The 2023 flood insurance marketplace is offering unprecedented opportunities for:

- Consumers looking for available and competitively priced flood coverage from a growing list of now 37 private insurance companies

- Insurance companies that want to expand into a now profitable private line

- Analytics and modeling firms able to leverage powerful technology into new applications for those insurers

- Brokerages looking to expand beyond the limited National Flood Insurance Program policies

- Resiliency firms offering flood mitigation products and services

- Local Government & Public Sector Organizations looking to reduce their catastrophe exposure, decrease costs, and improve public safety in response to extreme weather

Lisa addressing the National Flood Conference (June 2018)

Florida leads the nation in private flood coverage. The private flood insurance market is seen as a much-needed alternative to the debt-ridden, outdated, and increasingly expensive federal government’s National Flood Insurance Program (NFIP). Even more so for Florida consumers, who are largely subsidizing the NFIP, receiving just $1 in claims benefits for every $4 in paid premiums.

New modeling technology and in Florida, a welcoming regulatory environment, have created a vibrant private market. Our clients include actuarial experts, disaster modelers, and third-party vendors who are utilizing new technology to better predict and price flood risk – and offering better priced products than the NFIP in many instances.

Private market insurance is just one part of the 21st Century approach to flood protection that Lisa Miller and Associates is using to help its clients. Resiliency efforts are seeing a rebirth, too. With greater coastal flooding, FEMA estimates that for every $1 spent on pre-event mitigation, $6 is saved in insurance claims. If it’s resilient, flood insurance will follow!

Lisa Miller & Associates served as an advisor on passage of Florida’s two key laws (SB 1094 and SB 542) and negotiated needed changes leading to successful passage of the national Private Primary Residential Flood Insurance Model Act in 2020. The Act serves as a template for state legislatures across the country now to adopt, with South and North Carolina adopting provisions. While Congress works on various NFIP reforms, Lisa Miller, a disaster insurance and recovery expert, is helping clients of all sizes seize the tremendous opportunity for the private market to fill the vacuum and provide consumers improved availability and affordability in flood insurance and greater safety in resiliency. Please check out our efforts and resources below and read Lisa’s latest Risk Management and Insurance Review article.

At Lisa Miller & Associates, we have a passion for policy and client success. Put Our Passion to Work for You – Give Us a Call Today!

Flooding in downtown Pensacola, Florida, September 16, 2020. Courtesy, Complete Inc., Pensacola, FL

King Tide flooding along the 8000 block of Crespi Blvd in Miami Beach, October 19, 2020. Courtesy, Alex Harris, Miami Herald

Read More about Lisa Miller’s 25 years of disaster insurance and recovery field and policy experience

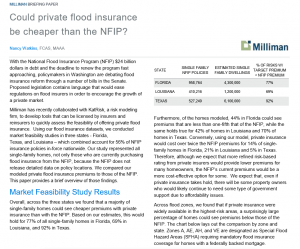

Click here for a comparison of private rates to NFIP Florida rates

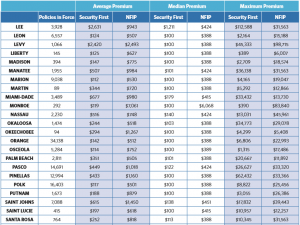

Click here to read about private flood insurance savings in NJ & NY

As host of The Florida Insurance Roundup podcast, Lisa regularly features topics on resiliency, flood insurance risk, and the need to encourage a vibrant private marketplace.

