down with and talk with someone and sort things out is really the way to negotiate,” said Lisa Miller, Insurance Consultant. CFO Holds Insurance Villages, October 12, 2019

- “I’m puzzled why lawyers who say they have their consumers’ best interest at heart encourage people to file a claim that 33 cents of every dollar goes in that lawyer’s pocket,” said Lisa Miller, a consultant to carriers and former Florida deputy insurance commissioner. Hurricane Michael destroyed their homes. Then the insurance heartache began, Tampa Bay Times, June 26, 2019

- Lisa also warned of abuses taking place by some contractors who are pushing Assignment of Benefits (AOB) contracts on insurance policyholders. She explained that by signing an AOB, a homeowners is literally signing over the rights to their entire insurance policy claim to the contractor or vendor. She warned that AOBs are used as a tool to do nefarious things. Hurricane Insurance and Rebuilding After Hurricane Michael, WFLA-FM, October 18, 2018

- Miller said to be careful of what the conditions are in the contracts you are asked to sign. “If you see a sentence that says, ‘I hereby assign all my rights of this policy to this vendor,’ do not sign it,” Miller said. Few Hurricane Michael insurance claims filed yet, News4Jax, October 12, 2018

- “We never had AOB in the claims paying process and all of a sudden it’s become the Holy Grail in getting a claim paid?” she challenged, citing Florida’s one-way attorney fees law that has encouraged abuse in the tremendous increase in AOB lawsuits over the years, without major weather events. Lisa Miller on Insurance Claims Advice Post-Hurricane Michael, WFSU-FM, October 12, 2018

- “It’s hard for our elected officials to believe that our insurance companies are trying to do the right thing,” added panelist Lisa Miller, a former deputy insurance commissioner and CEO of Lisa Miller & Associates, a governmental affairs firm. “But those companies are doing right every day by their policyholders. Legislators have a hard time believing this is a problem.” Changing the Approach to Solving Florida’s Assignment of Benefits Abuse, MarketsInsider, June 22, 2018.

- “Policyholders insured with the handful of insurance companies that require mortgage company approval for a valid AOB are protected from unscrupulous vendors,” Miller said in an email to Insurance Journal. “It’s unfortunate that all policyholders cannot access this benefit because of regulatory, judicial and legislative limitations.” Florida Appeals Court, Regulator Reject Policy Language Aimed at Curbing AOB Abuse, Insurance Journal, January 10, 2018

- “If you hear the words ‘I’ll take care of everything and it won’t cost you anything, just sign here,’ you must run the other way,” said Lisa Miller, Florida’s former deputy insurance commissioner and now a consultant in Tallahassee. “It’s a racket. They’ve created a factory for lawsuits. You are signing away all your rights and benefits. You lose control of your policy. If you want pink countertops, that’s not up to you. That’s up to the vendor.” Miller advises policyholders not to fall for the pitch and to call their insurance agent or the state’s helpline. The state urges policyholders to file claims directly with their insurance company. “People you know come to your back door, and people you don’t know come to your front door, especially after a hurricane,” she said. “Don’t answer that knock.” Don’t Get Duped by Insurance Scams or You’ll Fall Victims to Irma Again, Miami Herald, October 10, 2017

- “When a consumer signs an AOB, that document assigns all of a policyholder’s benefits to a stranger,” said Lisa Miller, a lobbyist for five insurance companies and a former state regulator. “The consumer loses control and their ability to work with their insurance company directly.” Hurricane Irma victims could face fight between insurers, contractors, Orlando Sentinel, September 20, 2017

- Lisa Miller, former Florida deputy insurance commissioner, also advised homeowners to beware of anyone who knocks on doors and offers a free roof, plumbing or other services. “If it’s too good to be true, it likely is,” she warned. Hurricane Irma travels up the East Coast, sparing few, Property Casualty 360, September 14, 2017

- “The hotline is “ideal for consumers who want help reaching their insurance company, understanding their coverage, and want general help in knowing what to do next and how filing a claim works, etc.,” Former Florida Deputy Insurance Commissioner Lisa Miller told News 6. “There are no dumb insurance questions, so encourage folks to call that line with any issue they need about their insurance policy, coverage or company.” Insurance adjusters hit central Florida neighborhoods, WKMG-TV Orlando, September 12, 2017

- “The Office of Insurance Regulation and Citizens Insurance have acted where the legislature has so far failed to act, to bring measures of responsibility and accountability to an out of control Assignment of Benefits system that is causing double-digit property insurance rate increases on Floridians,” said Lisa Miller, former deputy insurance commissioner and host of The Florida Insurance Roundup podcast. She predicts that other insurance companies will now seek the same newly approved coverage cap from OIR. Florida OIR approves Citizens request to limit coverage on non-weather claims, Property Casualty 360, August 21, 2017

- “Although the problem began in South Florida, it’s moving to Tampa and Orlando, said Lisa Miller, a Tallahassee lobbyist for several private carriers. “All policyholders are paying for the actions of a few who are cheating the system and costing all of us higher premiums,” Miller said. “We have to get a handle on this assignments of benefits issue.” Higher insurance costs but other expenses flat for 2017, Orlando Sentinel, December 30, 2016

Other Lisa Miller & Associates (LMA) Produced Products & Resources

- Florida Appellate Court Says No to a $442,000 Attorney Fee in a $25,000 Settlement, LMA Newsletter of November 30, 2020

- Funny, But No Laughing Matter, LMA Newsletter, September 28 ,2020

- Don’t Let Storm Chasing Crooks Fool You With Roof Repair Scams, Forbes, September 21, 2020