Listen to Hurricane Ian: Was the Damage Flood or Wind? podcast (October 2022) |

Listen to Our Cities Are Flooding podcast (July 2020) |

Listen to Making the Call on Flood Insurance podcast (November 2019) |

Listen to National Flood Insurance Reform podcast (December 2017) |

Listen to Growing Florida’s Private Flood Market – Part 2 podcast (July 2017) |

Listen to Growing Florida’s Private Flood Market – Part 1 podcast (June 2017) |

Listen to Beating Back Flood Rates podcast (March 2017) |

Lisa’s Blog: Florida’s Floody Mess: Who Pays? December 1, 2022

Lisa’s Blog: FEMA Flood Insurance Rates Show Little or No Increase for Florida Policyholders, April 11, 2022

Lisa’s Blog: Risk Rating 2.0 Begins, October 6, 2021

Lisa’s Blog: Blue-Green Algae Turning Deadly, July 28, 2021

Lisa’s Blog: Florida Leads in Avoided Losses in FEMA Building Codes Study, January 6, 2021

Insurance Journal: Urban Flooding Is On The Rise, So What Can Be Done? August 6, 2020, by Lisa Miller

Lisa’s Blog: Nuisance Flooding Becoming Worse: 2 of 15 Florida tide stations set records, July 21, 2020

Lisa’s Blog: A Disaster Resilience Framework: Investing now to pay less later, November 10, 2019

Lisa’s Blog: New Miami Zoning Tackles Flooding, While NFIP Rate Plan Challenged, April 11, 2019

Risk Management and Insurance Review: Two New Developments Hold Promise for the Private Flood Insurance Market, March 6, 2019, by Lisa Miller

Lisa’s Blog: Exporting Florida’s Model Flood Laws, July 24, 2018

Lisa’s Blog: The Flood Coverage Gap & FEMA’s Aspirations, June 18, 2018

Lisa’s Blog: Changes Coming to the Flood Insurance Marketplace, March 29, 2018

Lisa’s Blog: Rising Sea Levels a Fact in Florida for Now: Legislative Action Underway, August 16, 2017

Lisa’s Blog: Florida’s Private Flood Market Nearly Doubles While National Flood Insurance Reform Makes Bipartisan Headway in Washington, July 6, 2017

Startling Statistics:

- Nearly 60% of Floridians who live in flood hazard zones have no flood insurance

- The other 40% have purchased 1.75 million NFIP policies, paying $982 million in premiums as of June 2019, covering nearly $439 billion in property value.

- NFIP rates rose an average 7.3% in 2019 – following rate increases of 18%-25% in recent years – and are expected to rise again in 2020 by 11% for those not paying the full risk rate. Some properties will see larger increases as part of a risk-rating “redesign” now scheduled for October 2021.

- The Tampa Bay area is the third most at-risk area in the country for flood, with almost 460,000 homes at risk from tidal storm surge from the Gulf of Mexico and Tampa and Hillsborough Bays. The cost to rebuild those homes is estimated at nearly $81 billion.

Lisa testifying about flood mitigation programs before a legislative committee (October 2017)

Lisa Miller advocating for a Private Flood Insurance Model Law at the National Council of Insurance Legislators (NCOIL) Special Committee on Natural Disaster Recovery, July 11, 2019

Lisa presenting mitigation and resilience strategies during a panel discussion at the National Flood Conference (June 2018)

Media Coverage of LMA Efforts on Private Flood Insurance & Mitigation (Resilience)

- Lisa Miller, former Florida Deputy Insurance Commissioner, said flood coverage needs to be extended in most policies in order to cover losses. “Water does not know how to stop at a line on a map,” Miller said. “They believed they were never going to flood, and they often believe that because they are living in a certain area that a map tells them that they are not going to flood.” Florida Gov. DeSantis Announces Special Session on Property Insurance and Victims of Hurricane Ian, WKMG-TV News 6, Orlando, October 20, 2022

- “It’s becoming clearer that flood, rather than wind claims, are going to drive losses in Florida,” former Florida deputy insurance commissioner Lisa Miller posted late last week. Video Shows Ian Storm Surge Devastated Part of Florida; Losses Mounting, Insurance Journal, October 3, 2022

- “FEMA’s Risk Rating 2.0 Florida Profile shows that nearly 96% of current policyholders’ premiums will either decrease or increase by $20 or less per month. Roughly two-thirds of policyholders with older pre-FIRM homes, pre-1970s, will see a premium decrease.” Flood Insurance Risk and Rates, Insurance NewsNet, April 17, 2022

- “It’s the boldest step in the right direction to help consumers in this country, it’s like nothing I’ve ever seen,” said insurance consultant Lisa Miller, a former deputy insurance commissioner in Florida. “It may be painful for some, but the long-term effect of what FEMA is trying to do is transformational.” More Accurate NFIP Rates Open Floodgates for Private Coverage, Property Insurance Report, November 22, 2021

- “I applaud NFIP for saying we can’t keep running this thing like a government program,” Tallahassee-based flood insurance consultant Lisa Miller said. “We’ve got to run it like an insurance company.” Miller, the former deputy insurance commissioner in Florida, said the FEMA program is catching up to how private insurers determine risk. They are trying to make the rates right to encourage the private market,” Miller said. “The way to make them right is to do what insurance companies use. Use catastrophe models, actuarial principles, rate the risk for what it is, proper mitigation. All those kinds of things that insurance companies do every day.” “It’s going to go up, but it’s not going to go up 300 percent, the most it can go up is 18 percent,” Miller said. How FEMA’s Overhauls of Flood Insurance Rates Could Impact You, Spectrum News 13 and Bay News 9, June 1, 2021

- Florida’s former Deputy Insurance Commissioner Lisa Miller advises homeowners to document all damages and review policy coverages before the insurance adjuster arrives. “You have to protect yourself, document what you can so you can have an intelligent conversation with your insurance company when the estimates come in,” she said. Storm Damage Estimate Tops $1 Billion for Florida After Tropical Storm Eta, WFTS-TV, November 16, 2020

- Lisa Miller and Associates, an insurance industry government relations consulting firm, offered a bird’s-eye view of damages in the Pensacola area in a blog post with drone video taken by Complete Inc., a catastrophe claims appraisal and arbitration services firm. According to the blog, barges anchored in Pensacola Bay wreaked havoc on coastal structures. One barge struck the Pensacola Bay Bridge, causing a portion of the south-bound lane to collapse. Miller said another barge wiped out the 18th hole of a golf course. Claims Journal, September 21, 2020

- “Lisa Miller is a former Florida Deputy Insurance Commissioner who served as an advisor on passage of Florida’s key laws to encourage the development of a private flood insurance market.” Urban Flooding Is On The Rise, So What Can Be Done?, Insurance Journal, August 6, 2020

- “Lisa Miller is a former Florida deputy insurance commissioner who now serves as a disaster insurance and recovery expert and CEO of Lisa Miller & Associates.” Viewpoint: Nuisance Flooding Becomes Worse, Claims Journal, July 21, 2020

- “Lisa Miller, CEO of Lisa Miller & Associates and former Florida Deputy Insurance Commissioner gives us a sneak peek at her Private Flood Insurance Model Law and how she’s campaigning to take it federal.” FloodTalks Podcast, February 25, 2020

- “This entire industry is moving from yellow legal pads to artificial intelligence,” Miller said. “The parametric insurance concept — all this new technology — for security purposes, is where it’s at.” FEMA Urged to Adopt Parametric Insurance and Blockchain to Address Coverage Gap, Claims Journal, November 21, 2019

- “It’s not a burden, it’s a responsibility,” Miller said. “When 70% of those in Hurricane Harvey did not have flood insurance, something was missing. Would a conversation with homeowners have prevented that misery?” Advocates Push Model Law for Private Flood, Quibble about Education Mandate, Claims Journal, October 28, 2019

- “This simple idea is designed not only to allow for consumer protections, but to simplify claims handling and perhaps rectify the wind vs flood debate, with one deductible and one adjuster for the property and flood insurance claim,” Miller said. Growing Private Flood Market Will Test Claim Professionals, Claims Journal, October 14, 2019

- Canceling the program’s debt would essentially amount to a $20 billion subsidy of flood claim filers, where “taxpayers who were not affected by instances that caused the event are subsidizing those that were.” Bipartisan Flood Insurance Compromise Gets Lukewarm Reception, Bloomberg Environment, June 11, 2019.