- Citizens Insurance Tracking Contingency Fee Multipliers, LMA Newsletter, September 14, 2020

- Contractor & Henchmen Sentenced in Hurricane Scam, LMA Newsletter, August 31, 2020

- Insurance Company Loses AOB Argument, LMA Newsletter, August 31, 2020

- “A Tale of Two Tails” on insurance claims lawsuits, Demotech webinar, August 18, 2020

- Roofing Solicitation with AOB – Homeowner Beware, LMA Newsletter, May 26, 2020

- AOB Case Challenge, LMA Newsletter, May 26, 2020

- AOB Executed by Tenant Invalid, LMA Newsletter, March 9, 2020

- Florida Regulators Issue AOB Data Call, LMA Newsletter, February 24, 2020

- AOB cases shrinking; bad faith targeted, LMA Newsletter, December 2, 2019

- Florida Homeowners Rating Pressure, LMA Newsletter, November 18, 2019

- Disputed AOBs a Source for Hurricane Michael Open Claims, LMA Newsletter of November 4, 2019

- AOB Reform Enforcement, LMA Newsletter, November 4, 2019

- Auto AOB among bills of interest, LMA Newsletter, October 21, 2019

- Florida Supreme Court Punts AOB Case, LMA Newsletter, August 12, 2019

- Can a Contractor Negotiate with an Insurer?, LMA Newsletter, July 1, 2019

- Industry Beware: Inside the AOB Epidemic, on-demand webinar hosted by Demotech and CaseGlide, featuring Lisa Miller (June 2018)

- Citizens, OIR Announcing AOB Reform-Related Changes, LMA Newsletter, June 17, 2019

- AOB Reform Signed Into Law, LMA Newsletter, June 3, 2019

- How Florida’s New AOB Law May be Exploited, LMA Newsletter, May 20, 2019

- Governor to Sign AOB Reform Bill, LMA Newsletter, April 29, 2019

- Contractor Arrested on AOB Fraud, LMA Newsletter, April 22, 2019

- Hurricane Michael Six Months Later Includes Third-Party Purchases of AOBs, LMA Newsletter, April 15, 2019

- AOB abuse is costing $400 per Florida homeowner, LMA Newsletter, April 8, 2019

- AOB Lawsuits Continue Meteoric Rise, LMA Newsletter, April 1, 2019

- Concern on Spread of AOB Lawsuits, LMA Newsletter, March 25, 2019

- A Strong Defense in Property Claims Lawsuits, LMA Newsletter, February 18, 2019

- OIR Summit Report – AOB, LMA Newsletter, January 21, 2019

- Florida Supreme Court to Hear AOB Case, LMA Newsletter, January 7, 2019

- LMA Backgrounder: Assignment of Benefits (AOB) 2018 contains a summary of the 2018 Florida AOB legislation, along with pertinent testimony before the two insurance committees.

- Assignment of Benefits Contract Example (Notice it reads that ALL of the policy rights are signed away by this document – why does a vendor need ALL of a policy’s rights?)

- Florida’s One-Way Attorney’s Fee Statute, 627.428 f.s.

- Florida Insurance Code Civil Remedy Statute – 624.155 f.s. (regarding Bad Faith)

- Assignment of Benefits Resources & Consumer Alerts, Florida Office of Insurance Regulation

- Florida Homeowner Claims Bill of Rights, Florida Office of Insurance Regulation

- Frustration Over Hurricane Michael Recover, LMA Newsletter, November 5, 2018

- Judge sentences property restorer Duane Cottier to 45 years in prison for robbing Sugarmill Woods out of roof repairs, Citrus County Chronicle, October 8, 2018

- Orlando Contractor Busted for AOB Fraud in Florida & Texas, LMA Newsletter, June 18, 2018

- Court Rules Multiple Assignment of Benefits Okay, LMA Newsletter, May 21, 2018

- Insurance Companies Responding to Legislative Inaction on AOB Reform, LMA Newsletter, April 9, 2018

- Citizens Property Insurance Reopening a Third of Irma Claims, While Managed Repair Program Fine-Tuned, LMA Newsletter, April 9, 2018

- More Than Half of Florida Insurance Litigation in 2017 Involved AOBs, LMA Newsletter, February 26, 2018

- Same Policy Language and Insurer, Two Different Court Rulings, LMA Newsletter, February 19, 2018

- AOB Policy Language Limbo Continues, LMA Newsletter, January 22, 2018

- Protecting Legal Fraud in Florida, Wall Street Journal, January 21, 2018

- Report Shows Florida AOB Abuse Worsening as Lawmakers Consider Reforms, Insurance Journal, January 17, 2018

- OIR Poised to Eliminate AOB Language Protections from Policies, LMA Newsletter, January 15, 2018

- New Data on AOB Abuse Outlines Real Problem in Florida, LMA Newsletter, January 8, 2018

- 2017 Review of Assignment of Benefits (AOB) Data Call Report, Florida Office of Insurance Regulation, January 2018

- Citizens’ Change Ok’d in Use of Managed Repair Programs and Water Coverage Caps, Sun-Sentinel, August 18, 2017

- AOB Fraud: An Unchecked, Growing Problem in Florida, WTSP-TV, Channel 10, Tampa, August 1, 2017

- Florida Insurers Place All Options on Table to Address AOB Abuse, Insurance Journal, July 19, 2017

- Category 5 Flores, Wall Street Journal, April 1, 2017