- “The goal is to educate other states’ legislators using language that was tested in Florida.” Spreading Florida’s model laws nationwide, by Lisa Miller, Property Casualty 360, August 20, 2018

- “With Congress once again kicking the can down the road on needed reforms to the National Flood Insurance Program (NFIP) until its next expiration on Nov. 30, the time is ripe for the private insurance market to step up and play a greater role in providing Americans needed flood coverage.” Op-Ed: Florida’s flood laws can be a nationwide model, Miami Herald, August 14, 2018

- “While Congress works on various reforms to the National Flood Insurance Program (NFIP), the time is ripe for the private insurance market to step up and play a greater role in providing Americans needed flood coverage.” Lisa Miller Commentary: How Florida’s Flood Insurance Model Could Work Nationwide, Insurance Journal, August 1, 2018

- “They want people talking about impact windows at their next party,” said Lisa Miller, an insurance industry consultant and one of FAIR’s earliest supporters. “They want homeowners competing not to see who can get the fanciest granite countertops but who will be the first to install hurricane-resistant roof straps and asphalt shingles.” Miller said she looks forward to seeing what Neal and Handerhan can accomplish with the FAIR Foundation’s storm preparedness goals. “Their mission is to make mitigation as cool as Starbucks,” she said. We All Need To Be Storm Preppers, Insurance Watchdog Group Urges, Sun-Sentinel, January 26, 2018

- “Models are important because the NFIP and parent FEMA don’t use models, they use only maps,” said Lisa Miller, a former Florida Deputy Insurance Commissioner. “But models help differentiate the flood risk between a property owner in Zone X with mitigation measures versus another person in Zone X without mitigation and insurance premiums are being priced accordingly and more reasonably by the growing number of private flood insurers entering the marketplace. Consumers are benefiting,” said Miller. Flood insurers in Florida have doubled thanks to technology, Intelligent Insurer, July 20, 2017

Other Resources

- Stemming a Rising Tide: How Insurers Can Close the Flood Protection Gap, Insurance Information Institute, September 2022

- Top 25 Writers of US Private Flood Insurance, AM Best, September 2022

- Risk Rating 2.0: Equity in Action, National Flood Insurance Program, April 2022

- Florida’s private flood insurance model legislation (through SB 542 and SB 1094 passed in 2014 & 2015 and HB 813 in 2017) in Section 627.715, Florida Statutes

- The National Flood Insurance Program-Challenges and Solutions, American Association of Actuaries, September 2020

- Flood Insurance Model Legislation for the U.S. (revised), presented to the National Council of Insurance Legislators, December 2019

- The National Flood Insurance Program: Selected Issues and Legislation in the 116th Congress, Congressional Research Service, December 2019

- State Laws and Regulations Related to Flood Insurance, Milliman, via the National Association of Realtors, July 8, 2019

- Actions for State Regulators in Building the Private Flood Insurance Market, National Association of Insurance Commissioners (NAIC), July 2019

- 2018 State of U.S. High Tide Flooding with a 2019 Outlook, National Oceanic and Atmospheric Administration, June 2019

- Flood Insurance Model Legislation for the U.S., presented to the National Council of Insurance Legislators, July 2018

- Private Flood Insurance Rate Comparison to NFIP Rates

- The 21st Century Flood Reform Act passed by the U.S. House of Representatives on November 14, 2017 (awaits Senate consideration)

- Flood Insurance: Comprehensive Reform Could Improve Solvency and Enhance Resilience, U.S. Government Accountability Office report on the NFIP, April 27, 2017

- FEMA webpage on NFIP Reform

- Florida Office of Insurance Regulation’s list of flood insurance writers in Florida

- Top 10 Facts About the National Flood Insurance Program, LMA’s Florida Insurance Roundup podcast, July 2017

- The Flood Risk Mitigation Act of 2017, draft bill by the U.S. House of Representatives as of summer 2017, which would require communities to create plans to mitigate high concentrations of multiple-loss properties

- The House Select Committee on Hurricane Response and Preparedness Final Report, Florida House of Representatives, January 16, 2018 (regarding 2017’s Hurricane Irma)

- State of Florida Action Plan for Disaster Recovery submitted to FEMA, May 2018

LMA Newsletter articles & others dedicated to coverage of flood insurance & resiliency

- Disaster Management Digest, LMA Newsletter of January 23, 2023

- Florida’s Floody Mess, LMA Newsletter of December 5, 2022

- Early Lessons from Ian’s Damage, LMA Newsletter of December 5, 2022

- Ian Prompting Stormwater Review, LMA Newsletter Flood Digest of November 21, 2022

- Maps Misleading Homeowners, LMA Newsletter Flood Digest of November 7, 2022

- NFIP Reauthorized – Again, LMA Newsletter Flood Digest of October 10, 2022

- Ian More a Flood Event, LMA Newsletter of October 10, 2022

- Sea Level Rise Will Take Most Property from Floridians, LMA Newsletter of September 19, 2022

- A Break from High-Tide Flooding, LMA Newsletter of August 22, 2022

- Florida Rescuers in Kentucky, LMA Newsletter of August 8, 2022

- “Loop Current” Cause for Concern, LMA Newsletter of June 27, 2022

- Refusing federal flood insurance just one of FEMA’s bold proposals, LMA Newsletter of June 27, 2022

- Flood-Prone Homes Could Lose Federal Insurance Under FEMA Plan, Wall Street Journal, June 16, 2022

- In hurricane-prone NC, do you need flood insurance? Here’s what to know., Raleigh News & Observer, June 7, 2022

- Florida’s Commitment to Flood Resilience, LMA Newsletter of May 9, 2022

- 30,000+ Without Required Federal Flood Insurance, LMA Newsletter of April 25, 2022

- Autonomous Surge Mapping Coming to Florida, LMA Newsletter of April 25, 2022

- Risk Rating 2.0 in Florida, LMA Newsletter of April 11, 2022

- Catastrophes Coming Early, LMA Newsletter of April 11, 2022

- The Flooding Disconnect, LMA Newsletter of February 28, 2022

- New Sea Level Rise Projections, LMA Newsletter of February 21, 2022

- A 200 mph Wall of Wind, LMA Newsletter of February 14, 2022

- More Money for Flood Resilience, LMA Newsletter of February 7, 2022

- Mitigation awards, Tampa’s threat, LMA Newsletter of January 31, 2022

- FEMA’s new Risk Rating 2.0 interactive map, LMA Newsletter of January 18, 2022

- Statewide Flooding Resilience Plan Premiers, LMA Newsletter of December 13, 2021

- New Plan, Reservoir for Lake Okeechobee, LMA Newsletter of November 29, 2021

- Congress Tries Again with NFIP, LMA Newsletter of November 15, 2021

- Effective Evacuation Sign, LMA Newsletter of September 20, 2021

- Conversation with a Leading Floodplain Manager, LMA Newsletter of September 20, 2021

- A Tale of Two Cities (and Mayors), LMA Newsletter of September 20, 2021

- Necessity the Mother of Invention, LMA Newsletter of September 20, 2021

- Flood Control to the Rescue, LMA Newsletter of August 23, 2021

- Congress Takes Positive Step on Flood Insurance, LMA Newsletter of August 9, 2021

- Survey: Consumers urgently need flood insurance education, PropertyCasualty360, June 10, 2021

- And the survey says: 29% of Floridians would ignore hurricane evacuation warnings, Charlotte Florida Weekly, July 8, 2021

- ‘The water is coming’: Florida Keys faces stark reality as seas rise, The Guardian, June 24, 2021

- Re-creating Hurricane Michael, LMA Newsletter of June 28, 2021

- Flood Digest – Defending Risk Rating 2.0, LMA Newsletter of June 28, 2021

- Building a Home that Stands Strong During a Hurricane, FEMA Press Office, June 3, 2021

- Florida’s Emergency Management Director: Talk to Your Insurance Agent, LMA Newsletter of June 1, 2021

- Flood Digest – Federal Flood Insurance Debates, LMA Newsletter of June 1, 2021

- Hurricane Season Nearing, LMA Newsletter of May 17, 2021

- Bill Watch – End of 2021 Session, LMA Newsletter of May 3, 2021

- Flood Digest – NFIP reauthorization, private flood, LMA Newsletter of May 3, 2021

- Flood Digest – Record flood claims, LMA Newsletter of April 19, 2021

- Flood Digest – Alabama’s new law, consumer survey, LMA Newsletter of April 12, 2021

- FEMA’s Risk Rating 2.0, LMA Newsletter of April 5, 2021

- Florida’s Property Insurance Dilemma: Two agents share consumers’ experience, LMA Newsletter of March 29, 2021

- Super Termites Creating Future Hurricane Damage, LMA Newsletter of March 29, 2021

- New Details on Risk Rating 2.0, LMA Newsletter of March 22, 2021

- AIR Sharing Its Catastrophe Exposure Database Schema, LMA Newsletter of March 22, 2021

- Community-Based Catastrophe Insurance, LMA Newsletter of March 22, 2021

- Private Flood Insurance Bills Advancing in 3 States, LMA Newsletter of February 22, 2021

- New Help for Hurricane Michael Victims, Resilience, LMA Newsletter of February 15, 2021

- New Call to Disclose Flood Risk, LMA Newsletter of February 8, 2021

- Hurricane Risk in 2050, LMA Newsletter of February 1, 2021

- Quantifying the Impact from Climate Change on U.S. Hurricane Risk, AIR Worldwide, January 2021

- Climate Change Blamed for One-Third of Flood Damage, LMA Newsletter of January 18, 2021

- Climate Change Teed-Up in Florida Legislature, LMA Newsletter of January 18, 2021

- Roof Changes to Florida Building Code, LMA Newsletter of January 4, 2021

- A Florida Storm Mitigation Work Plan?, LMA Newsletter of November 30, 2020

- FEMA Releases Building Codes Study – Florida leads in avoided losses, LMA Newsletter of November 30, 2020

- South Carolina Passes Flood Insurance Law to Boost Private Market, Insurance Journal, October 6, 2020

- For Sale, With Flood Risk, LMA Newsletter of August 31, 2020

- Urban Flooding on the Rise, LMA Newsletter of August 3, 2020

- Nuisance Flooding Becoming Worse, LMA Newsletter of July 20, 2020

- New Tool Assesses Flood Risk, LMA Newsletter of July 6, 2020

- Lower-Risk Properties Flooding More, LMA Newsletter of June 8, 2020

- Property Devaluation from Flooding, LMA Newsletter of May 11, 2020

- Flood Monitoring Slipping, LMA Newsletter of May 11, 2020

- Flood Insurance Improvements – Pushing for a better NFIP & private market, LMA Newsletter, April 27, 2020

- Not Fighting Mother Nature in the Keys, LMA Newsletter, March 2. 2020

- Build That Wall? – Feds consider flood walling Miami-Dade County, LMA Newsletter, February 17, 2020

- FEMA Premiers South Florida Flood Maps, LMA Newsletter, February 10, 2020

- Miami Beach Flooding – To Raise or not to raise the roadways, LMA Newsletter, February 10, 2020

- NCOIL & NAIC Private Flood Insurance Model Acts, LMA Newsletter, December 16, 2019

- Flood buyouts, LMA Newsletter, December 16, 2019

- Florida Tides on the Rise, LMA Newsletter, December 16, 2019

- Federal Flood Rates Rising Despite 2.0 Delay, LMA Newsletter, November 18, 2019

- Private market growth, FEMA buyouts, and public perception woes, LMA Newsletter, November 4, 2019

- 62 Million Residences at Flood Risk, LMA Newsletter, August 26, 2019

- Florida Has Riskiest Hurricane Cities in U.S., LMA Newsletter, August 12, 2019

- Majority of Michael Flood Victims Uninsured, LMA Newsletter, July 29, 2019

- A Floodie Future – Report from the NCOIL meeting, LMA Newsletter, July 15, 2019

- Private Flood Insurance Gets Boost, LMA Newsletter, July 1, 2019

- NFIP Releases Historical Data to Private Market, LMA Newsletter, June 17, 2019

- The National Flood Conference – Watching NFIP Changes Unfold, LMA Newsletter, June 3, 2019

- The Growing Risks of Flood, LMA Newsletter, April 22, 2019

- NAIC Commissioners Talk Flood Insurance, LMA Newsletter, April 15, 2019

- New Miami Zoning Tackles Flooding, LMA Newsletter, April 8, 2019

- The New Federal Flood Insurance Program, LMA Newsletter, March 25, 2019

- NCOIL Considers Model Flood Law, LMA Newsletter, March 18, 2019

- Two New Developments Hold Promise for Private Flood Insurance Market, LMA Newsletter, March 11, 2019

- Florida Building Resiliency, LMA Newsletter, March 11, 2019

- Hurricane Improvements Pay, Not Cost, LMA Newsletter, March 11, 2019

- The Private Flood Insurance Rule, LMA Newsletter, February 4, 2019

- Model Flood Law Considered for All 50 States, LMA Newsletter, February 4, 2019

- Private Flood Insurance is the Remedy for NFIP Shutdowns, LMA Newsletter, January 7, 2019

- Flood Risk Underestimated in Florida’s Panhandle, LMA Newsletter, November 19, 2018

- Sea Level Rise & Development Contribute to Storm Surge, LMA Newsletter, November 19, 2018

- National Flood Insurance Program Faces Expiration (Again), LMA Newsletter, November 19, 2018

- States’ Lawmakers Consider Florida’s Model Flood Legislation LMA Newsletter, July 16, 2018

- FEMA Risk Ratings Changing, LMA Newsletter, July 16, 2018

- Florida at Highest Risk for Future Tidal Flooding, LMA Newsletter, July 2, 2018

- National Flood Program Facing Another Expiration, LMA Newsletter, June 18, 2018

- The Flood Coverage Gap & FEMA’s Aspirations from the National Flood Conference, LMA Newsletter, June 18, 2018

- Mitigation: As Cool as Starbucks®, LMA Newsletter, June 18, 2018

- Sea Level Rise Impacts on Insurance and Real Estate, LMA Newsletter, May 7, 2018

- NFIP Restrictions Easing on Homeowners and Agents, LMA Newsletter, April 23, 2018

- FEMA to Provide Some NFIP Data to States, LMA Newsletter, April 9, 2018

- This Spring is All About Flood, LMA Newsletter, March 26, 2018

- The Private Flood Insurance Market Gets a Boost From Verisk, LMA Newsletter, January 22, 2018

- 12 Counties Account for a Third of U.S. Flood Insurance Claims, Zillow Research, November 16, 2017

- Since 1978, 12 Counties Have Accounted for a Third of U.S. Flood Insurance Claims, Forbes, November 16, 2017

- Irma Flood Losses Could Exceed Wind Losses in Places, LMA Newsletter, October 16, 2017

- Those Without Flood Insurance Face Tougher Road Ahead in Irma Recovery, LMA Newsletter, September 18, 2017

- FEMA-NFIP and Florida OIR Ease Regulatory Restrictions on Claims Submissions and Policies, LMA Newsletter, September 18, 2017

- Why Federal Flood Program Is Sinking Deeper Into Debt: CBO Report, Insurance Journal, September 5, 2017

- Still Think You Don’t Need Flood Insurance?, Sun-Sentinel, August 30, 2017

- Aligning Natural Resource Conservation, Flood Hazard Mitigation, and Social Vulnerability Remediation in Florida, Journal of Ocean and Coastal Economics: Vol. 4: Iss. 1,

Article 4. Summer 2017 (This research found Florida has 15,000 “Repetitive Loss Properties”. Those properties collectively filed more than 40,000 claims against the National Flood Insurance Program between 1978 and 2011 – more than 1,200 claims per year, on average.) - Flood Insurance: Potential Barriers Cited to Increased Use of Private Flood Insurance, Congress’ General Accounting Office, July 14, 2016